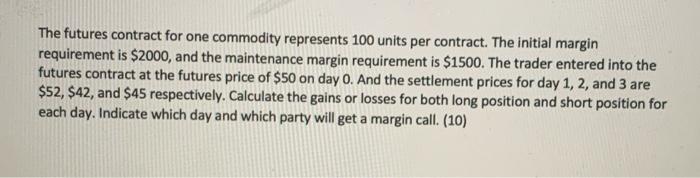

Question: The futures contract for one commodity represents 100 units per contract. The initial margin requirement is $2000, and the maintenance margin requirement is $1500. The

The futures contract for one commodity represents 100 units per contract. The initial margin requirement is $2000, and the maintenance margin requirement is $1500. The trader entered into the futures contract at the futures price of $50 on day 0. And the settlement prices for day 1, 2, and 3 are $52, $42, and $45 respectively. Calculate the gains or losses for both long position and short position for each day. Indicate which day and which party will get a margin call

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts