Question: The following table lists the essential data for you to compute the after tax weighted average cost of capital assuming a marginal tax rate of

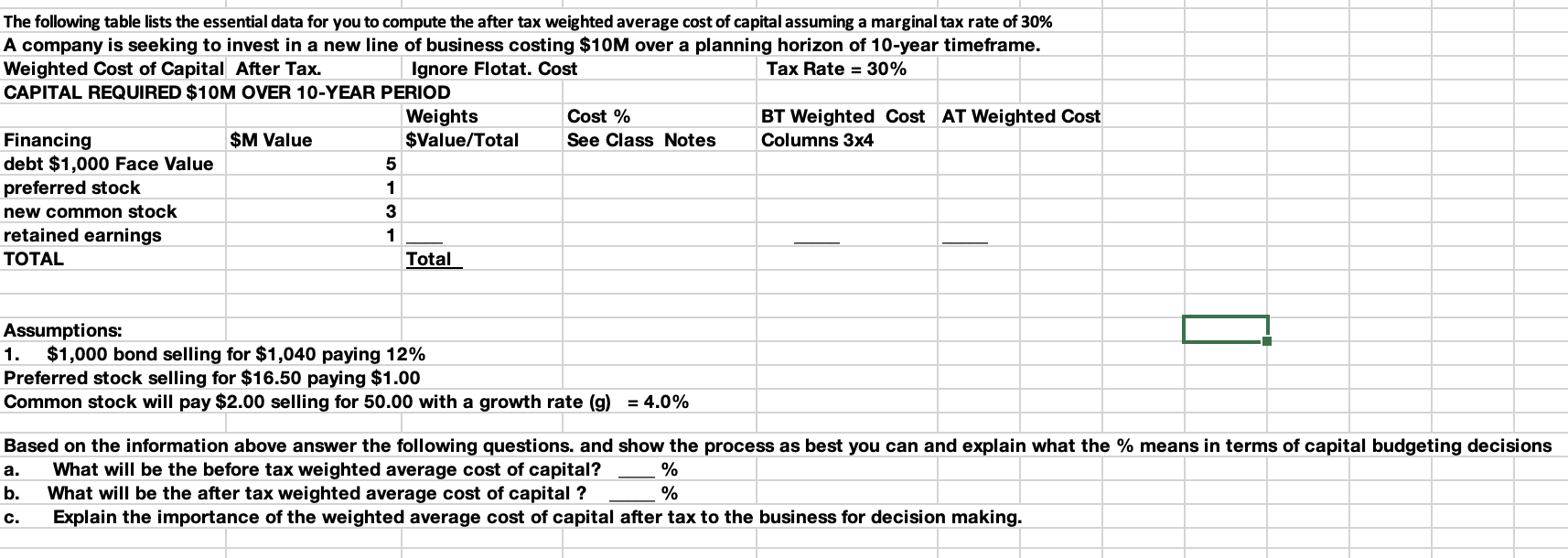

The following table lists the essential data for you to compute the after tax weighted average cost of capital assuming a marginal tax rate of 30% A company is seeking to invest in a new line of business costing $10M over a planning horizon of 10-year timeframe. Weighted Cost of Capital After Tax. Ignore Flotat. Cost Tax Rate = 30% CAPITAL REQUIRED $10M OVER 10-YEAR PERIOD Weights Cost % BT Weighted Cost AT Weighted Cost Financing $M Value $Value/Total See Class Notes Columns 3x4 debt $1,000 Face Value 5 preferred stock 1 new common stock 3 retained earnings 1 TOTAL Total Assumptions: 1. $1,000 bond selling for $1,040 paying 12% Preferred stock selling for $16.50 paying $1.00 Common stock will pay $2.00 selling for 50.00 with a growth rate (g) = 4.0% a. Based on the information above answer the following questions, and show the process as best you can and explain what the % means in terms of capital budgeting decisions What will be the before tax weighted average cost of capital? % b. What will be the after tax weighted average cost of capital ? % c. Explain the importance of the weighted average cost of capital after tax to the business for decision making. The following table lists the essential data for you to compute the after tax weighted average cost of capital assuming a marginal tax rate of 30% A company is seeking to invest in a new line of business costing $10M over a planning horizon of 10-year timeframe. Weighted Cost of Capital After Tax. Ignore Flotat. Cost Tax Rate = 30% CAPITAL REQUIRED $10M OVER 10-YEAR PERIOD Weights Cost % BT Weighted Cost AT Weighted Cost Financing $M Value $Value/Total See Class Notes Columns 3x4 debt $1,000 Face Value 5 preferred stock 1 new common stock 3 retained earnings 1 TOTAL Total Assumptions: 1. $1,000 bond selling for $1,040 paying 12% Preferred stock selling for $16.50 paying $1.00 Common stock will pay $2.00 selling for 50.00 with a growth rate (g) = 4.0% a. Based on the information above answer the following questions, and show the process as best you can and explain what the % means in terms of capital budgeting decisions What will be the before tax weighted average cost of capital? % b. What will be the after tax weighted average cost of capital ? % c. Explain the importance of the weighted average cost of capital after tax to the business for decision making

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts