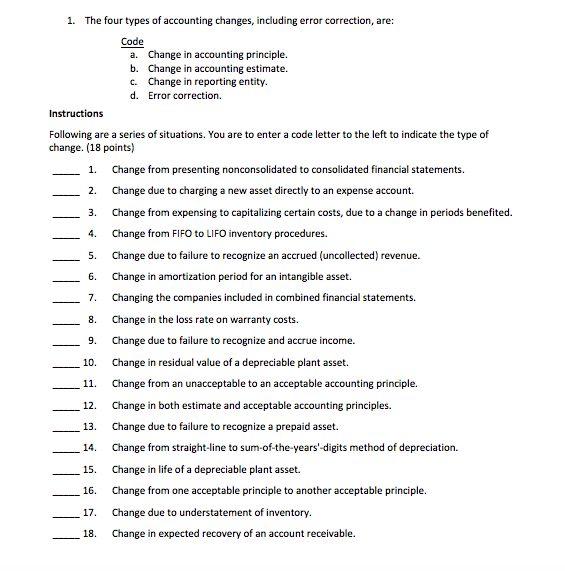

Question: The four types of accounting changes, including error correction, are: Code Change in accounting principle. Change in accounting estimate. Change in reporting entity. Error correction.

The four types of accounting changes, including error correction, are: Code Change in accounting principle. Change in accounting estimate. Change in reporting entity. Error correction. Instructions Following are a series of situations. You are to enter a code letter to the left to indicate the type of change. ________ Change from presenting nonconsolidated to consolidated financial statements. _______ Change due to charging a new asset directly to an expense account. ________ Change from expensing to capitalizing certain costs, due to a change in periods benefited. _______ Change from FIFO to LIFO inventory procedures. _________ Change due to failure to recognize an accrued (uncollected) revenue. ________ Change in amortization period for an intangible asset. _________ Changing the companies included in combined financial statements. __________ Change in the loss rate on warranty costs. _________ Change due to failure to recognize and accrue income. __________ Change in residual value of a depreciable plant asset. _____ Change from an unacceptable to an acceptable accounting principle. _______ Change in both estimate and acceptable accounting principles. _________ Change due to failure to recognize a prepaid asset. __________ Change from straight-line to sum-of-the-years' digits method of depreciation. _________ Change in life of a depreciable plant asset. _____________ Change from one acceptable principle to another acceptable principle. ___________ Change due to understatement of inventory. _______ Change in expected recovery of an account receivable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts