Question: The following problem will be used for the remaining questions: Problem: You are thinking about investing in a small strip retail center. The broker has

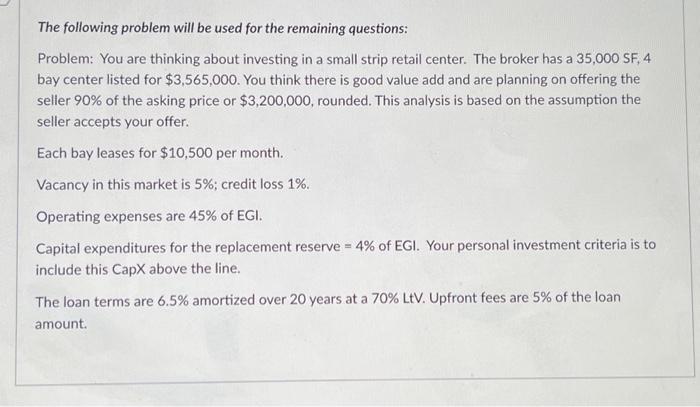

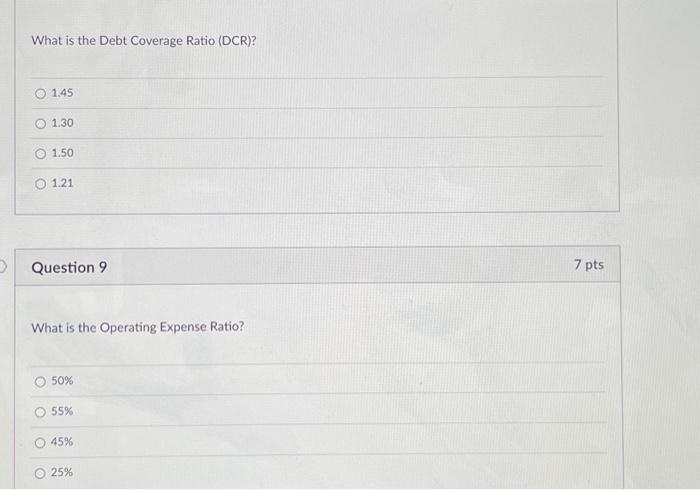

The following problem will be used for the remaining questions: Problem: You are thinking about investing in a small strip retail center. The broker has a 35,000 SF, 4 bay center listed for $3,565,000. You think there is good value add and are planning on offering the seller 90% of the asking price or $3,200,000, rounded. This analysis is based on the assumption the seller accepts your offer. Each bay leases for $10,500 per month. Vacancy in this market is 5%; credit loss 1%. Operating expenses are 45% of EGI. Capital expenditures for the replacement reserve =4% of EGI. Your personal investment criteria is to include this CapX above the line. The loan terms are 6.5% amortized over 20 years at a 70% LtV. Upfront fees are 5% of the loan amount. What is the Debt Coverage Ratio (DCR)? \begin{tabular}{|r|} \hline 1.45 \\ \hline 1.30 \\ \hline 1.50 \\ \hline 1.21 \\ \hline \end{tabular} Question 9 7 pts What is the Operating Expense Ratio? 50%55%45%25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts