Question: The following table shows that relevant data for two mutually exclusive alternative machines. The market interest rate is 20% compounded monthly. a) Determine the discounted

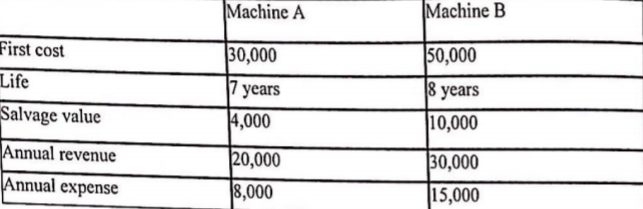

The following table shows that relevant data for two mutually exclusive alternative machines. The market interest rate is 20% compounded monthly. a) Determine the discounted payback period for machine A. b) Determine which machine should be chosen assuming that you will need the machine for only 4 years. Assume that the salvage values for Machine A and Machine B at the end of year 4 are $6000 and $15000, respectively. c) Determine which machine should be chosen assuming that you will need the machine for an indefinite amount of time. Assume that if you buy one of the machines you will use it until end of its service life and then replace it with a new one of the same type.

Machine A Machine B First cost 30,000 |50,000 Life Salvage value 17 years 18 years 10,000 14,000 Annual revenue Annual expense 20,000 8,000 |30,000 (15,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts