Question: The following questions are based on the case provided below. Able Inc. and Baker Inc. face the following borrowing costs in the fixed and floating

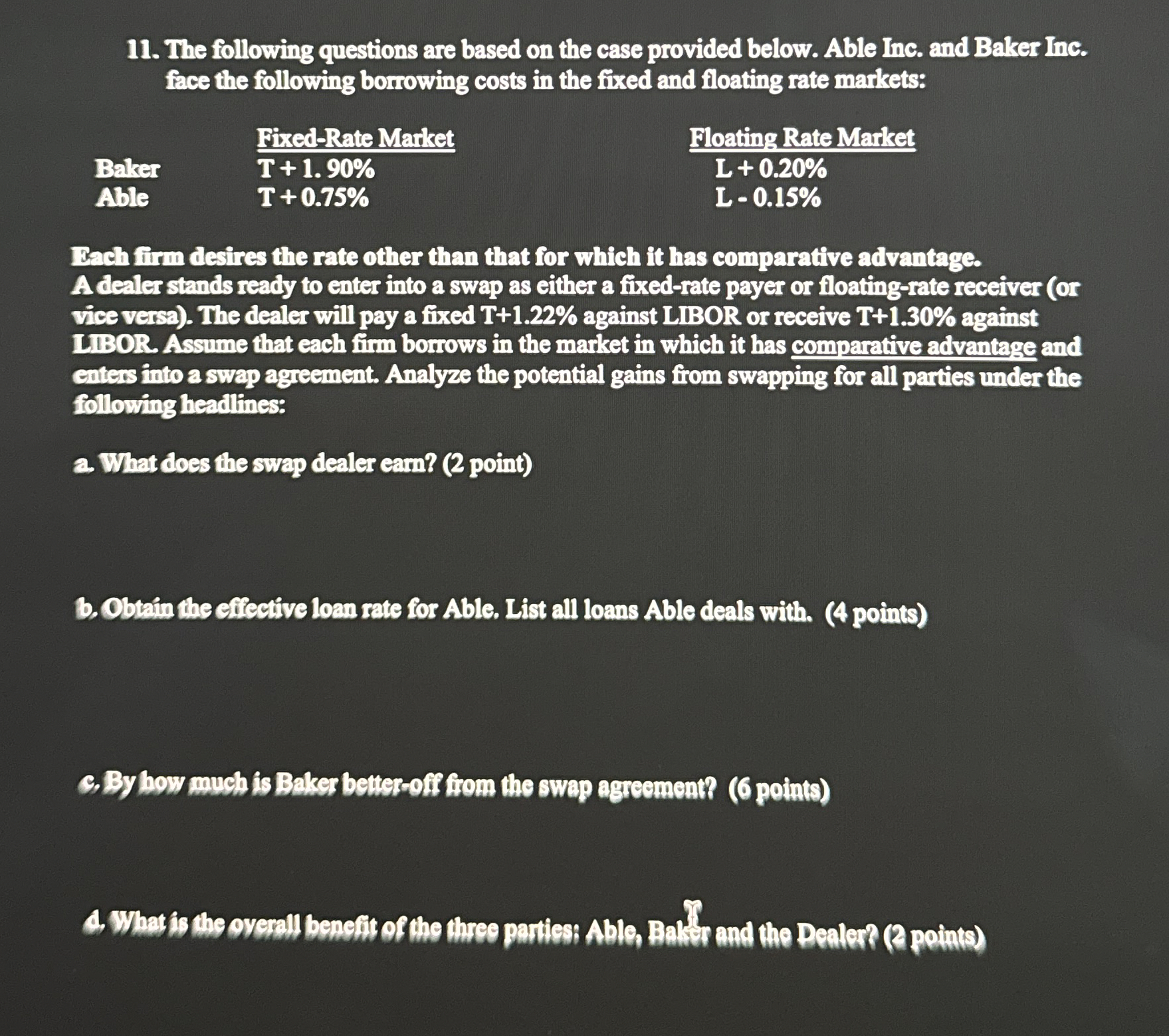

The following questions are based on the case provided below. Able Inc. and Baker Inc. face the following borrowing costs in the fixed and floating rate markets:

tableFiredRate Market,Floating Rate MarketBaker

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock