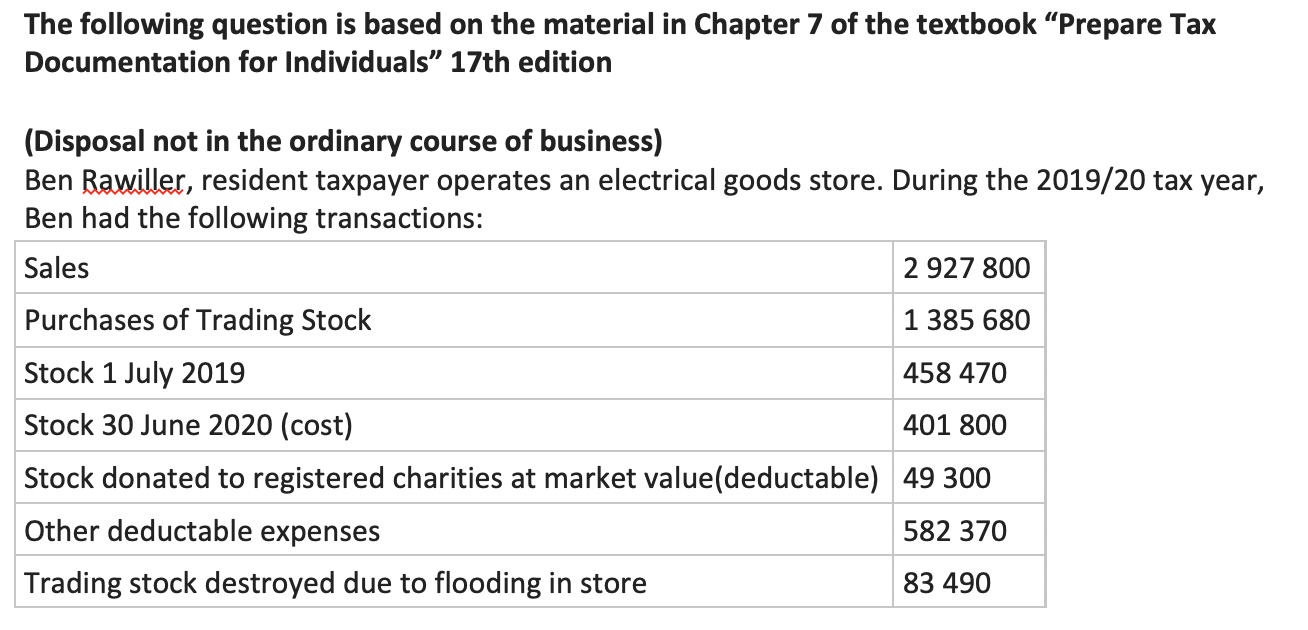

Question: The following question is based on the material in Chapter 7 of the textbook Prepare Tax Documentation for Individuals 17th edition (Disposal not in the

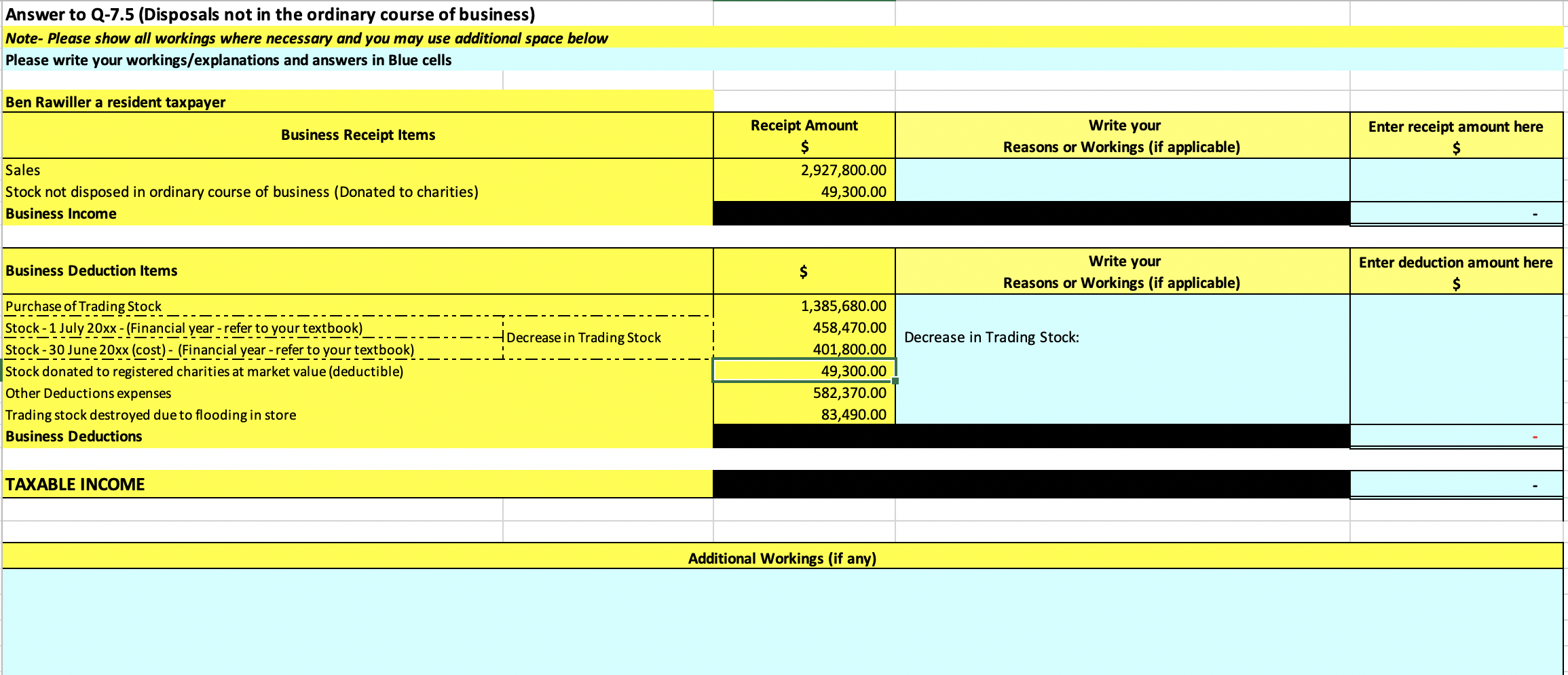

The following question is based on the material in Chapter 7 of the textbook Prepare Tax Documentation for Individuals 17th edition (Disposal not in the ordinary course of business) Ben Rawiller, resident taxpayer operates an electrical goods store. During the 2019/20 tax year, Ben had the following transactions: Sales 2 927 800 Purchases of Trading Stock 1 385 680 Stock 1 July 2019 458 470 Stock 30 June 2020 (cost) 401 800 Stock donated to registered charities at market value(deductable) 49 300 Other deductable expenses 582 370 Trading stock destroyed due to flooding in store 83 490 Answer to Q-7.5 (Disposals not in the ordinary course of business) Note- Please show all workings where necessary and you may use additional space below Please write your workings/explanations and answers in Blue cells Ben Rawiller a resident taxpayer Enter receipt amount here Business Receipt Items Write your Reasons or Workings (if applicable) $ Receipt Amount $ 2,927,800.00 49,300.00 Sales Stock not disposed in ordinary course of business (Donated to charities) Business Income Enter deduction amount here Business Deduction Items Write your Reasons or Workings (if applicable) is Decrease in Trading Stock Decrease in Trading Stock: Purchase of Trading Stock Stock-1 July 20xx - (Financial year - refer to your textbook) Stock - 30 June 20xx (cost) - (Financial year - refer to your textbook) Stock donated to registered charities at market value (deductible) Other Deductions expenses Trading stock destroyed due to flooding in store Business Deductions 1,385,680.00 458,470.00 401,800.00 49,300.00 582,370.00 83,490.00 TAXABLE INCOME Additional Workings (if any) The following question is based on the material in Chapter 7 of the textbook Prepare Tax Documentation for Individuals 17th edition (Disposal not in the ordinary course of business) Ben Rawiller, resident taxpayer operates an electrical goods store. During the 2019/20 tax year, Ben had the following transactions: Sales 2 927 800 Purchases of Trading Stock 1 385 680 Stock 1 July 2019 458 470 Stock 30 June 2020 (cost) 401 800 Stock donated to registered charities at market value(deductable) 49 300 Other deductable expenses 582 370 Trading stock destroyed due to flooding in store 83 490 Answer to Q-7.5 (Disposals not in the ordinary course of business) Note- Please show all workings where necessary and you may use additional space below Please write your workings/explanations and answers in Blue cells Ben Rawiller a resident taxpayer Enter receipt amount here Business Receipt Items Write your Reasons or Workings (if applicable) $ Receipt Amount $ 2,927,800.00 49,300.00 Sales Stock not disposed in ordinary course of business (Donated to charities) Business Income Enter deduction amount here Business Deduction Items Write your Reasons or Workings (if applicable) is Decrease in Trading Stock Decrease in Trading Stock: Purchase of Trading Stock Stock-1 July 20xx - (Financial year - refer to your textbook) Stock - 30 June 20xx (cost) - (Financial year - refer to your textbook) Stock donated to registered charities at market value (deductible) Other Deductions expenses Trading stock destroyed due to flooding in store Business Deductions 1,385,680.00 458,470.00 401,800.00 49,300.00 582,370.00 83,490.00 TAXABLE INCOME Additional Workings (if any)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts