Question: The following multiple-choice is solved. Could you please explain to me why these are the results? I tried to calculate the first one, as an

The following multiple-choice is solved. Could you please explain to me why these are the results? I tried to calculate the first one, as an example but did not get the results until I did random operations that although gave the answers, I know are wrong. Could you please help me to state why these are correct? Thanks

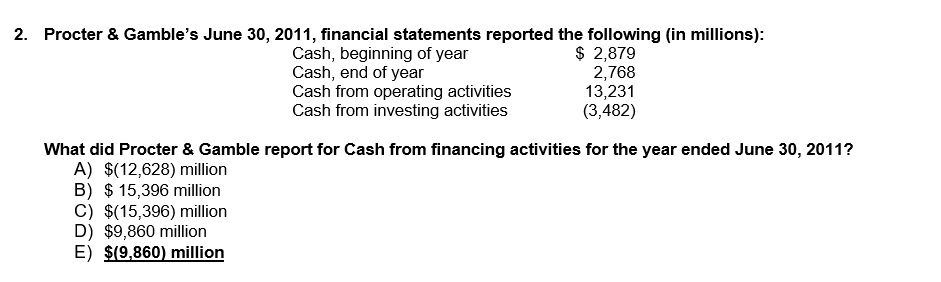

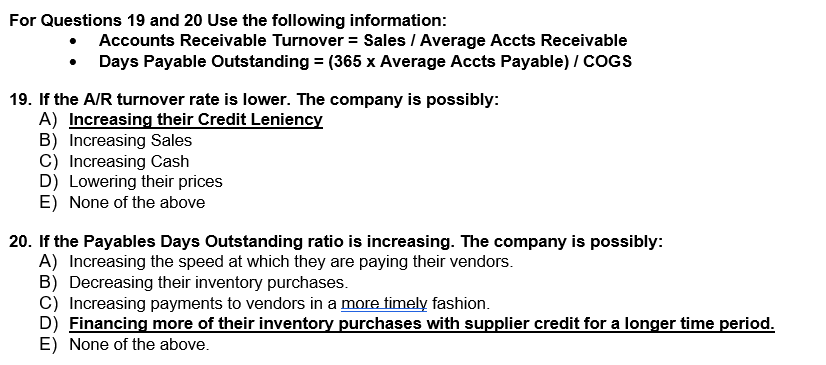

2. Procter & Gamble's June 30, 2011, financial statements reported the following (in millions): Cash, beginning of year $ 2,879 Cash, end of year 2,768 Cash from operating activities 13,231 Cash from investing activities (3,482) vities What did Procter & Gamble report for Cash from financing activities for the year ended June 30, 2011? A) $(12,628) million B) $ 15,396 million C) $(15,396) million D) $9,860 million E) $19,860 million For Questions 19 and 20 Use the following information: Accounts Receivable Turnover = Sales / Average Accts Receivable Days Payable Outstanding = (365 x Average Accts Payable) / COGS 19. If the A/R turnover rate is lower. The company is possibly: A) Increasing their Credit Leniency B) Increasing Sales C) Increasing Cash D) Lowering their prices E) None of the above 20. If the Payables Days Outstanding ratio is increasing. The company is possibly: A) Increasing the speed at which they are paying their vendors. B) Decreasing their inventory purchases. C) Increasing payments to vendors in a more timely fashion. D) Financing more of their inventory purchases with supplier credit for a longer time period. E) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts