Question: The Industrial Machine Division has requested a specially designed subassembly from the Metal Fabricating Division. Because the assembly is specially designed, no outside market price

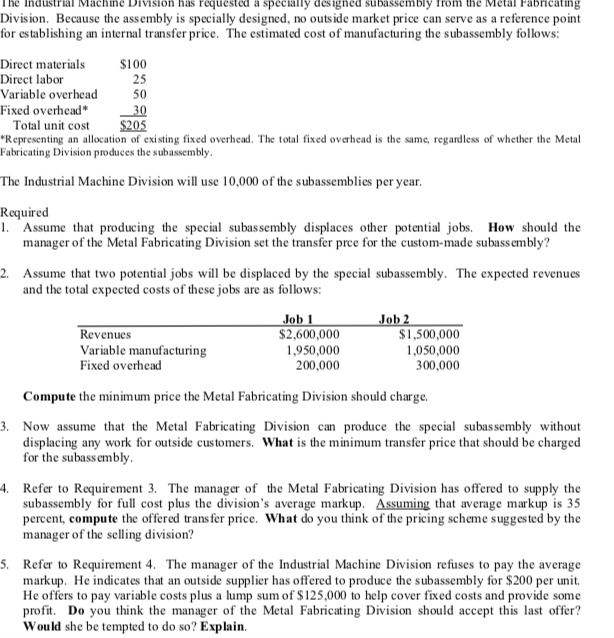

The Industrial Machine Division has requested a specially designed subassembly from the Metal Fabricating Division. Because the assembly is specially designed, no outside market price can serve as a reference point for establishing an internal transfer price. The estimated cost of manufacturing the subassembly follows: Direct materials $100 Direct labor 25 Variable overhead Fixed overhead* _30 Total unit cost $205 *Representing an allocation of existing fixed overhead. The total fixed overhead is the same, regardless of whether the Metal Fabricating Division produces the subassembly. The Industrial Machine Division will use 10,000 of the subassemblies per year. Required 1. Assume that producing the special subassembly displaces other potential jobs. How should the manager of the Metal Fabricating Division set the transfer prce for the custom-made subassembly? 2. Assume that two potential jobs will be displaced by the special subassembly. The expected revenues and the total expected costs of these jobs are as follows: Revenues Variable manufacturing Fixed overhead Job 1 $2,600,000 1,950,000 200,000 Job 2 $1,500,000 1,050,000 300,000 Compute the minimum price the Metal Fabricating Division should charge. 3. Now assume that the Metal Fabricating Division can produce the special subassembly without displacing any work for outside customers. What is the minimum transfer price that should be charged for the subassembly 4. Refer to Requirement 3. The manager of the Metal Fabricating Division has offered to supply the subassembly for full cost plus the division's average markup. Assuming that average markup is 35 percent, compute the offered transfer price. What do you think of the pricing scheme suggested by the manager of the selling division? Refer to Requirement 4. The manager of the Industrial Machine Division refuses to pay the average markup. He indicates that an outside supplier has offered to produce the subassembly for $200 per unit. He offers to pay variable costs plus a lump sum of $125,000 to help cover fixed costs and provide some profit. Do you think the manager of the Metal Fabricating Division should accept this last offer? Would she be tempted to do so? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts