Question: The following question concerns Dana, whose interview notes are below. Dana is 3 2 , unmarried, and earned $ 4 0 , 0 0 0

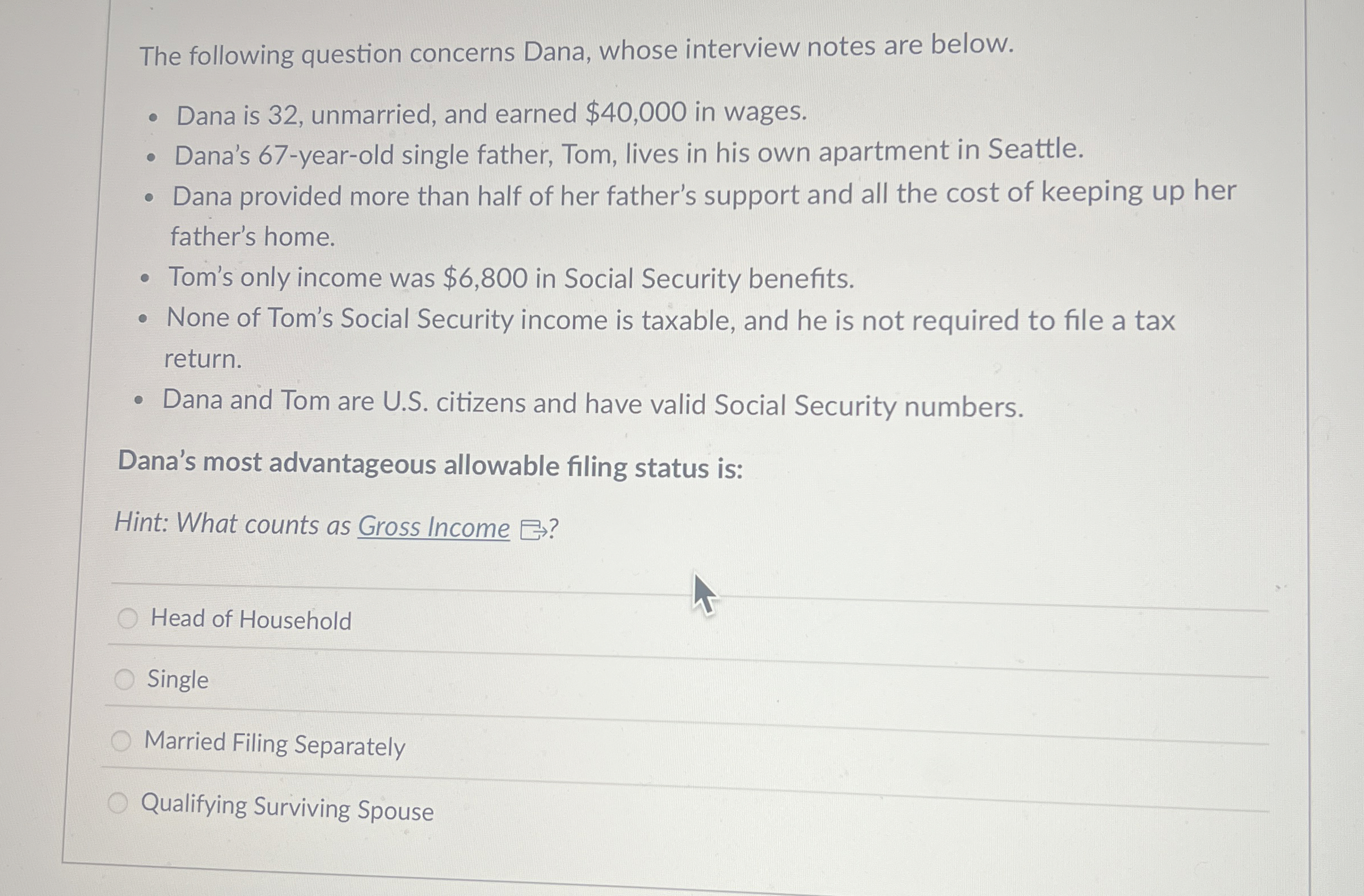

The following question concerns Dana, whose interview notes are below.

Dana is unmarried, and earned $ in wages.

Dana's yearold single father, Tom, lives in his own apartment in Seattle.

Dana provided more than half of her father's support and all the cost of keeping up her father's home.

Tom's only income was $ in Social Security benefits.

None of Tom's Social Security income is taxable, and he is not required to file a tax return.

Dana and Tom are US citizens and have valid Social Security numbers.

Dana's most advantageous allowable filing status is:

Hint: What counts as Gross Income

Head of Household

Single

Married Filing Separately

Qualifying Surviving Spouse

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock