Question: The following problem will be used to answer the next five questions. The Doug and Bob Corporation is calculating its WACC. Its 2,000,000 bonds have

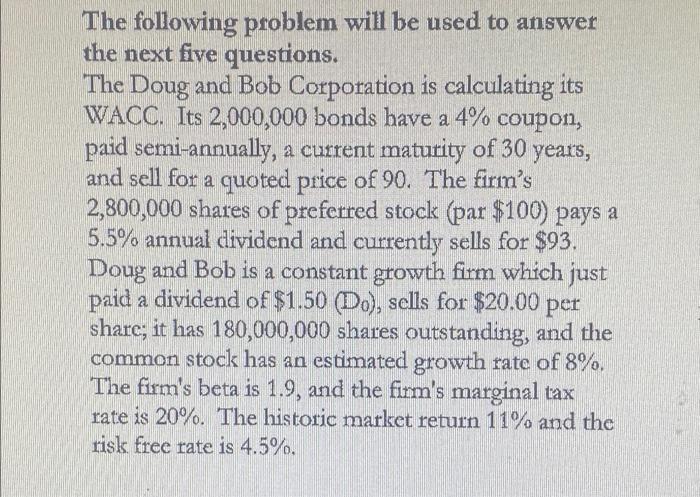

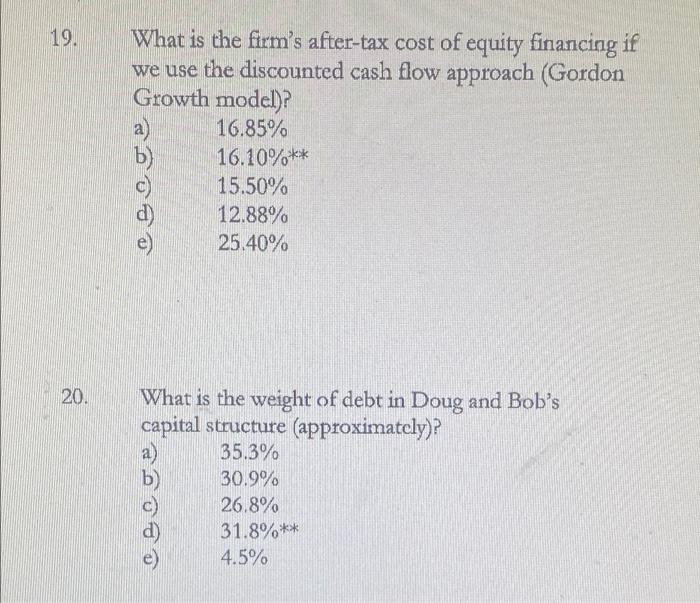

The following problem will be used to answer the next five questions. The Doug and Bob Corporation is calculating its WACC. Its 2,000,000 bonds have a 4% coupon, paid semi-annually, a current maturity of 30 years, and sell for a quoted price of 90. The firm's 2,800,000 shares of preferred stock (par $100) pays a 5.5% annual dividend and currently sells for $93. Doug and Bob is a constant growth firm which just paid a dividend of $1.50 (Do), sells for $20.00 per share; it has 180,000,000 shares outstanding, and the common stock has an estimated growth rate of 8%. The firm's beta is 1.9, and the firm's marginal tax rate is 20%. The historic market return 11% and the risk free rate is 4.5%, 19. What is the firm's after-tax cost of equity financing if we use the discounted cash flow approach (Gordon Growth model)? a) 16.85% b) 16.10%** C) 15.50% 12.88% 25.40% 20. What is the weight of debt in Doug and Bob's capital structure (approximately)? a) 35.3% b 30.9% C) 26.8% 31.8%** e) 4.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts