Question: the given below is the complete question. You are the accountant for XYZ Enterprises, a newly established retail company. During its first month of operations,

the given below is the complete question.

You are the accountant for XYZ Enterprises, a newly established retail company. During its first month of operations, the company engaged in the following hypothetical transactions:

Investment by Owners: The owners invested $ cash into the business in exchange for common stock.

Office Space Rental Agreement: Signed a month lease for retail space, paying the first month's rent of $ in advance.

Purchase of Inventory: Purchased units of inventory at $ per unit on account with terms n

Sale of Inventory Cash: Sold units of inventory for $ per unit in cash. The inventory cost per unit was $

Sale of Inventory On Account: Sold units of inventory for $ per unit on account, terms n The inventory cost per unit was $

Purchase of Equipment: Bought equipment for $ paying $ in cash and the remaining $ on a year note payable.

Utility Expenses: Paid $ in cash for utility bills.

Salaries Expense: Paid $ in cash for employees' salaries.

Advertising Expense: Incurred $ in advertising costs, paid in cash.

Collection from Accounts Receivable: Collected $ from customers who were billed on account.

Payment to Suppliers: Paid $ to suppliers for inventory purchased, taking advantage of the early payment discount.

Prepaid Insurance: Paid $ for a month insurance policy.

Accrued Salaries: Recorded $ in salaries for work done during the last week of the month, to be paid next month.

Depreciation Expense: Recorded $ depreciation for the month on equipment.

Sales Return: Accepted the return of units of inventory sold on account. The inventory was originally sold at $ per unit, with a cost of $ per unit.

Interest Expense: Accrued interest of $ on the note payable.

Inventory Writedown: Due to obsolescence, wrote down inventory by $

Deferred Revenue: Received $ in advance for goods to be delivered next month.

Loan Payment: Paid $ towards the principal of the note payable.

Corporate Taxes: Estimated and recorded income tax expense of $ for the month.

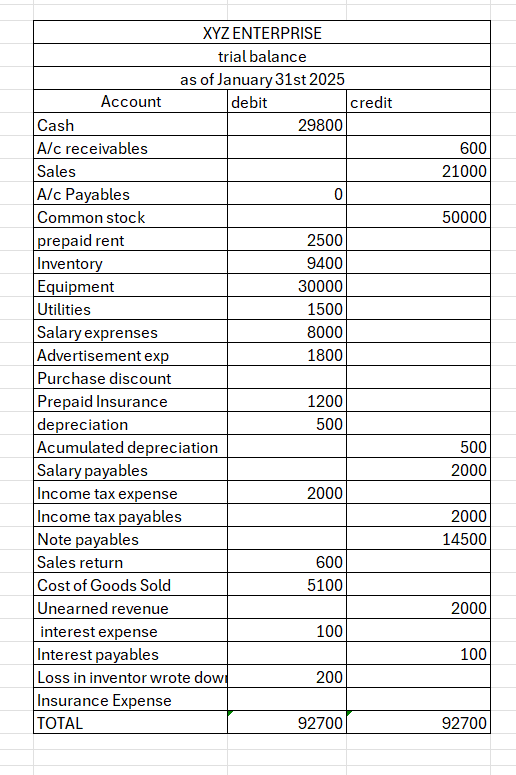

the images is the trial balance, income statement and balance sheet that i did. I am getting a difference of please let me know were i went wrong.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock