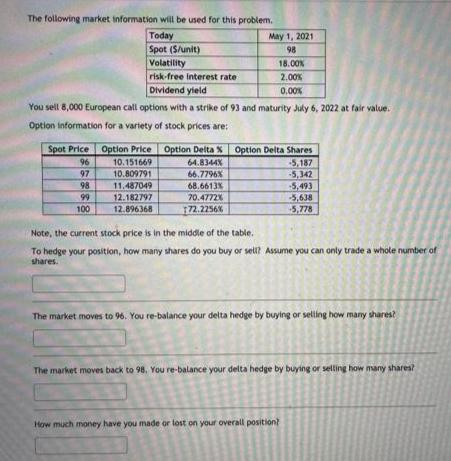

Question: The following market information will be used for this problem. Today Spot (S/unit) May 1, 2021 98 Volatility risk-free Interest rate 18.00X 2.00% Dividend

The following market information will be used for this problem. Today Spot (S/unit) May 1, 2021 98 Volatility risk-free Interest rate 18.00X 2.00% Dividend yleld 0.00% You sell 8,000 European call options with a strike of 93 and maturity July 6, 2022 at fair value. Option information for a varlety of stock prices are: Spot Price Option Price Option Delta % Option Delta Shares -5,187 -5,342 -5,493 -5,638 5,778 96 10.151669 10.809791 64.8344X 66.7796X 97 11.487049 12.182797 12.896368 98 68.6613% 99 100 70.4772X 172.2256% Note, the current stock price is in the middle of the table. To hedge your position, how many shares do you buy or sell? Assume you can only trade a whole number of shares. The market moves to 96. You re-balance your delta hedge by buying or seliing how many sharest The market moves back to 98. You re-balance your delta hedge by buying or selling how many shares? How much money have you made or lost on your overall position?

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

ANSWERA NO OF SHARES BOUGHT TO HEDGE YOUR POSITION OPTION DELTA NO OF OPTIONS SOLD 686613 8... View full answer

Get step-by-step solutions from verified subject matter experts