Question: The following net present value (NPV) is presented to you. Assume all calculations were done correctly. T Year 0 Year 1 Year 2 Year

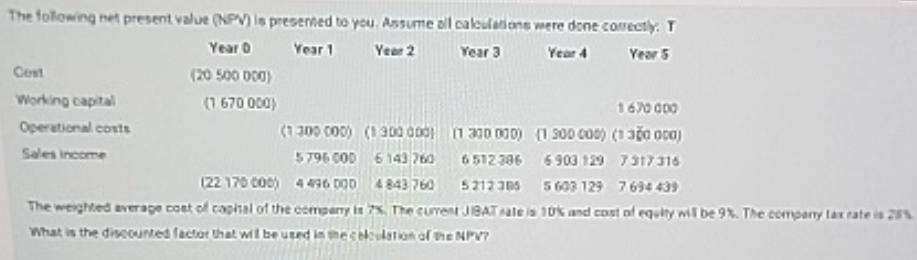

The following net present value (NPV) is presented to you. Assume all calculations were done correctly. T Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Cost (20 500 000) Working capital (1670 000) 1670 000 Operational costs Sales income (22 170 000) (1.300 000) (300 000) 5796 000 6143 760 4496 000 4843 760 11 300 000) 6512 396 5212 305 (1 300 000) (1 300 000) 6903 129 7317316 5603 129 7 694 439 The weighted average cost of capital of the company is 7%. The curent JBAT rate is 10% and cost of equity will be 9%. The company tax rate is 28% What is the discounted factor that will be used in me calculation of the NPV?

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Given information Weighted Average Cost of Capital WACC 7 JIBAR rate 10 Cost of equity 9 Company tax ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

6643106e4d451_952624.pdf

180 KBs PDF File

6643106e4d451_952624.docx

120 KBs Word File