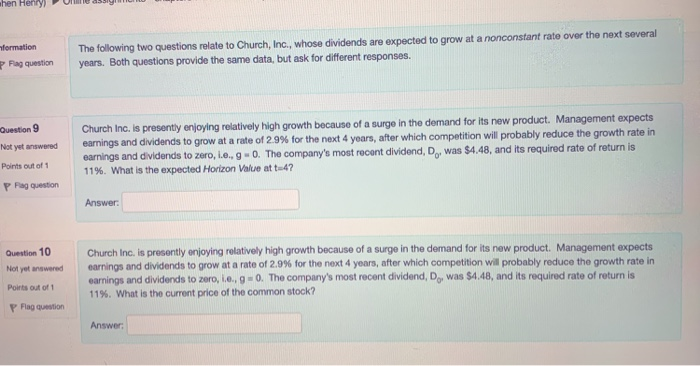

Question: The following two years. Both questions provide the same data, but ask for different responses. formation questions relate to Church, Inc., whose dividends are expected

The following two years. Both questions provide the same data, but ask for different responses. formation questions relate to Church, Inc., whose dividends are expected to grow at a nonconstant rate over the next several P Fiag question Church Inc. is presenty earnings and dividends to grow at a rate f2.9% for the next 4 years, after which competition will probably reduce the rth rate n earnings and dividends to zero, i.e., g -0. The company's most recent dividend, Do, was $4.48, and its required rate of return is 11%. What is the expected Horizon Value at t.47 enjoyling relatively high growth because of a surge in the demand for its new product. Management expects Question 9 Not yet ar Points out of d Answer Church Inc. is presently enjoying relatively high growth because of a surge in the demand for its new product. earnings and dividends to grow at a rate of 2.9% for the next 4 years, after which competition wil probably reduce the growth rate in earnings and dividends to zero, i.e., g o. The company's most recent dividend, Do was $4.48, and its required rate of return is 11%, what is the current price of the common stock? Management expects Question 10 Not yet answered Poirts out of 1 P Flag questiorn

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts