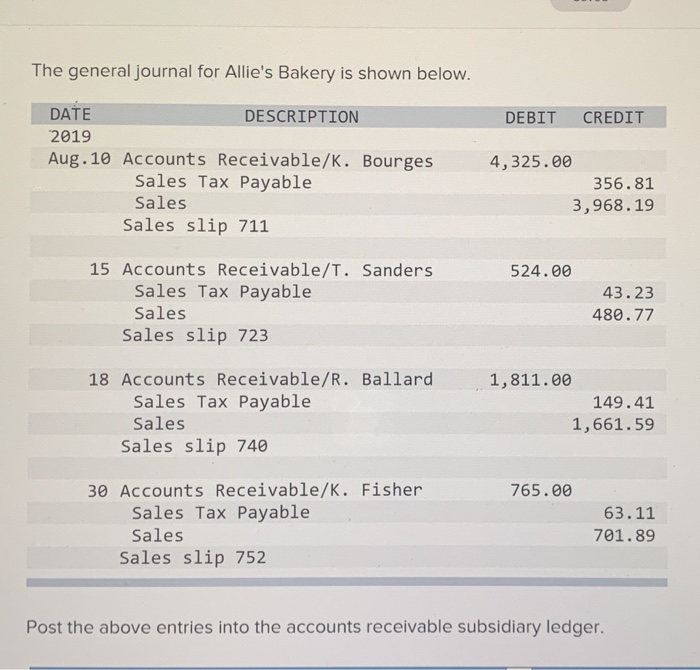

Question: The general journal for Allie's Bakery is shown below DATE 2019 Aug. 10 Accounts Receivable/K. Bourges DESCRIPTION DEBIT CREDIT 4, 325.00 Sales Tax Payable Sales

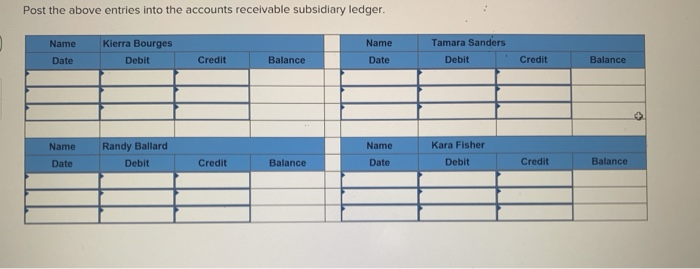

The general journal for Allie's Bakery is shown below DATE 2019 Aug. 10 Accounts Receivable/K. Bourges DESCRIPTION DEBIT CREDIT 4, 325.00 Sales Tax Payable Sales 356.81 3,968.19 Sales slip 711 15 Accounts Receivable/T. Sanders 524.00 Sales Tax Payable Sales 43.23 480.77 Sales slip 723 18 Accounts Receivable/R. Ballard 1,811.00 Sales Tax Payable Sales 149.41 1,661.59 Sales slip 740 30 Accounts Receivable/K, Fisher 765.00 Sales Tax Payable Sales 63.11 701.89 Sales slip 752 Post the above entries into the accounts receivable subsidiary ledger. Post the above entries into the accounts receivable subsidiary ledger. Tamara Sanders Name Kierra Bourges Debit Name Balance Credit Balance Date Debit Credit Date Name Kara Fisher Randy Ballard Debit Name Debit Credit Balance Credit Balance Date Date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts