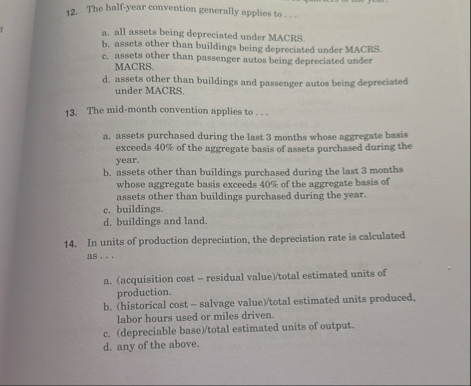

Question: The half - year convention generally applies to . . . a . all assets being deprecinted under MACRS. b . assets other than buildings

The halfyear convention generally applies to

a all assets being deprecinted under MACRS.

b assets other than buildings being depreciated under MACRS.

c assets other than passenger autos being depreciated under MACRS.

d assets other than buildings and passenger autos being depreciated under MACRS.

The midmonth convention applies to

a assets purchased during the last months whose aggregate basis exceeds of the aggregate basis of assets purchased during the year.

b assets other than buildings purchased during the last months whose aggregate basis exceeds of the aggregate basis of assets other than buildings purchased during the year.

c buildings.

d buildings and land.

In units of production depreciation, the depreciation rate is calculated as

aacquisition cost residual valuetotal estimated units of production.

bhistorical cost salvage valuetotal estimated units produced, labor hours used or miles driven.

cdepreciable basetotal estimated units of output.

d any of the above.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock