Question: The following programming question is in R Studio, I've already done part (a) and the code is down below. Could you please help me with

The following programming question is in R Studio, I've already done part (a) and the code is down below. Could you please help me with part (b) and (c)? Thank you very much!

(a)

library(reshape2) library(imputeTS) library(tidyquant) library(readxl) library(e1071) library(bookdown)

#Data preparation price_data

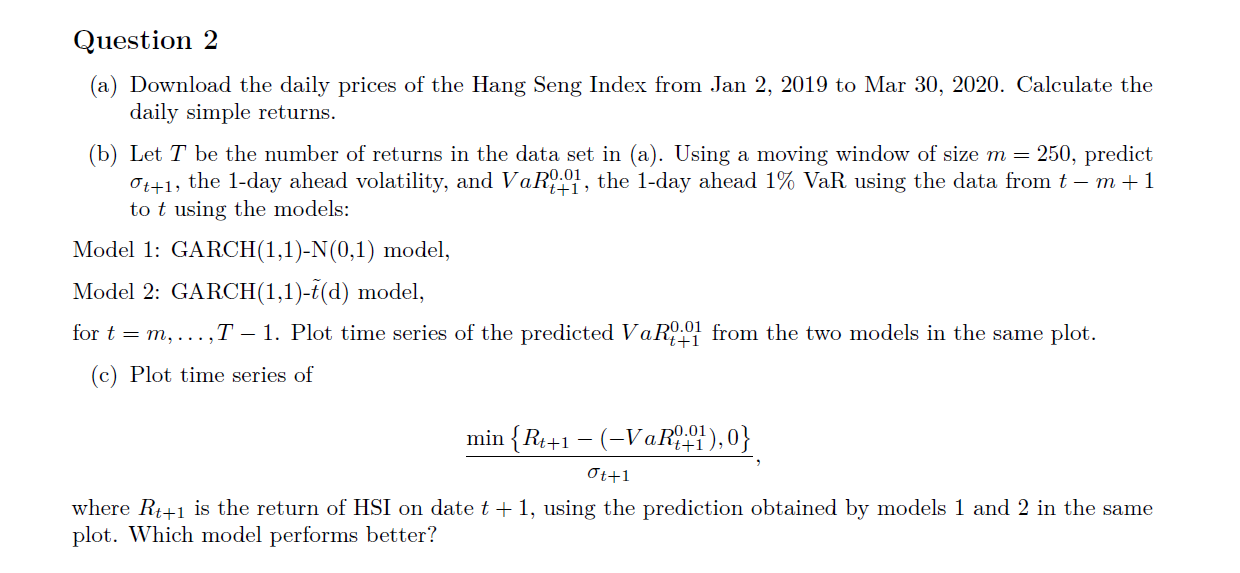

(a) Download the daily prices of the Hang Seng Index from Jan 2, 2019 to Mar 30, 2020. Calculate the daily simple returns. (b) Let T be the number of returns in the data set in (a). Using a moving window of size m=250, predict t+1, the 1-day ahead volatility, and VaRt+10.01, the 1-day ahead 1% VaR using the data from tm+1 to t using the models: Model 1: GARCH(1,1)-N(0,1) model, Model 2: GARCH(1,1)t~(d) model for t=m,,T1. Plot time series of the predicted VaRt+10.01 from the two models in the same plot. (c) Plot time series of t+1min{Rt+1(VaRt+10.01),0} where Rt+1 is the return of HSI on date t+1, using the prediction obtained by models 1 and 2 in the same plot. Which model performs better

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts