Question: The following two questions, one is calculated using ROE, and one is by using ROA. Both in the question mentioned something like additional external financing

The following two questions, one is calculated using ROE, and one is by using ROA. Both in the question mentioned something like "additional external financing incur". Then how should I decide which one to calculate with ROE and which with ROA? I cannot find any obvious evidence. (I am not asking to solve the question (They are solved in the picture), just the explnation for concept behind the question)

Many thanks!

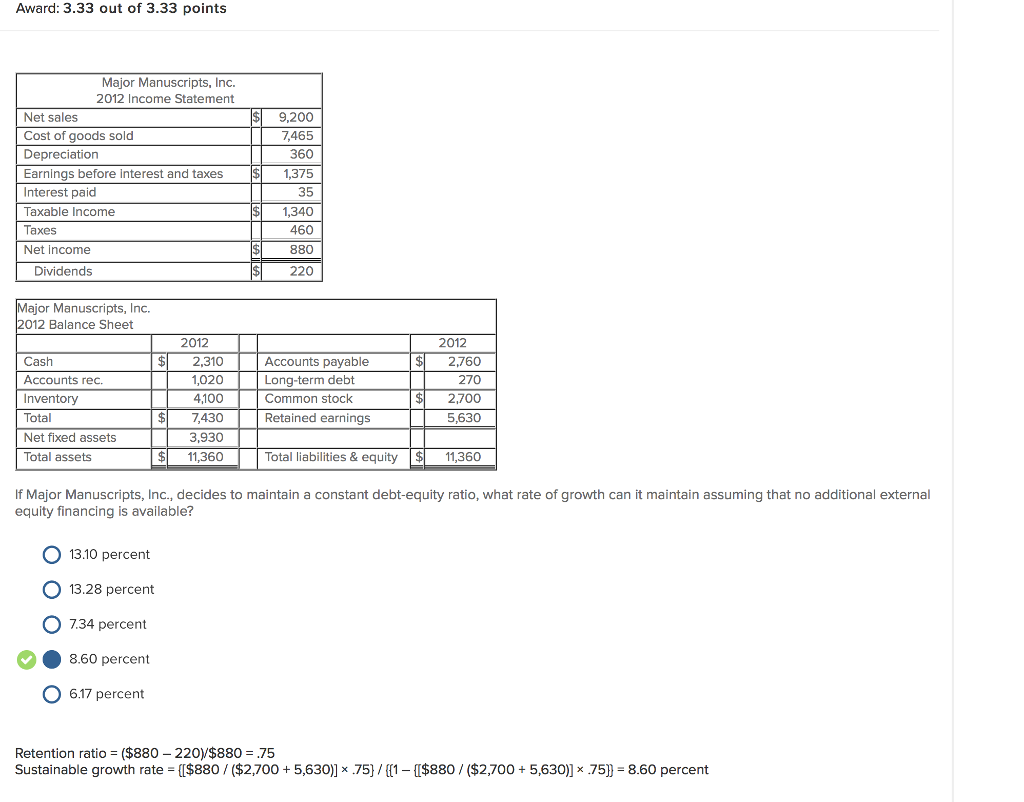

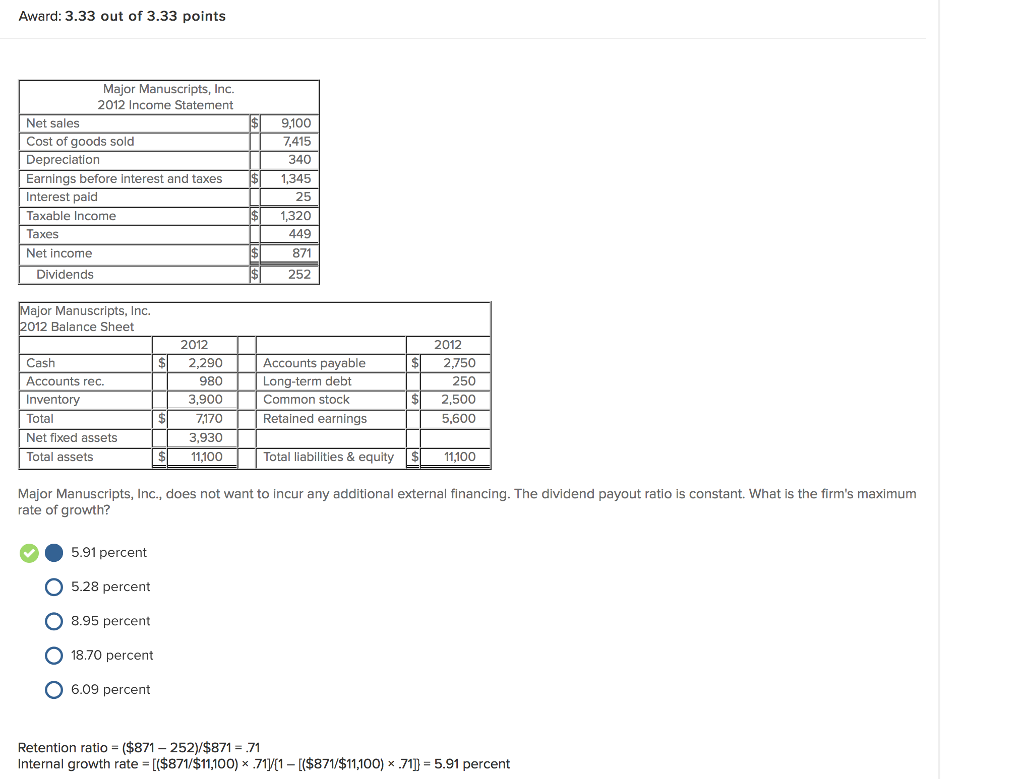

Award: 3.33 out of 3.33 points Major Manuscripts, Inc. 2012 Income Statement Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable Income Taxes Net Income 9,200 7,465 360 1,375 35 1,340 460 880 220 Dividends ajor Manuscripts, Inc 012 Balance Sheet 2012 2012 Cash Accounts rec. Inventory Total Net fixed assets Total assets 1,020 4,100 $7,430 3,930 $11,360 Accounts payable Long-term debt Common stock Retained earnings 2,760 270 2,700 5,630 Total liabilities & equity 11,360 If Major Manuscripts, Inc., decides to maintain a constant debt-equity ratio, what rate of growth can it maintain assuming that no additional external equity financing is available? 13.10 percent O 13.28 percent O 7.34 percent 8.60 percent 6.17 percent Retention ratio ($880 220 $880 .75 Sustainable growth rate I$880/ ($2,700+ 5,630)] x .75) 1 I$880 ($2,7005,63075)-8.60 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts