Question: The income statement for Travers & Co. is shown below. The firm currently has 25.0 million shares of common stock outstanding. However, an analyst has

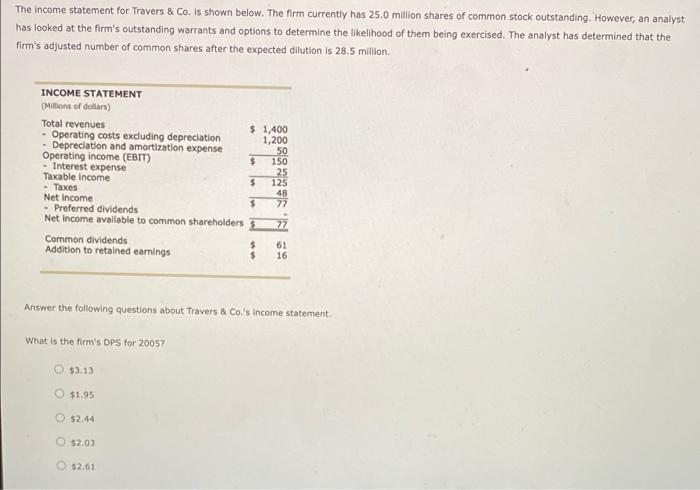

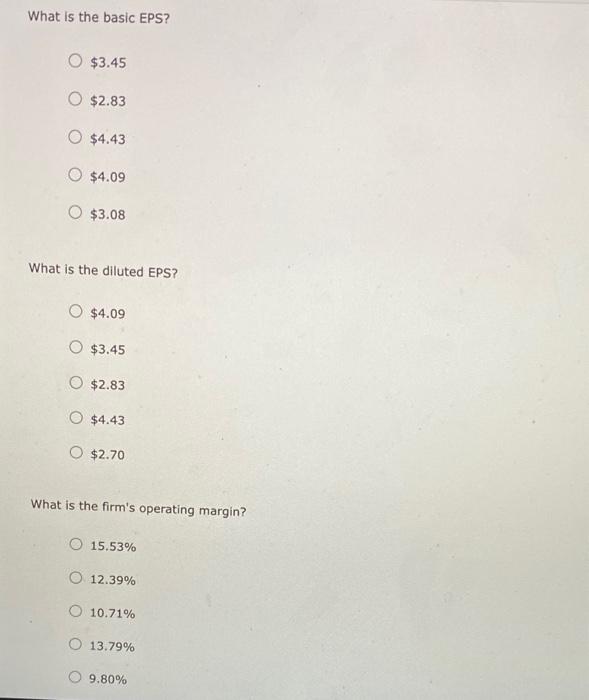

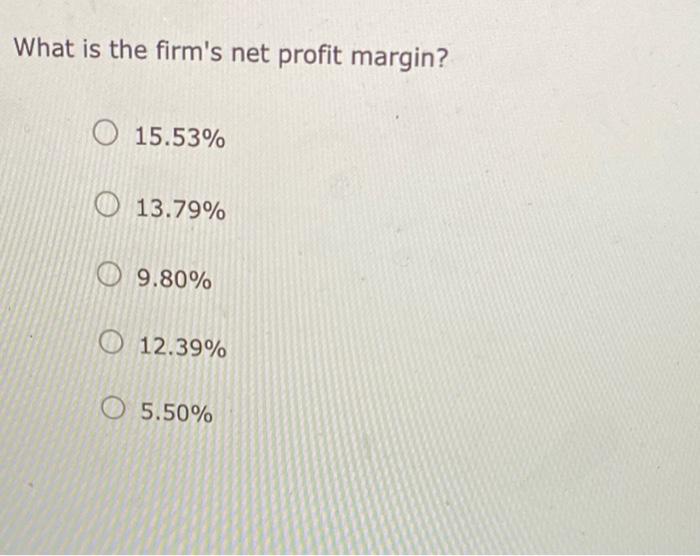

The income statement for Travers & Co. is shown below. The firm currently has 25.0 million shares of common stock outstanding. However, an analyst has looked at the firm's outstanding warrants and options to determine the likelihood of them being exercised. The analyst has determined that the firm's adjusted number of common shares after the expected dilution is 28.5 million INCOME STATEMENT (Millions of dollars) Total revenues $ 1,400 - Operating costs excluding depreciation 1,200 Depreciation and amortization expense 50 Operating income (EBIT) $ 150 - Interest expense 25 Taxable income $ 125 - Taxes 48 Net Income $ 22 - Preferred dividends Net Income available to common shareholders 27 Common dividends $ 61 Addition to retained earnings 16 900.00 Answer the following questions about Travers & Co's income statement What is the firm's DPS for 20057 $3.13 $1.95 $2.44 $2.03 $2.61 What is the basic EPS? $3.45 O $2.83 O $4.43 $4.09 $3.08 What is the diluted EPS? $4.09 O $3.45 O $2.83 O $4.43 $2.70 What is the firm's operating margin? O 15.53% O 12.39% O 10.71% O 13.79% 9.80% What is the firm's net profit margin? O 15.53% O 13.79% 9.80% O 12.39% O 5.50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts