Question: The following problem will be used to answer the next three questions. Elsinore Company is considering the purchase of a new brewing equipment. The new

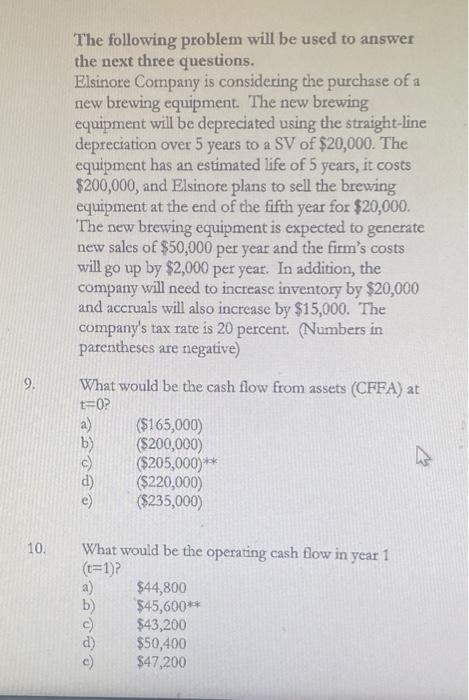

The following problem will be used to answer the next three questions. Elsinore Company is considering the purchase of a new brewing equipment. The new brewing equipment will be depreciated using the straight-line depreciation over 5 years to a SV of $20,000. The equipment has an estimated life of 5 years, it costs $200,000, and Elsinore plans to sell the brewing equipment at the end of the fifth year for $20,000. The new brewing equipment is expected to generate new sales of $50,000 per year and the firm's costs will go up by $2,000 per year. In addition, the company will need to increase inventory by $20,000 and accruals will also increase by $15,000. The company's tax rate is 20 percent. (Numbers in parentheses are negative) 9. What would be the cash flow from assets (CFFA) at t=0? a) ($165,000) ($200,000) ($205,000)** ($220,000) ($235,000) 10. What would be the operating cash flow in year 1 (t=1) a) $44,800 b) $45,600** c) $43,200 $50,400 $47,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts