Question: The idea that individuals with the same economic capacity should pay the same tax represents a tax fairness. b vertical equity. c horizontal equity. d

The idea that individuals with the same economic capacity should pay the same tax represents

a tax fairness.

b vertical equity.

c horizontal equity.

d common-sense tax system.

e All of the above.

f  None of the above.

None of the above.

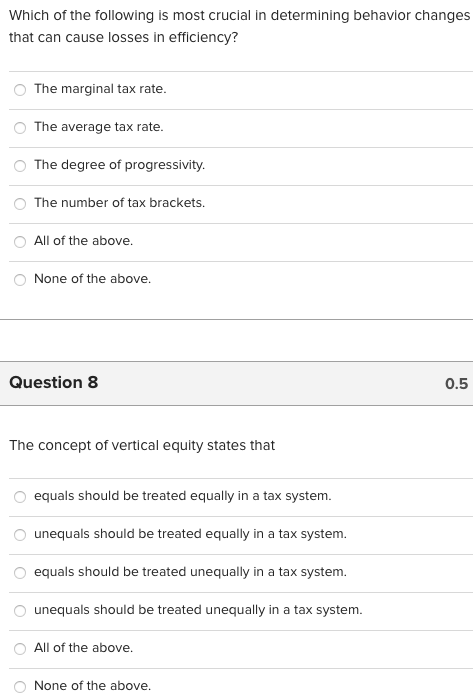

Which of the following is most crucial in determining behavior changes that can cause losses in efficiency? The marginal tax rate. The average tax rate. The degree of progressivity. The number of tax brackets. All of the above. None of the above. Question 8 0.5 The concept of vertical equity states that equals should be treated equally in a tax system. unequals should be treated equally in a tax system. equals should be treated unequally in a tax system. unequals should be treated unequally in a tax system. All of the above. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts