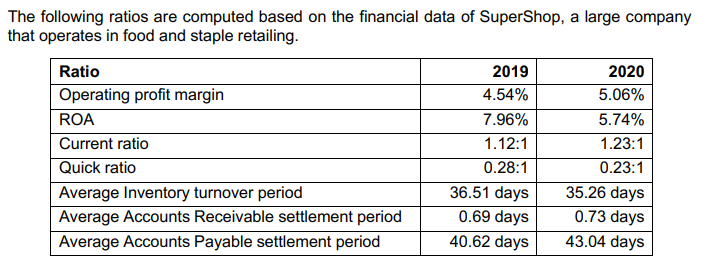

Question: The following ratios are computed based on the financial data of SuperShop, a large company that operates in food and staple retailing. Ratio 2019 2020

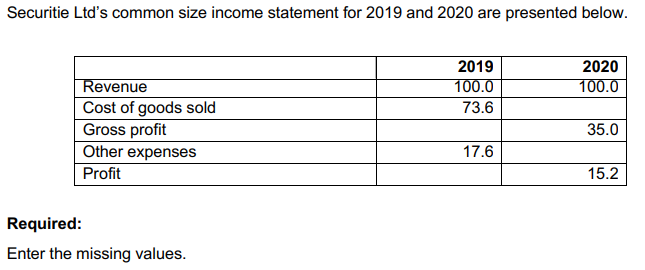

The following ratios are computed based on the financial data of SuperShop, a large company that operates in food and staple retailing. Ratio 2019 2020 Operating profit margin 4.54% 5.06% ROA 7.96% 5.74% Current ratio 1.12:1 1.23:1 Quick ratio 0.28:1 0.23:1 Average Inventory turnover period 36.51 days 35.26 days Average Accounts Receivable settlement period 0.69 days 0.73 days Average Accounts Payable settlement period 40.62 days 43.04 days Securitie Ltd's common size income statement for 2019 and 2020 are presented below. 2019 100.0 73.6 2020 100.0 Revenue Cost of goods sold Gross profit Other expenses Profit 35.0 17.6 15.2 Required: Enter the missing values

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts