Question: The following return forecasts are for two stocks, Mars and Venus: Bear market Normal 0.5 10% 10% Probability Mars Venus 0.3 -8% -5% Bull

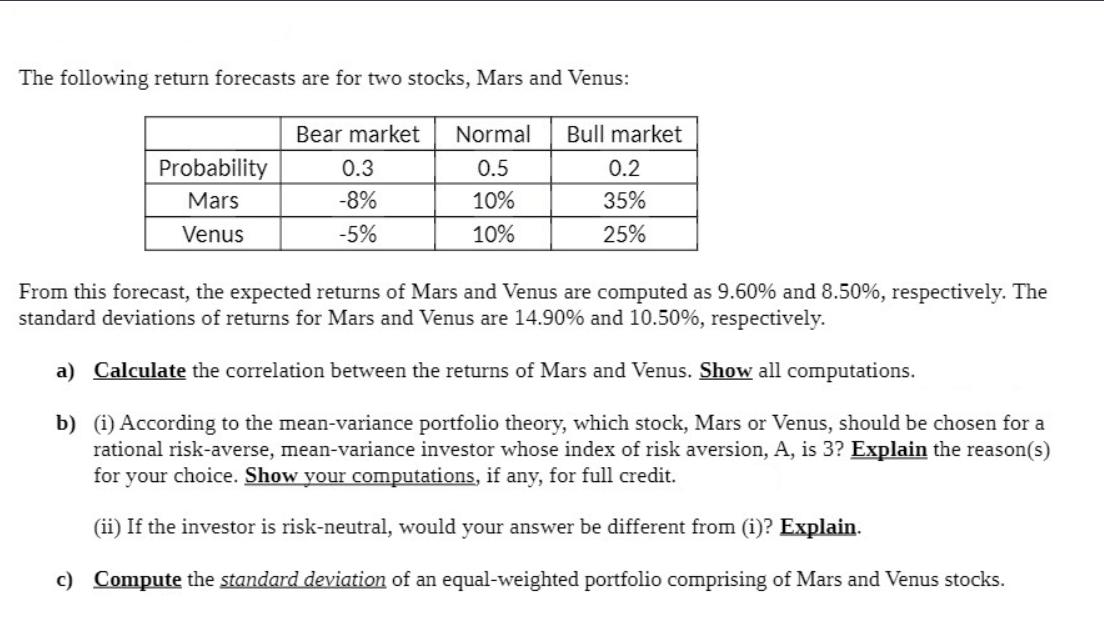

The following return forecasts are for two stocks, Mars and Venus: Bear market Normal 0.5 10% 10% Probability Mars Venus 0.3 -8% -5% Bull market 0.2 35% 25% From this forecast, the expected returns of Mars and Venus are computed as 9.60% and 8.50%, respectively. The standard deviations of returns for Mars and Venus are 14.90% and 10.50%, respectively. a) Calculate the correlation between the returns of Mars and Venus. Show all computations. b) (i) According to the mean-variance portfolio theory, which stock, Mars or Venus, should be chosen for a rational risk-averse, mean-variance investor whose index of risk aversion, A, is 3? Explain the reason(s) for your choice. Show your computations, if any, for full credit. (ii) If the investor is risk-neutral, would your answer be different from (i)? Explain. c) Compute the standard deviation of an equal-weighted portfolio comprising of Mars and Venus stocks.

Step by Step Solution

There are 3 Steps involved in it

a To calculate the correlation between the returns of Mars and Venus we can use the following formula textCorrelation fracCovariance of ReturnstextStandard Deviation of Mars ReturnstextStandard Deviat... View full answer

Get step-by-step solutions from verified subject matter experts