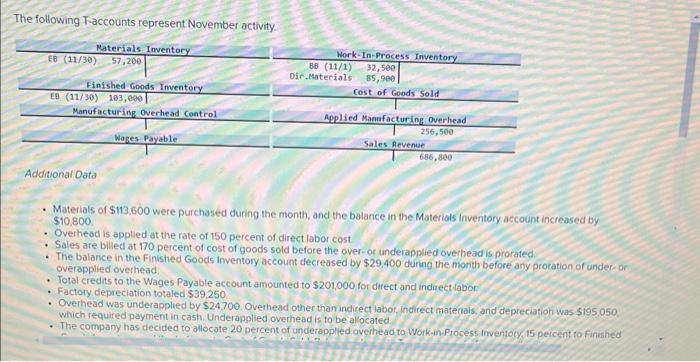

Question: The following Taccounts represent November activity. Additional Data - Materials of $113,600 were purchased during the month, and the balance in the Materials inventory account

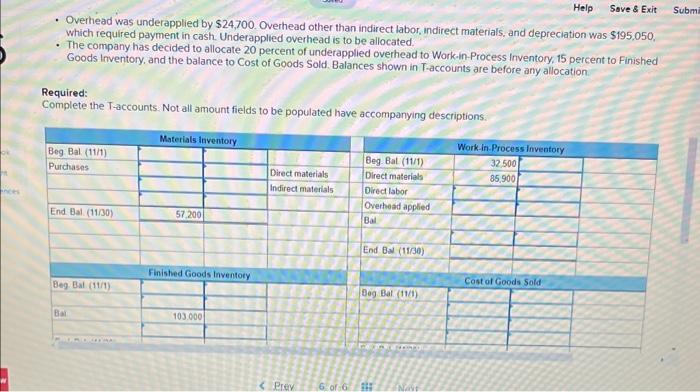

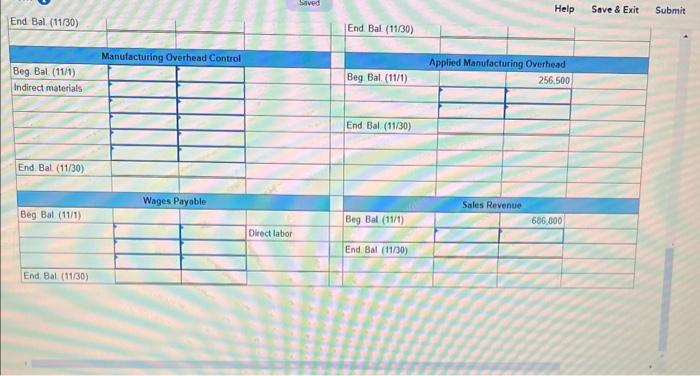

The following Taccounts represent November activity. Additional Data - Materials of $113,600 were purchased during the month, and the balance in the Materials inventory account increased by $10,800 - Overheod is applied at the rate of 150 percent of direct labor cost - Sales are billed at 170 percent of cost of goods sold before the over-or underapplied overheadis prorated - The balance in the Finished Goods inventory account decreased by $29.400 during the month before any procation of under- or overapplied overhead - Total credits to the Wages Payable account amounted to $201,000 for direct and indirect labor. - Factory depreciation totaled $39,250 - Overhead was underapplied by $24700. Overhead other than indirect labot, indirect maternais, and depreciation was $195.050. which required payment in cash. Underapplied overhead is to be allocated. - The company has decided to allocate 20 percent of underapplied overhead to Work-in-Process Inventocy, 15 percent to Finished - Overhead was underapplied by $24,700. Overhead other than indirect labor, indirect materials, and depreciation was $195,050, which required payment in cash. Underapplied overhead is to be allocated. - The company has decided to allocate 20 percent of underapplied overhead to Workain-Process Inventory, 15 percent to Finished Goods Inventory, and the balance to Cost of Goods Sold. Balances shown in T-accounts are before any allocation. Required: Complete the T-accounts. Not all amount fields to be populated have accompanying descriptions. Help Save \& Exit Submit End Bal. (11/30) The following Taccounts represent November activity. Additional Data - Materials of $113,600 were purchased during the month, and the balance in the Materials inventory account increased by $10,800 - Overheod is applied at the rate of 150 percent of direct labor cost - Sales are billed at 170 percent of cost of goods sold before the over-or underapplied overheadis prorated - The balance in the Finished Goods inventory account decreased by $29.400 during the month before any procation of under- or overapplied overhead - Total credits to the Wages Payable account amounted to $201,000 for direct and indirect labor. - Factory depreciation totaled $39,250 - Overhead was underapplied by $24700. Overhead other than indirect labot, indirect maternais, and depreciation was $195.050. which required payment in cash. Underapplied overhead is to be allocated. - The company has decided to allocate 20 percent of underapplied overhead to Work-in-Process Inventocy, 15 percent to Finished - Overhead was underapplied by $24,700. Overhead other than indirect labor, indirect materials, and depreciation was $195,050, which required payment in cash. Underapplied overhead is to be allocated. - The company has decided to allocate 20 percent of underapplied overhead to Workain-Process Inventory, 15 percent to Finished Goods Inventory, and the balance to Cost of Goods Sold. Balances shown in T-accounts are before any allocation. Required: Complete the T-accounts. Not all amount fields to be populated have accompanying descriptions. Help Save \& Exit Submit End Bal. (11/30)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts