Question: The future value and present value equations also help in finding the interest rate and the number of years that correspond to present and future

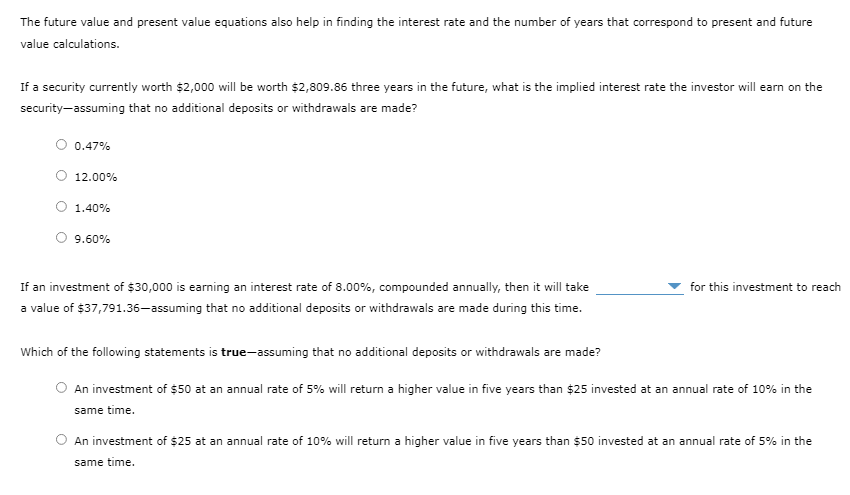

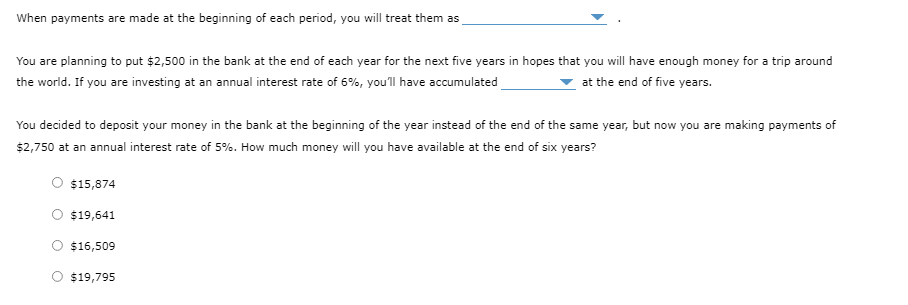

The future value and present value equations also help in finding the interest rate and the number of years that correspond to present and future value calculations. If a security currently worth $2,000 will be worth $2,809.86 three years in the future, what is the implied interest rate the investor will earn on the security-assuming that no additional deposits or withdrawals are made? 0.47% 12.00% O 1.40% 9.60% for this investment to reach If an investment of $30,000 is earning an interest rate of 8.00%, compounded annually, then it will take a value of $37,791.36-assuming that no additional deposits or withdrawals are made during this time. Which of the following statements is true-assuming that no additional deposits or withdrawals are made? An investment of $50 at an annual rate of 5% will return a higher value in five years than $25 invested at an annual rate of 10% in the same time. An investment of $25 at an annual rate of 10% will return a higher value in five years than $50 invested at an annual rate of 5% in the same time. When payments are made at the beginning of each period, you will treat them as You are planning to put $2,500 in the bank at the end of each year for the next five years in hopes that you will have enough money for a trip around the world. If you are investing at an annual interest rate of 6%, you'll have accumulated at the end of five years. You decided to deposit your money in the bank at the beginning of the year instead of the end of the same year, but now you are making payments of $2,750 at an annual interest rate of 5%. How much money will you have available at the end of six years? $15,874 $19,641 $16,509 $19,795

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts