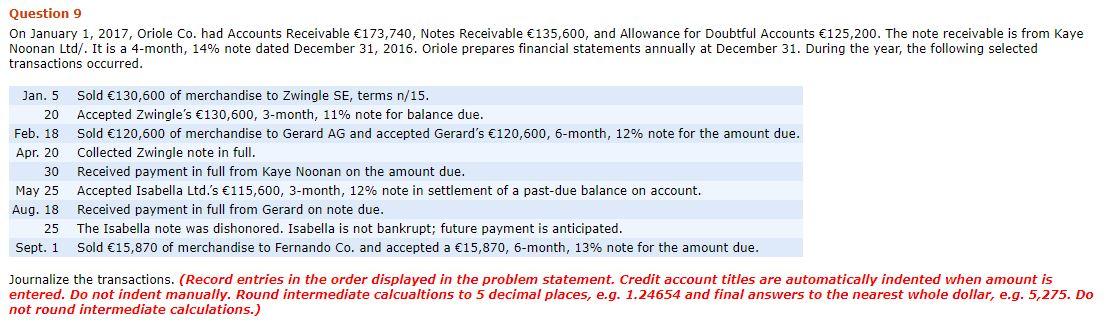

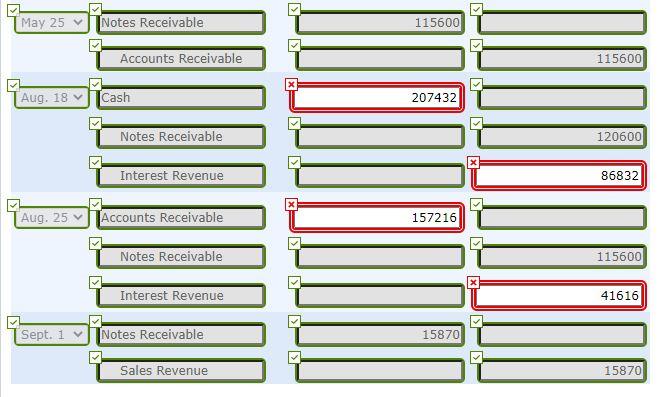

Question: THE GREEN BOXES ARE RIGHT, NO NEED TO FIX THEM THE RED BOXES ARE WRONG, PLEASE FIX THE NUMBERS. THANK YOU Question 9 On January

THE GREEN BOXES ARE RIGHT, NO NEED TO FIX THEM

THE RED BOXES ARE WRONG, PLEASE FIX THE NUMBERS.

THANK YOU

Question 9 On January 1, 2017, Oriole Co. had Accounts Receivable 173,740, Notes Receivable 135,600, and Allowance for Doubtful Accounts 125,200. The note receivable is from Kaye Noonan Ltd/. It is a 4-month, 14% note dated December 31, 2016. Oriole prepares financial statements annually at December 31. During the year, the following selected transactions occurred. Jan. 5 Sold 130,600 of merchandise to Zwingle SE, terms n/15. 20 Accepted Zwingle's 130,600, 3-month, 11% note for balance due. Feb. 18 Sold 120,600 of merchandise to Gerard AG and accepted Gerard's 120,600, 6-month, 12% note for the amount due. Apr. 20 Collected Zwingle note in full. 30 Received payment in full from Kaye Noonan on the amount due. May 25 Accepted Isabella Ltd.'s 115,600, 3-month, 12% note in settlement of a past-due balance on account. Aug. 18 Received payment in full from Gerard on note due. 25 The Isabella note was dishonored. Isabella is not bankrupt; future payment is anticipated. Sept. 1 Sold 15,870 of merchandise to Fernando Co. and accepted a 15,870, 6-month, 13% note for the amount due. Journalize the transactions. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when amount is entered. Do not indent manually. Round intermediate calcualtions to 5 decimal places, e.g. 1.24654 and final answers to the nearest whole dollar, e.g. 5,275. Do not round intermediate calculations.) Date Account Titles and Explanation Debit Credit Jan. 5 Accounts Receivable 130600 Sales Revenue 130600 > Jan. 20 Notes Receivable 130600 Accounts Receivable 130600 Feb. 18 Notes Receivable 120600 Sales Revenue 120600 > > Apr. 20 Cash 173698 Notes Receivable 130600 Interest Revenue 43098 X > Apr. 30 Cash 211536 Notes Receivable 135600 x Interest Revenue 75936 May 25 Notes Receivable 115600 Accounts Receivable 115600 Aug. 18 Cash 207432 Notes Receivable 120600 Interest Revenue 86832 Aug. 25 Accounts Receivable 157216 Notes Receivable 115600 Interest Revenue 41616 Sept. 1 Notes Receivable 15870 > Sales Revenue 15870

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts