Question: The following questions are based on the material in Chapter 4: 4a. According to its organisational procedures, enter the transactions of Salt Works into the

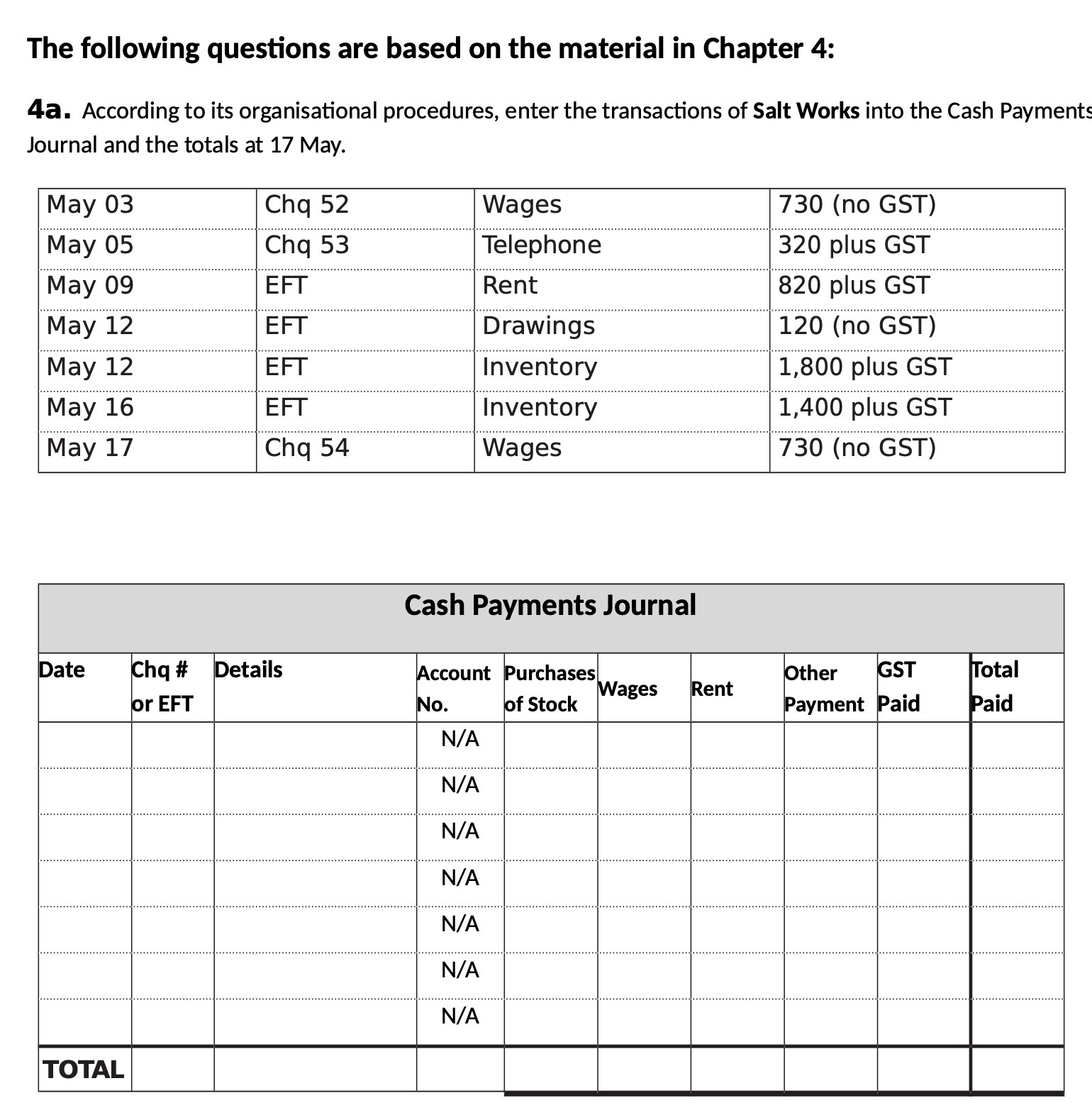

The following questions are based on the material in Chapter 4: 4a. According to its organisational procedures, enter the transactions of Salt Works into the Cash Payment Journal and the totals at 17 May. May 03 Cha 52 Wages 730 (no GST) May 05 Chq 53 Telephone 320 plus GST May 09 EFT Rent 820 plus GST May 12 EFT Drawings 120 (no GST) May 12 EFT Inventory 1,800 plus GST May 16 EFT Inventory 1,400 plus GST May 17 Chq 54 Wages 730 (no GST) Cash Payments Journal Date Chq # Details Account Purchases Other GST Total or EFT No. of Stock Wages Rent Payment Paid Paid N/A N/A N/A N/A N/A N/A N/A TOTAL

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock