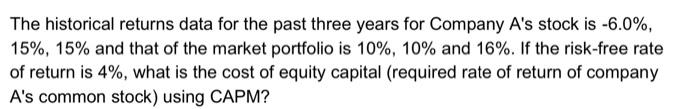

Question: The historical returns data for the past three years for Company A's stock is 6.0%, 15%,15% and that of the market portfolio is 10%,10% and

The historical returns data for the past three years for Company A's stock is 6.0%, 15%,15% and that of the market portfolio is 10%,10% and 16%. If the risk-free rate of return is 4%, what is the cost of equity capital (required rate of return of company A's common stock) using CAPM? The historical returns data for the past three years for Company A's stock is 6.0%, 15%,15% and that of the market portfolio is 10%,10% and 16%. If the risk-free rate of return is 4%, what is the cost of equity capital (required rate of return of company A's common stock) using CAPM

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock