Question: The following two bonds are identical ( ( mathrm { FV } = $ 1 , 0 0 0 , 1 0

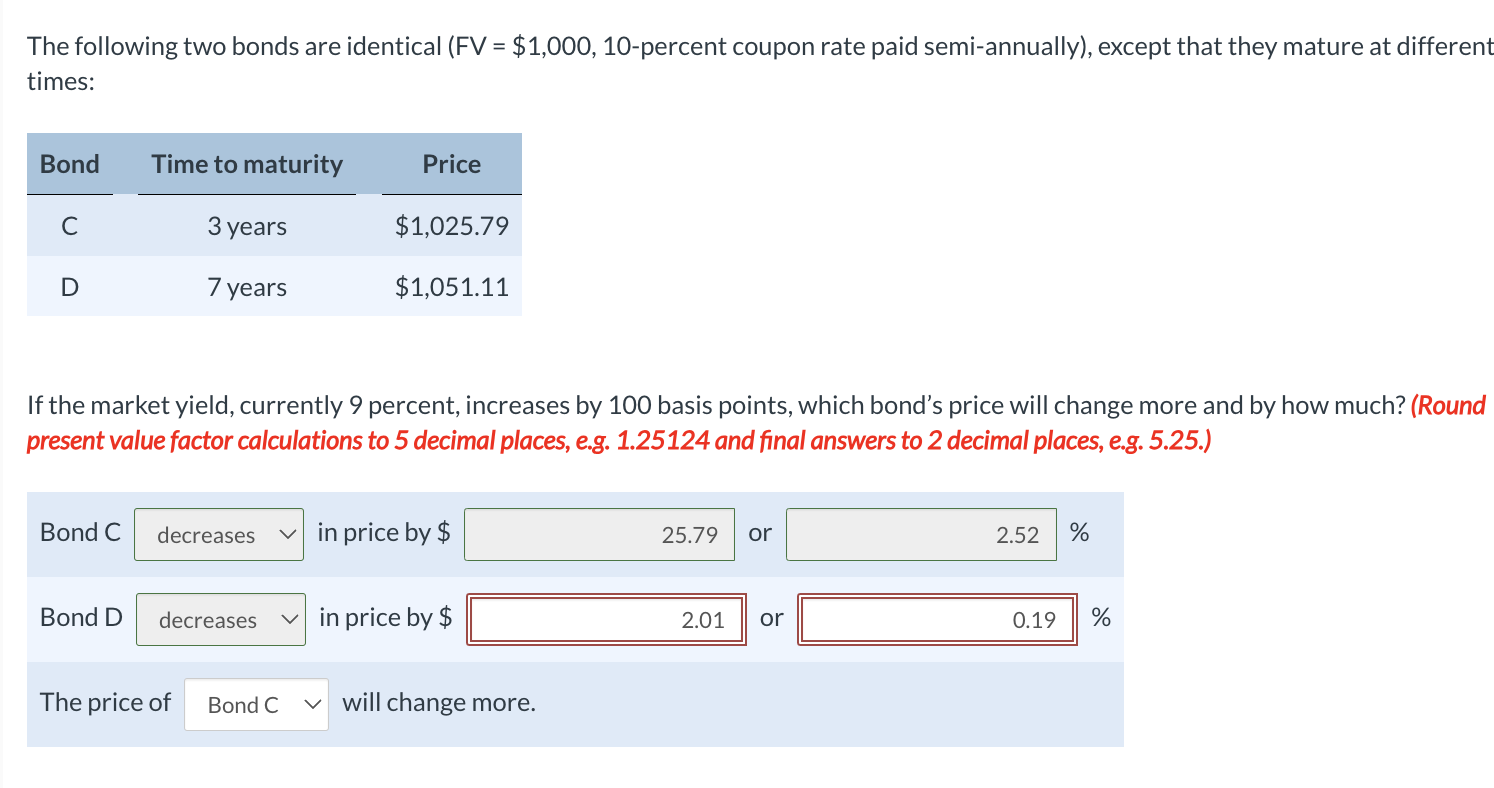

The following two bonds are identical mathrmFV$ percent coupon rate paid semiannually except that they mature at different times: If the market yield, currently percent, increases by basis points, which bond's price will change more and by how much? Round present value factor calculations to decimal places, eg and final answers to decimal places, eg Bond C in price by $ or Bond D in price by $ or The price of will change more.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock