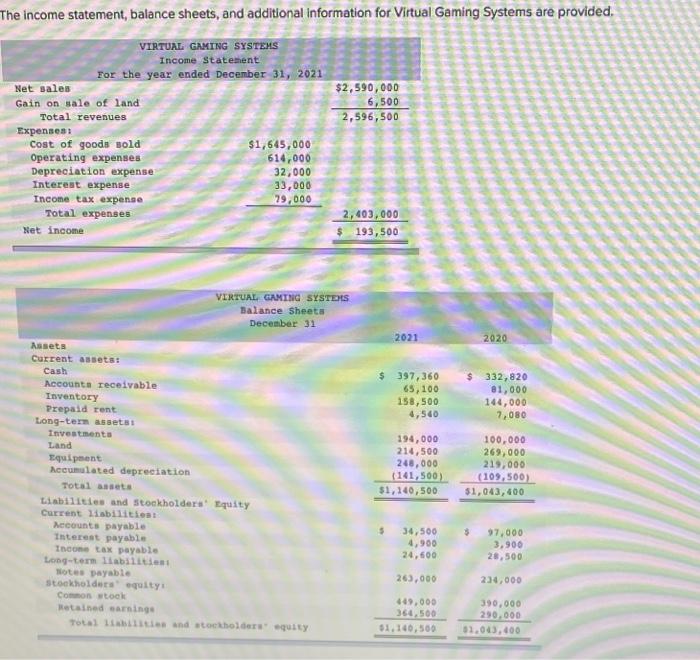

Question: The income statement, balance sheets, and additional information for Virtual Gaming Systems are provided. $2,590,000 6,500 2,596,500 VIRTUAL GAMING SYSTEMS Income Statement For the year

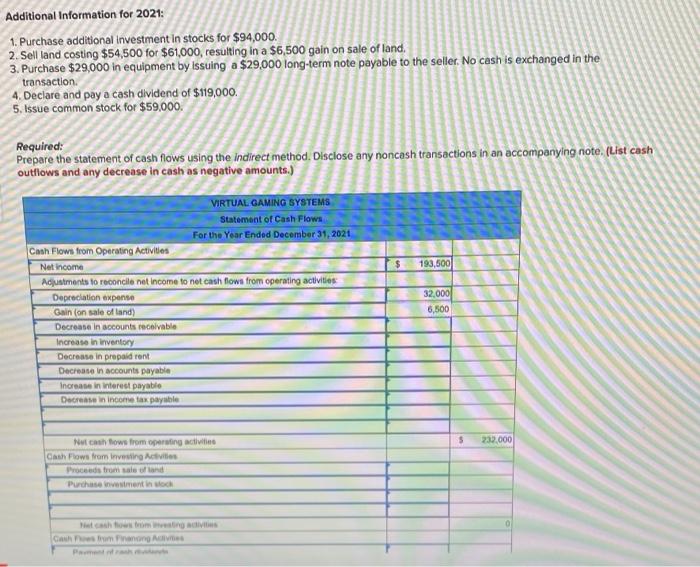

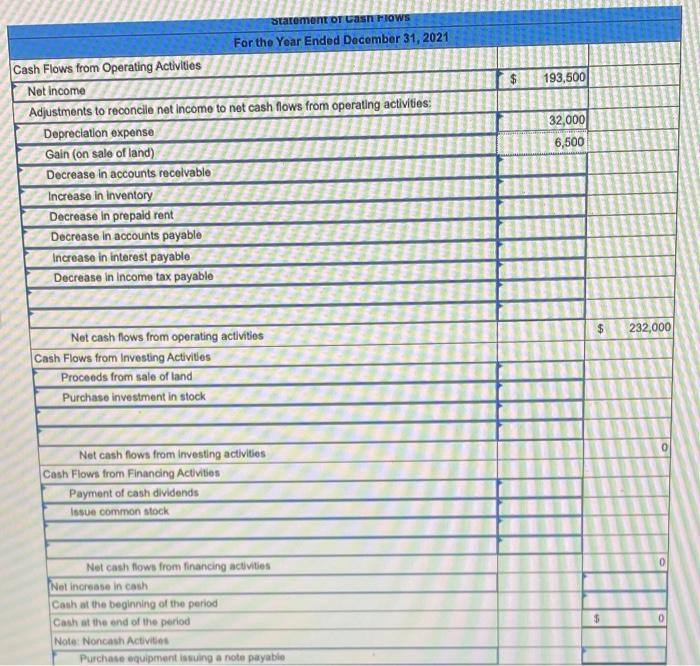

The income statement, balance sheets, and additional information for Virtual Gaming Systems are provided. $2,590,000 6,500 2,596,500 VIRTUAL GAMING SYSTEMS Income Statement For the year ended December 31, 2021 Net sales Gain on sale of land Total revenues Expenses Cost of goods sold $1,645,000 Operating expenses 614,000 Depreciation expense 32,000 Interest expense 33,000 Income tax expense 129,000 Total expenses Net income 2, 403,000 $ 193,500 VIRTUAL GAMING SYSTEMS Balance Sheeta December 31 2021 2020 $ 397,360 65,100 158,500 4,540 332,820 81,000 144,000 7,080 Assets Current assetst Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investments Land Equipment Accumulated depreciation Total asets Liabilities and stockholders' Equity Current abilities Accounts payable Interest payable Income tax payable Long-term liabilities Notes payable stockholders equity Common stock Betained samnings Total lities and stockholders uity 194,000 214,500 248,000 (141,500) $1,140,500 100,000 269,000 219,000 (109,500) $1,043,400 $ 3 34,500 4,900 24,500 97,000 3.900 28,500 263,000 234.000 449,000 364.500 01.140,500 390.000 290.000 01.00), 400 Additional Information for 2021: 1. Purchase additional Investment in stocks for $94,000. 2. Sell land costing $54,500 for $61,000, resulting in a $6,500 gain on sale of land. 3. Purchase $29,000 in equipment by Issuing a $29,000 long-term note payable to the seller. No cash is exchanged in the transaction 4. Declare and pay a cash dividend of $119,000. 5, Issue common stock for $59,000. Required: Prepare the statement of cash flows using the Indirect method. Disclose any noncash transactions in an accompanying note. (List cash outflows and any decrease in cash as negative amounts.) $ 193,500 VIRTUAL GAMING SYSTEMS Statement of Cash Flow For the Year Ended December 31, 2021 Cash Flows from Operating Activities Net Income Adjustments to reconcile net income to net cash flows from operating activities Depreciation expense Gain (on sale of land Decrease in accounts receivable Increase in inventory Decrease in prepaid rent Decrease in accounts payable Increase in interest Payable Decrease in income tax payable 32.000 6,800 5 232.000 Nutcash flows from operating activities Cash Flows from Investing Activities Proceedrom sale of land Purchase investment in och utch forming Chang $ 193,500 32,000 6,500 statement of Cash Flows For the Year Ended December 31, 2021 Cash Flows from Operating Activities Net income Adjustments to reconcile net Income to net cash flows from operating activities: Depreciation expense Gain (on sale of land) Decrease in accounts receivable Increase in inventory Decrease in prepaid rent Decrease in accounts payable Increase in interest payable Decrease in Income tax payable $ 232,000 Net cash flows from operating activities Cash Flows from Investing Activities Proceeds from sale of land Purchase investment in stock Net cash flows from Investing activities Cash Flows from Financing Activities Payment of cash dividends Issue common stock Net cash flows from financing activities Not increase in cash Cash at the beginning of the period Cash at the end of the period Note: Noncash Activities Purchase equipment issuing a note payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts