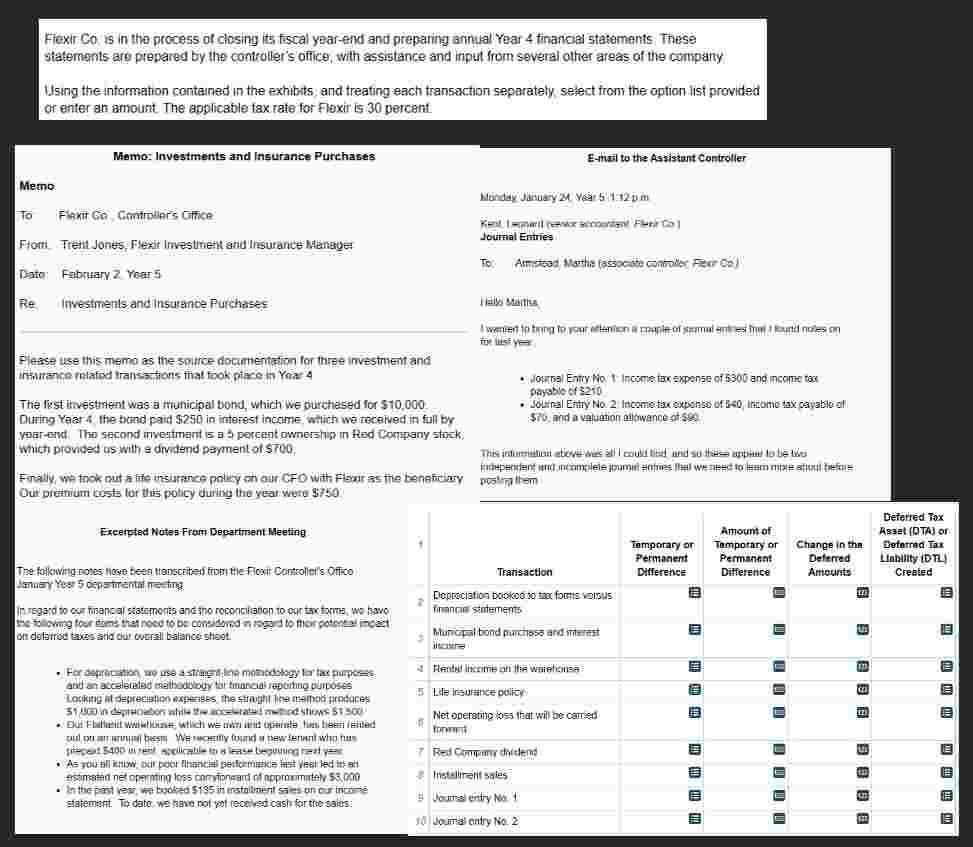

Question: The following notes have been transcribed from the Flexir Controller's Office January Year 5 departmental meeting. In regard to our financial statements and the reconciliation

The following notes have been transcribed from the Flexir Controller's Office January Year departmental meeting.

In regard to our financial statements and the reconciliation to our tax forms, we have the following four items that need to be considered in regard to their potential impact on deferred taxes and our overall balance sheet.

For depreciation, we use a straightline methodology for tax purposes and an accelerated methodology for financial reporting purposes. Looking at depreciation expenses, the straightline method produces $ in depreciation while the accelerated method shows $

Our Flatland warehouse, which we own and operate, has been rented out on an annual basis. We recently found a new tenant who has prepaid $ in rent, applicable to a lease beginning next year.

As you all know, our poor financial performance last year led to an estimated net operating loss carryforward of approximately $

In the past year, we booked $ in installment sales on our income statement. To date, we have not yet received cash for the sales.Memo: Investments and Insurance Purchases

Memo

To: Flexir Co Controller's Office

From: Trent Jones, Flexir Investment and Insurance Manager

Date: February Year

Re: Investments and Insurance Purchases

Please use this memo as the source documentation for three investment and insurance related transactions that took place in Year

The first investment was a municipal bond, which we purchased for $ During Year the bond paid $ in interest income, which we received in full by yearend. The second investment is a percent ownership in Red Company stock, which provided us with a dividend payment of $

Finally, we took out a life insurance policy on our CFO with Flexir as the beneficiary. Our premium costs for this policy during the year were $Email to the Assistant Controller

Monday, January Year : pm

Kent, Leonard senior accountant, Flexir Co

Journal Entries

To: Armstead, Martha associatecontroller Flexir Co

Hello Martha,

I wanted to bring to your attention a couple of journal entries that I found notes on for last year.

Journal Entry No: Income tax expense of $ and income tax payable of $

Journal Entry No: Income tax expense of $ income tax payable of $ and a valuation allowance of $

This information above was all I could find, and so these appear to be two independent and incomplete journal entries that we need to learn more about before posting them.

Sincerely,

LeonardScroll down to complete all parts of this task.

Flexir Co is in the process of closing its fiscal yearend and preparing annual Year financial statements. These statements are prepared by the controllers office, with assistance and input from several other areas of the company.

Using the information contained in the exhibits, and treating each transaction separately, select from the option list provided or enter an amount. The applicable tax rate for Flexir is percent

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock