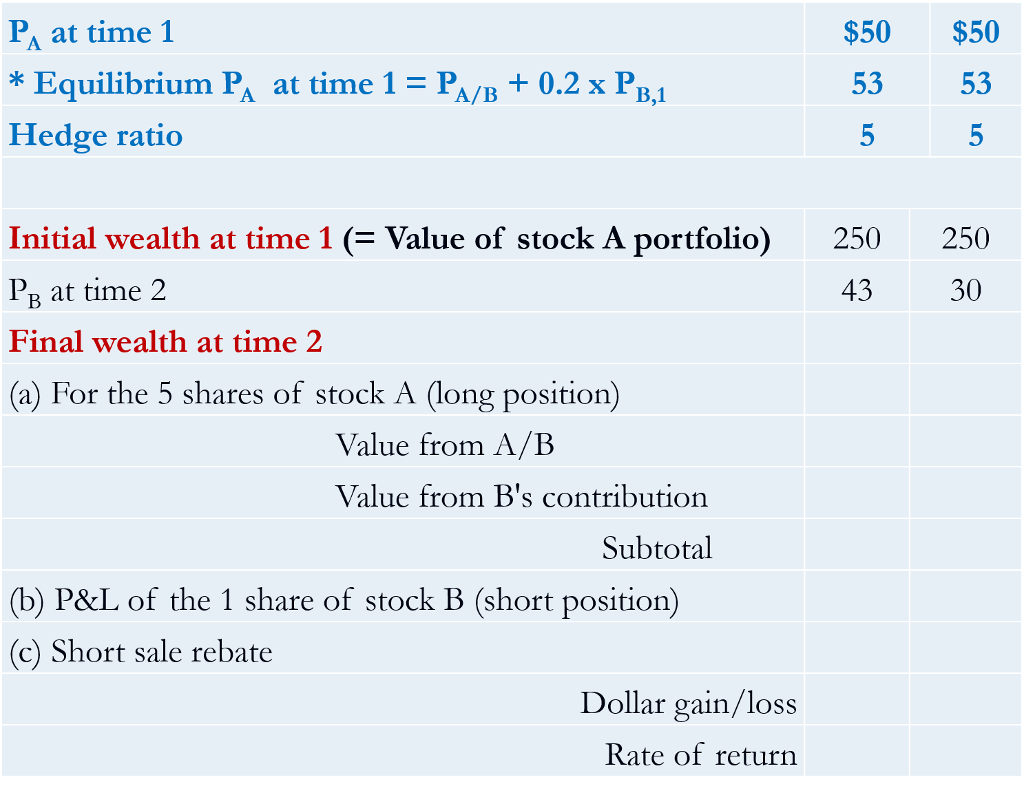

Question: The hedge fund now borrows a margin loadn to long stock A. The long margin ratio requirement is 55% and margin loan interest rate is

The hedge fund now borrows a margin loadn to long stock A. The long margin ratio requirement is 55% and margin loan interest rate is 3%. Please compute the dollar return and rate of return again if the sahre price of Firm B rises to $43 at time 2. ROI is 6.18%.

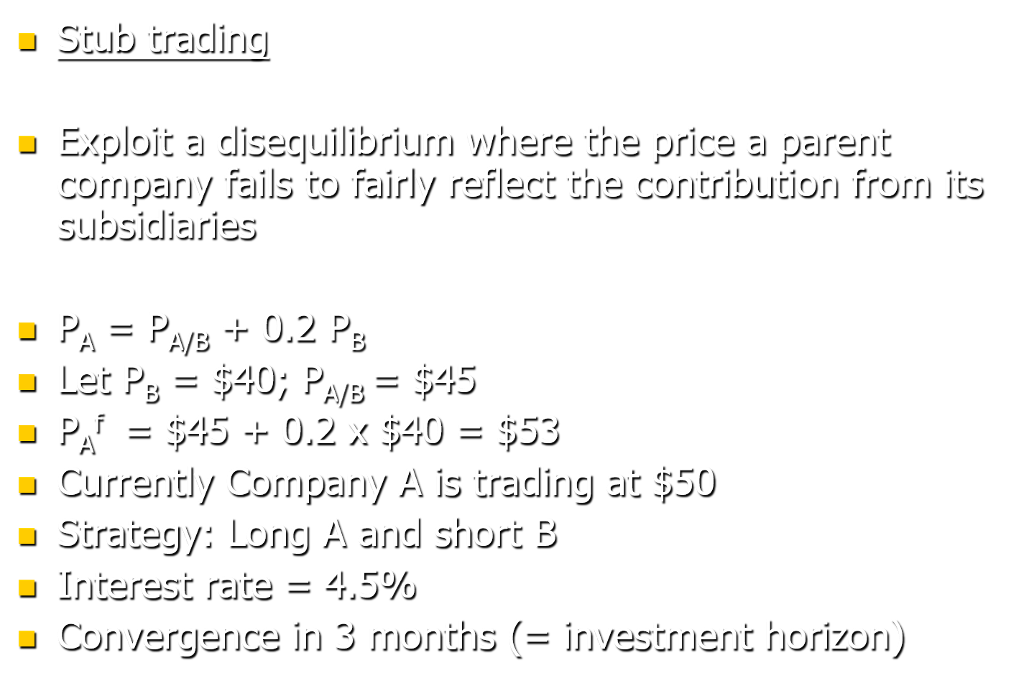

Stub tracingl Exploit a disequilibrium where the price a parent company fails to fairly reflect the contribution from its subsidiaries PAVE 0,2 P et P P, P r u Currently Company A is trading at 550 u Strategy: Long A and short B Interest rate 45% Convergence in 3 months investment horizon) Stub tracingl Exploit a disequilibrium where the price a parent company fails to fairly reflect the contribution from its subsidiaries PAVE 0,2 P et P P, P r u Currently Company A is trading at 550 u Strategy: Long A and short B Interest rate 45% Convergence in 3 months investment horizon)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts