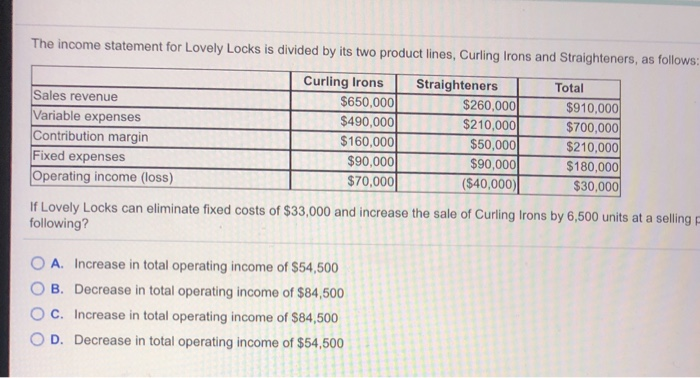

Question: The income statement for Lovely Locks is divided by its two product lines, Curling Irons and Straighteners, as follows: Sales revenue Variable expenses Contribution margin

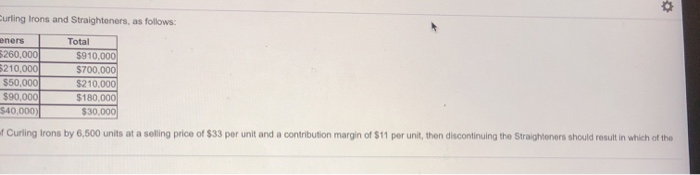

The income statement for Lovely Locks is divided by its two product lines, Curling Irons and Straighteners, as follows: Sales revenue Variable expenses Contribution margin Fixed expenses Operating income (loss) Curling Irons $650,000 $490,000 $160,000 $90,000 $70,000 argin- Straighteners $260,000 $210,000 $50,000 $90,000 ($40,000 Total $910,000 $700,000 $210,000 $180,000 $30,000 If Lovely Locks can eliminate fixed costs of $33,000 and increase th following? sale of Curling Irons by 6,500 units at a selling O A. Increase in total operating income of $54,500 OB. Decrease in total operating income of $84,500 OC. Increase in total operating income of $84,500 OD. Decrease in total operating income of $54, Curling Irons and Straighteners, as follows: eners 5260,000 $210,000 $50,000 $90.000 $40,000) Total $910,000 $700.000 $210.000 $180,000 $30,000 Curling Irons by 6,500 units at a selling price of $33 per unit and a contribution margin of $11 per unit, then discontinuing the Straighteners should result in which of the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts