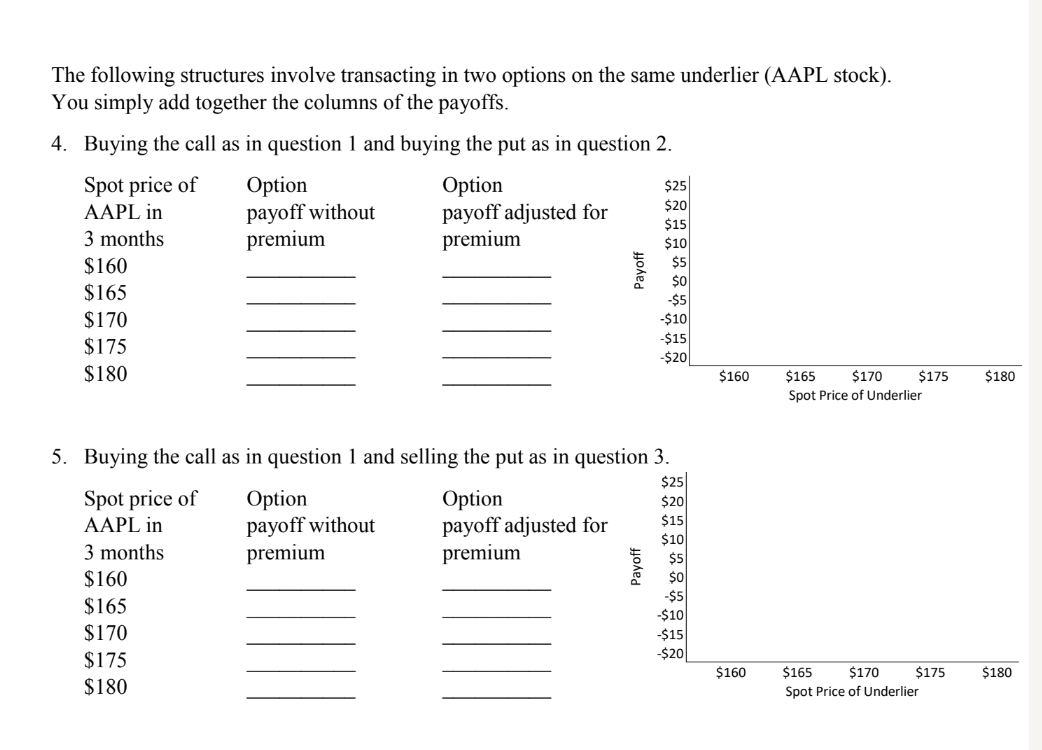

Question: The following structures involve transacting in two options on the same underlier (AAPL stock). You simply add together the columns of the payoffs. 4. Buying

The following structures involve transacting in two options on the same underlier (AAPL stock). You simply add together the columns of the payoffs. 4. Buying the call as in question 1 and buying the put as in question 2. Spot price of Option Option AAPL in payoff without payoff adjusted for 3 months premium premium $160 $0 $165 $5 $170 -$10 $175 $180 $160 $170 $175 Spot Price of Underlier $25 $20 $15 $10 $5 Payoff $15 $20 $165 $180 $15| 5. Buying the call as in question 1 and selling the put as in question 3. $25 Spot price of Option Option $200 AAPL in payoff without payoff adjusted for $100 3 months premium premium $5 $160 $0 $165 -$5 $100 $170 $15 $175 $180 Payoff $20 $160 $180 $165 $170 $175 Spot Price of Underlier The following structures involve transacting in two options on the same underlier (AAPL stock). You simply add together the columns of the payoffs. 4. Buying the call as in question 1 and buying the put as in question 2. Spot price of Option Option AAPL in payoff without payoff adjusted for 3 months premium premium $160 $0 $165 $5 $170 -$10 $175 $180 $160 $170 $175 Spot Price of Underlier $25 $20 $15 $10 $5 Payoff $15 $20 $165 $180 $15| 5. Buying the call as in question 1 and selling the put as in question 3. $25 Spot price of Option Option $200 AAPL in payoff without payoff adjusted for $100 3 months premium premium $5 $160 $0 $165 -$5 $100 $170 $15 $175 $180 Payoff $20 $160 $180 $165 $170 $175 Spot Price of Underlier

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts