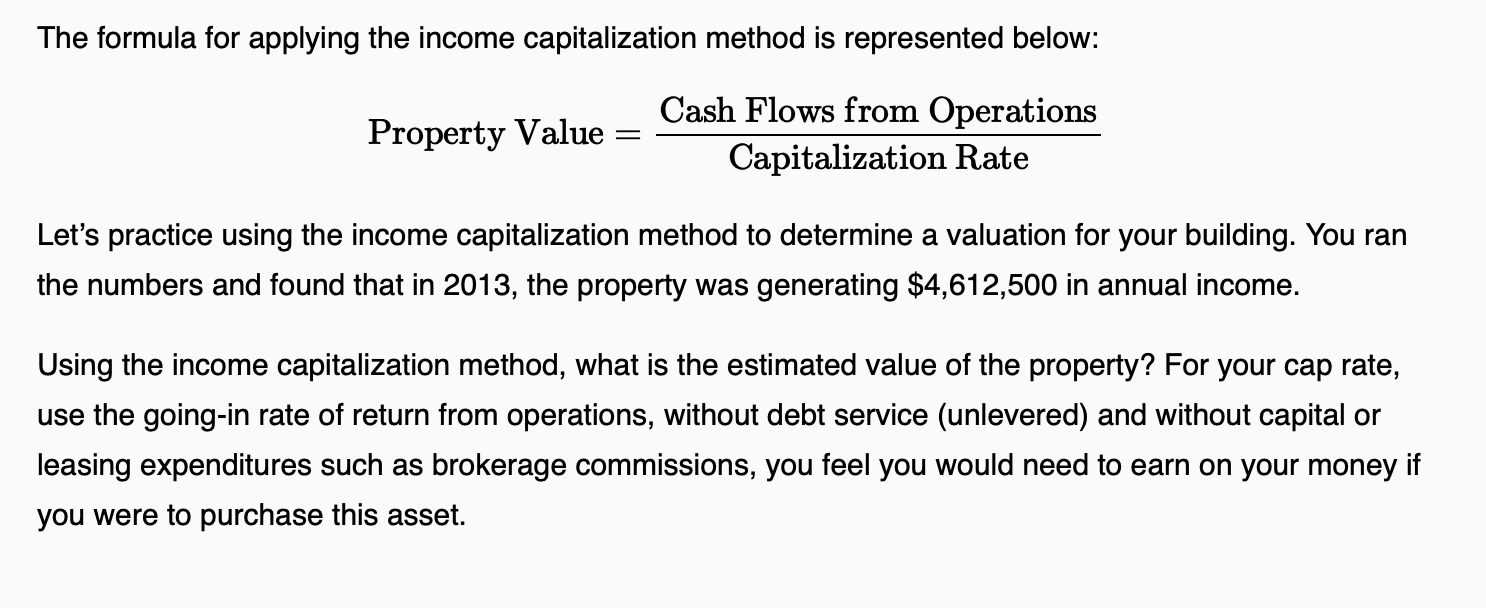

Question: The formula for applying the income capitalization method is represented below: PropertyValue=CapitalizationRateCashFlowsfromOperations Let's practice using the income capitalization method to determine a valuation for your

The formula for applying the income capitalization method is represented below: PropertyValue=CapitalizationRateCashFlowsfromOperations Let's practice using the income capitalization method to determine a valuation for your building. You ran the numbers and found that in 2013 , the property was generating $4,612,500 in annual income. Using the income capitalization method, what is the estimated value of the property? For your cap rate, use the going-in rate of return from operations, without debt service (unlevered) and without capital or leasing expenditures such as brokerage commissions, you feel you would need to earn on your money if you were to purchase this asset. The formula for applying the income capitalization method is represented below: PropertyValue=CapitalizationRateCashFlowsfromOperations Let's practice using the income capitalization method to determine a valuation for your building. You ran the numbers and found that in 2013 , the property was generating $4,612,500 in annual income. Using the income capitalization method, what is the estimated value of the property? For your cap rate, use the going-in rate of return from operations, without debt service (unlevered) and without capital or leasing expenditures such as brokerage commissions, you feel you would need to earn on your money if you were to purchase this asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts