Question: The following problems should help you prepare Consider the following information. Assume industry ratios have been constant. Calculate the firm's current and quick ratios. Compare

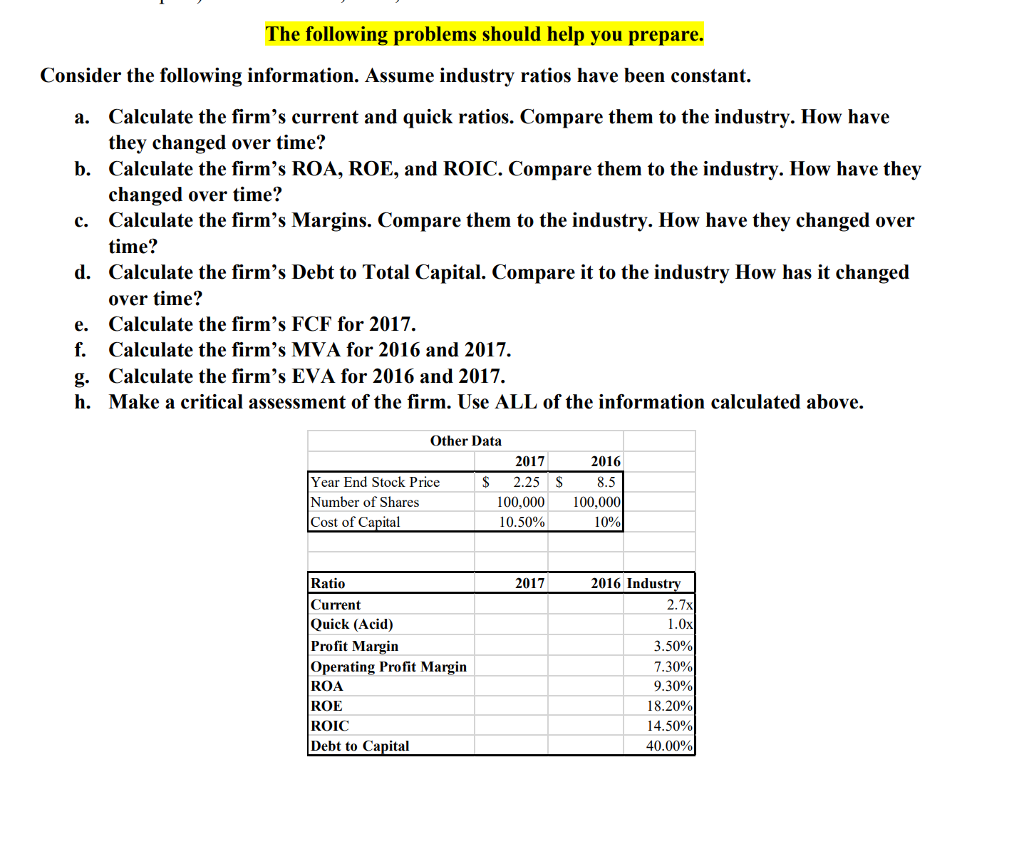

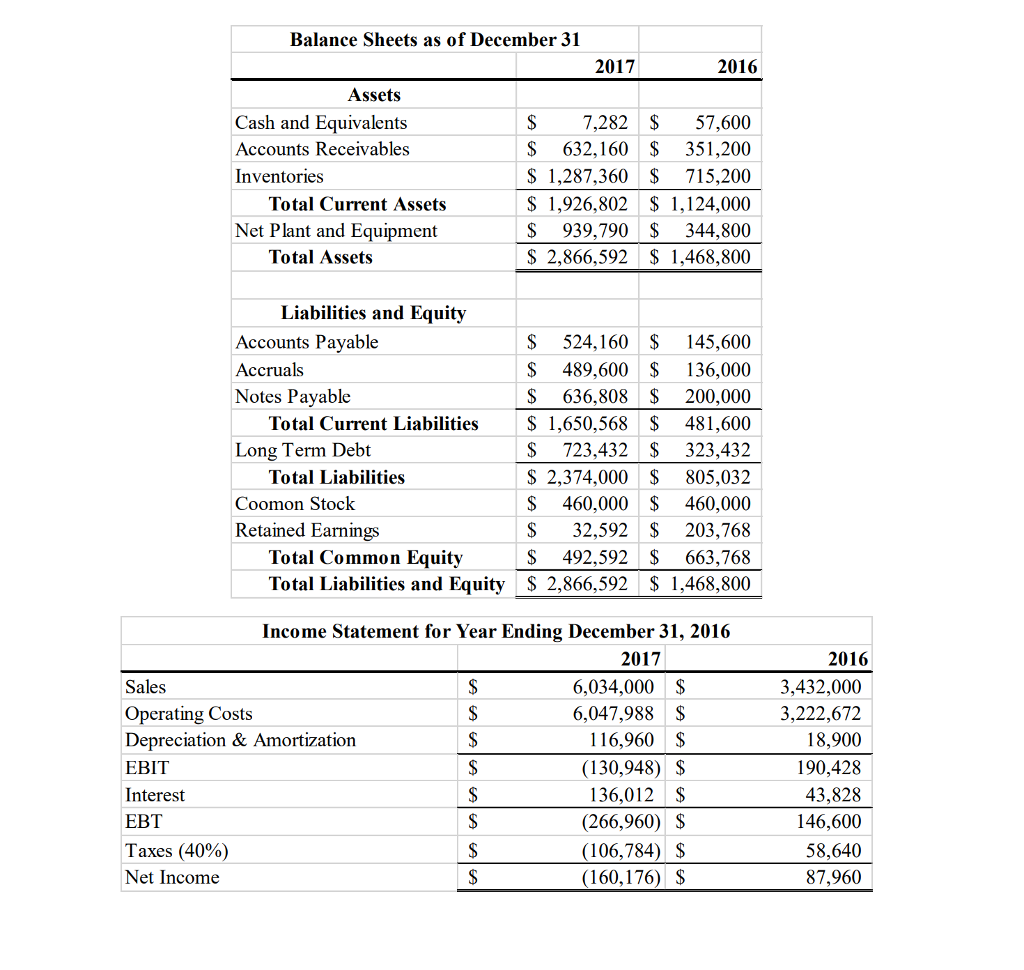

The following problems should help you prepare Consider the following information. Assume industry ratios have been constant. Calculate the firm's current and quick ratios. Compare them to the industry. How have they changed over time? Calculate the firm's ROA, ROE, and ROIC. Compare them to the industry. How have they changed over time: Calculate the firm's Margins. Compare them to the industry. How have they changed over time? Calculate the firm's Debt to Total Capital. Compare it to the industry How has it changed over time? Calculate the firm's FCF for 2017. Calculate the firm's MVA for 2016 and 2017. Calculate the firm's EVA for 2016 and 2017. Make a critical assessment of the firm. Use ALL of the information calculated above. a. b. c. d. e. f. g. h. Other Data 2017 2016 Year End Stock Price Number of Shares Cost of Capital $2.25 S8.5 00,000 100,000 10% 10.50% Ratio Current Quick (Acid) Profit Margin Operating Profit Margin ROA ROE ROIC Debt to Capital 2017 2016 Industry 2.7x 1.0x 3.50% 7.30% 9.30% 18.20% 14.50% 40.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts