Question: The following selected accounts were taken from the financial records of Los Olivos Distributors at December 31, 2019. All accounts have normal balances Cash $

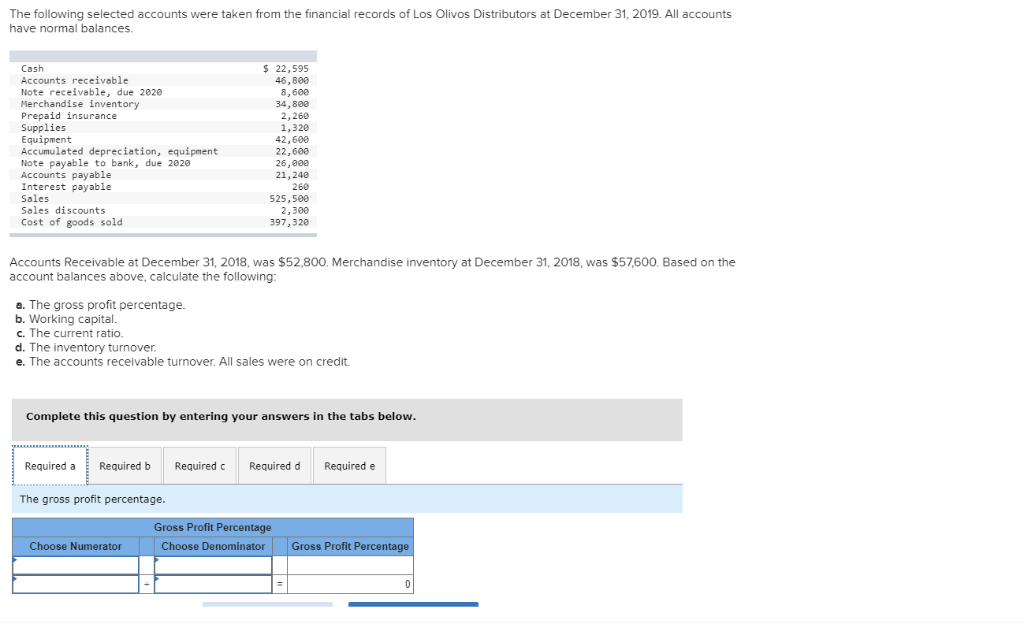

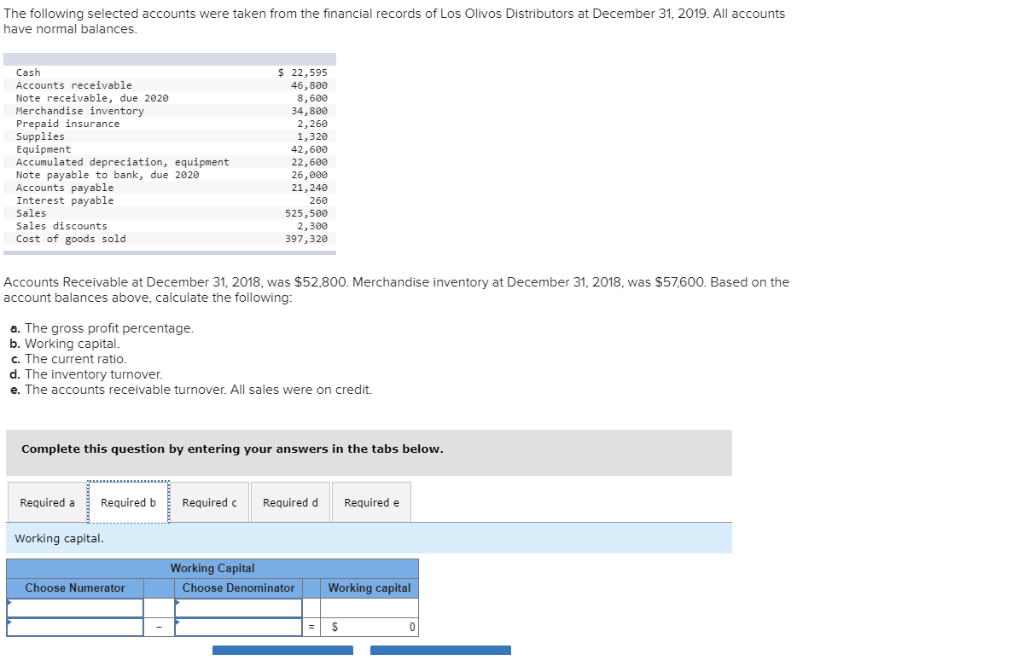

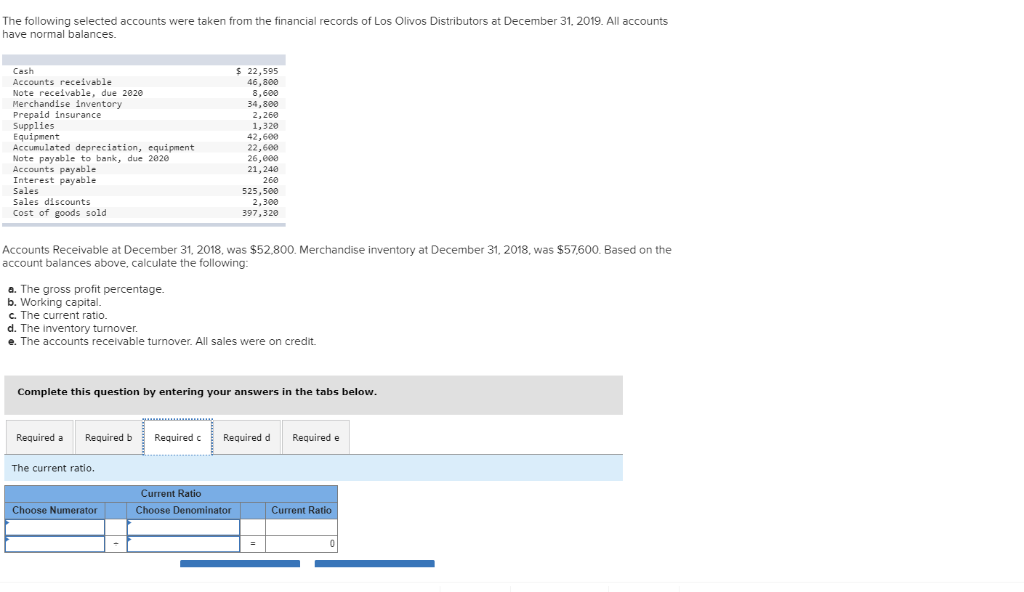

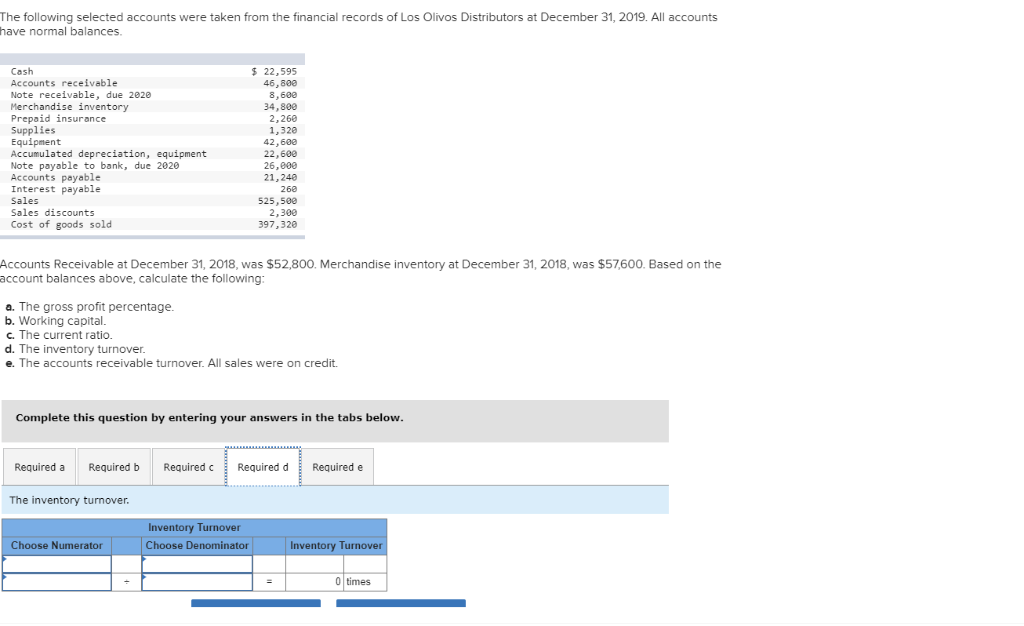

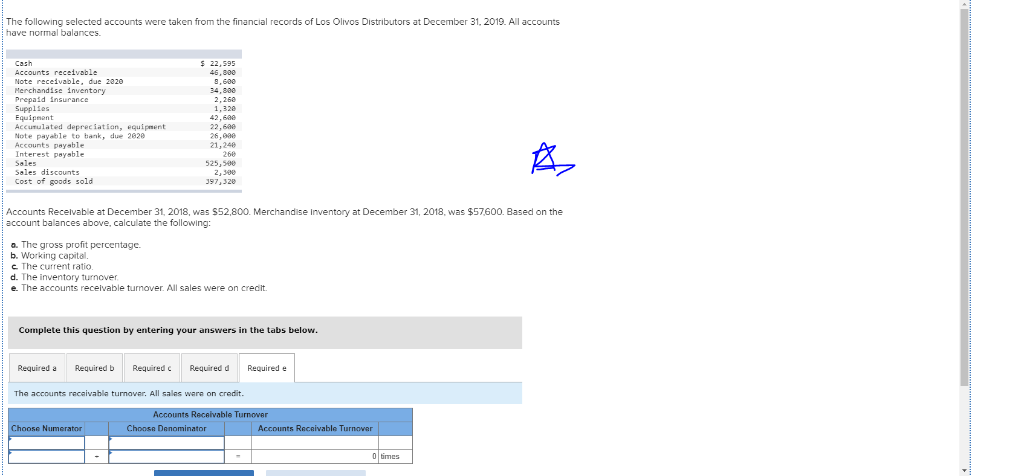

The following selected accounts were taken from the financial records of Los Olivos Distributors at December 31, 2019. All accounts have normal balances Cash $ 22,599 46,800 8,680 34,800 2,260 1,320 42,600 22,600 26,800 21,248 Accounts receivable Note receivable, due 2020 Merchandise inventory Prepaid insurance Supplies Equipment Accumuleted depreciation, equipment Note payable to bank, due 2820 Accounts payable Interest payable Sales Sales discounts 260 525,500 2,300 397,320 Cost of goods sold Accounts Receivable at December 31, 2018, was $52,800. Merchandise inventory at December 31, 2018, was $57,600. Based on the account balances above, calculate the following: a. The gross profit percentage b. Working capital. c. The current ratio. d. The inventory turnover e. The accounts receivable turnover All sales were on credit. Complete this question by entering your answers in the tabs below Required aRequired b Required c Required d Required e The gross profit percentage. Gross Profit Percentage Choose Numerator Choose Denominator Gross Profit Percentage The following selected accounts were taken from the financial records of Los Olivos Distributors at December 31, 2019. All accounts have normal balances Cash $ 22,595 46,800 8,600 34,800 2,260 1,320 Accounts receivable Note receivable, due 2020 Merchandise inventory Prepaid insurance Supplies Equipment Accumulated depreciation, equipment Note payable to bank, due 2028 Accounts payable Interest payable Sales Sales discounts 42,600 22,680 26,000 21,240 260 525,500 2, 300 397,320 Cost of goods sold Accounts Receivable at December 31, 2018, was $52,800. Merchandise inventory at December 31, 2018, was $57,600. Based on the account balances above, calculate the following: a. The gross profit percentage b. Working capital c. The current ratio. d. The inventory e. The accounts receivable turnover. All sales were on credit. turnover Complete this question by entering your answers in the tabs below Required aRequired bRequired c Required d Required e Working capital Working Capital Choose Numerator Choose Denominator Working capital The following selected accounts were taken from the financial records of Los Olivos Distributors at December 31, 2019. All accounts have normal balances. $ 22,595 Cash Accounts receivable 46,800 Note receivable, due 2820 Merchandise inventory Prepaid insurance Supplies Equipment Accumulated depreciation, equipment Note payable to bank, due 2828 Accounts payable Interest payable Sales Sales discounts 8,600 34,800 2, 260 1,320 42,600 22,600 26,800 21,240 260 525,500 2,300 Cost of goods sold 397,320 Accounts Receivable at December 31, 2018, was $52,800. Merchandise inventory at December 31, 2018, was $57,600. Based on the account balances above, calculate the following a. The gross profit pcentage. b. Working capital c. The current ratio d. The inventory turmover. e. The accounts receivable turnover. All sales were on credit Complete this question by entering your answers in the tabs below Required a Required bRequired c Required d Required e The current ratio. Ratio Choose Numerator Choose Denominator Current Ratio The following selected accounts were taken from the financial records of Los Olivos Distributors at December 31, 2019. All accounts have normal balances Cash Accounts receivable Note receivable, due 2020 Merchandise inventory Prepaid insurance Supplies Equipment Accumulated depreciation, equipment Note payable to bank, due 2020 Accounts payable Interest payable Sales $ 22,595 46,800 8,680 34,800 2,260 1,320 42,680 22,600 26,800 21,240 260 525,500 2,300 397,320 Sales discounts Cost of goods sold Accounts Receivable at December 31, 2018, was $52,800. Merchandise inventory at December 31, 2018, was $57,600. Based on the account balances above, calculate the following a. The gross profit pecentage. b. Working capital. c. The current ratio. d. The inventory turnover. e. The accounts receivable turnover. All sales were on credit. Complete this question by entering your answers in the tabs below Required a Required b Required cRequired dRequired e The inventory turnover y Turnover Choose Numerator Tu 0 times The following selected accounts were taken from the financial records of Los Olivos Distributors at December 31, 2019. All accounts have normal balances. 22,595 46,800 9,680 34,880 2,268 Cash Accounts receivable Note receivable, due 2320 Prepaid insurance Supplies Equipnent Accunulated depreciation, equipment Note payable to bank, due 2820 Accounts payable Interest paysble 42,6ae 22,6ae 26,00e 21,240 525,5ee Sales discounts 2,308 97,328 Cost of goods sold Accounts Recelvable at December 31, 2018, was S52,800. Merchandise Inventory at December 31, 2018, was $57600. Based on the account balances above, calculate the following: . . The gross profit percentage. b. Working capital c. The current ratio d. The inventory turnover e. The accounts receivable turnover. All sales were on crecit Complete this question by entering your answers in the tabs below. Required Required b Required Required d Required e The accounts recaivabla turnovar. All salas ware on credit umover times

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts