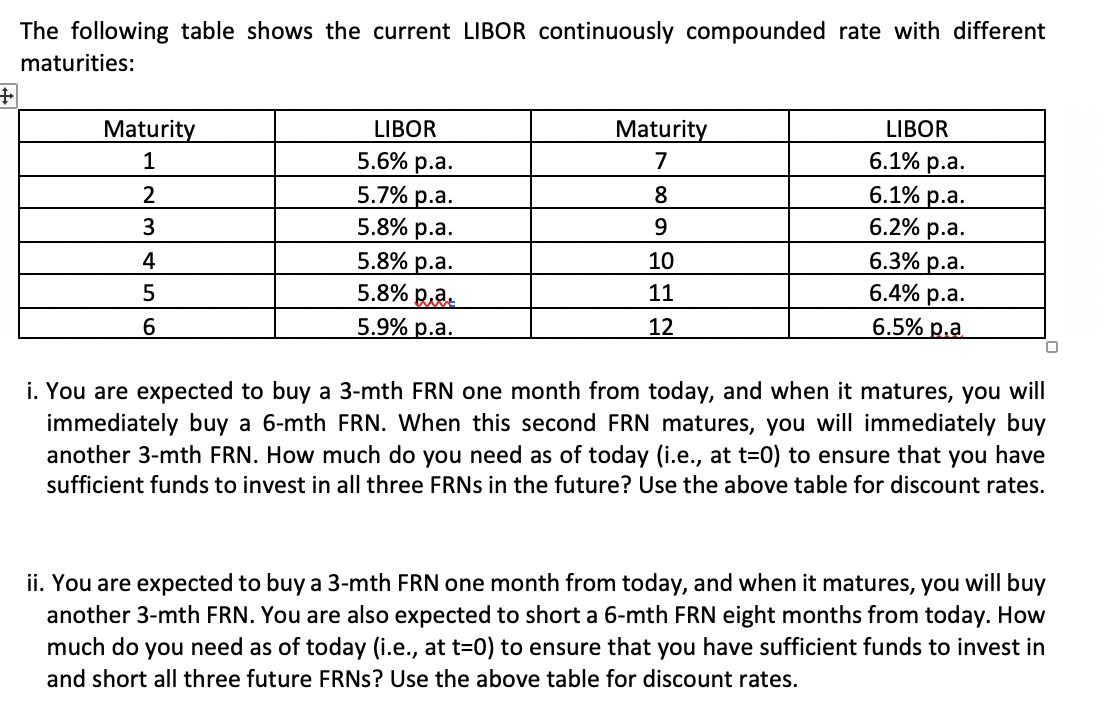

Question: The following table shows the current LIBOR continuously compounded rate with different maturities: + Maturity LIBOR Maturity LIBOR 1 7 2 8 3 5.6% p.a.

The following table shows the current LIBOR continuously compounded rate with different maturities: + Maturity LIBOR Maturity LIBOR 1 7 2 8 3 5.6% p.a. 5.7% p.a. 5.8% p.a. 5.8% p.a. 5.8% pia. 5.9% p.a. 9 10 6.1% p.a. 6.1% p.a. 6.2% p.a. 6.3% p.a. 6.4% p.a. 6.5% pa 4 5 11 6 12 O i. You are expected to buy a 3-mth FRN one month from today, and when it matures, you will immediately buy a 6-mth FRN. When this second FRN matures, you will immediately buy another 3-mth FRN. How much do you need as of today (i.e., at t=0) to ensure that you have sufficient funds to invest in all three FRNs in the future? Use the above table for discount rates. ii. You are expected to buy a 3-mth FRN one month from today, and when it matures, you will buy another 3-mth FRN. You are also expected to short a 6-mth FRN eight months from today. How much do you need as of today (i.e., at t=0) to ensure that you have sufficient funds to invest in and short all three future FRNS? Use the above table for discount rates. The following table shows the current LIBOR continuously compounded rate with different maturities: + Maturity LIBOR Maturity LIBOR 1 7 2 8 3 5.6% p.a. 5.7% p.a. 5.8% p.a. 5.8% p.a. 5.8% pia. 5.9% p.a. 9 10 6.1% p.a. 6.1% p.a. 6.2% p.a. 6.3% p.a. 6.4% p.a. 6.5% pa 4 5 11 6 12 O i. You are expected to buy a 3-mth FRN one month from today, and when it matures, you will immediately buy a 6-mth FRN. When this second FRN matures, you will immediately buy another 3-mth FRN. How much do you need as of today (i.e., at t=0) to ensure that you have sufficient funds to invest in all three FRNs in the future? Use the above table for discount rates. ii. You are expected to buy a 3-mth FRN one month from today, and when it matures, you will buy another 3-mth FRN. You are also expected to short a 6-mth FRN eight months from today. How much do you need as of today (i.e., at t=0) to ensure that you have sufficient funds to invest in and short all three future FRNS? Use the above table for discount rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts