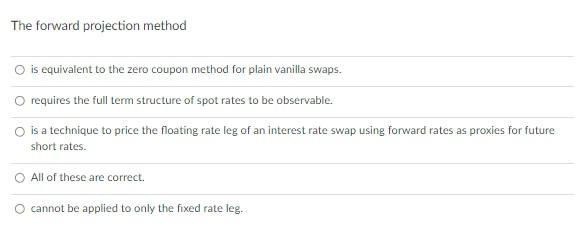

Question: The forward projection method O is equivalent to the zero coupon method for plain vanilla swaps. O requires the full term structure of spot rates

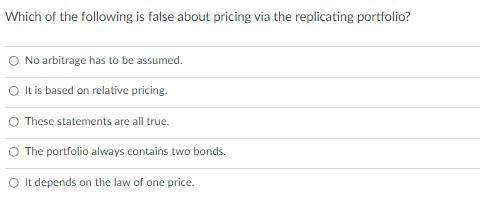

The forward projection method O is equivalent to the zero coupon method for plain vanilla swaps. O requires the full term structure of spot rates to be observable. O is a technique to price the floating rate leg of an interest rate swap using forward rates as proxies for future short rates. All of these are correct. cannot be applied to only the fixed rate leg. Which of the following is false about pricing via the replicating portfolio? O No arbitrage has to be assumed. O It is based on relative pricing. O These statements are all true. The portfolio always contains two bonds. O It depends on the law of one price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts