Question: the ine ints ses , us . pen Ibe wer ont ack and ugh the 1 of ator ipus 1 ore sard late. dent OVERVIEW

the

ine

ints

ses

us

pen

Ibe

wer

ont

ack

and

ugh

the

of

ator

ipus

ore

sard

late.

dent

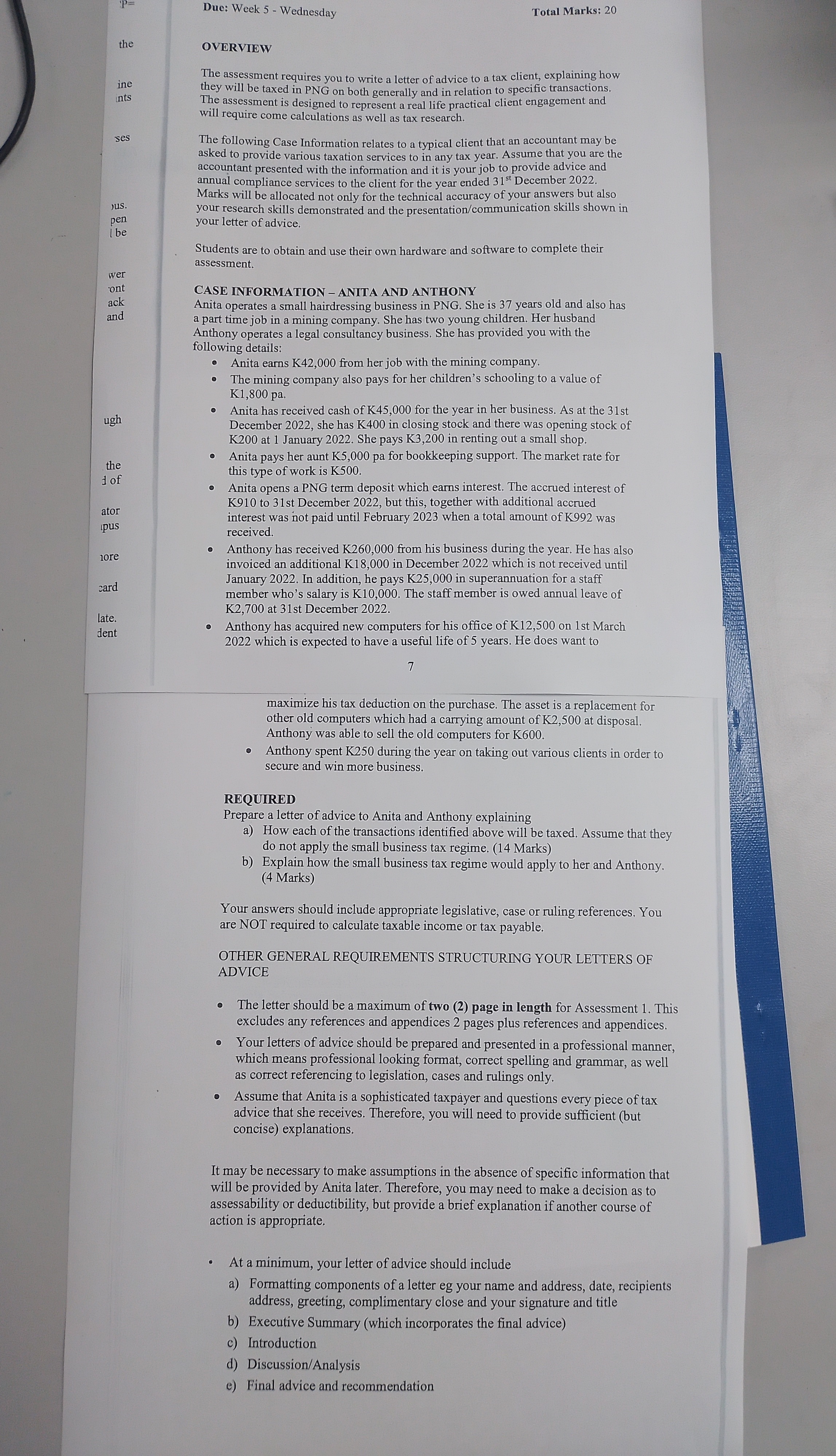

OVERVIEW

The assessment requires you to write a letter of advice to a tax client, explaining how

they will be taxed in PNG on both generally and in relation to specific transactions

The assessment is designed to represent a real life practical client engagement and

will require come calculations as well as tax research.

The following Case Information relates to a typical client that an accountant may be

asked to provide various taxation services to in any tax year. Assume that you are the

accountant presented with the information and it is your job to provide advice and

annual compliance services to the client for the year ended December

Marks will be allocated not only for the technical accuracy of your answers but also

your research skills demonstrated and the presentationcommunication skills shown in

your letter of advice.

Students are to obtain and use their own hardware and software to complete their

assessment.

CASE INFORMATION ANITA AND ANTHONY

Anita operates a small hairdressing business in PNG She is years old and also has

a part time job in a mining company. She has two young children. Her husband

Anthony operates a legal consultancy business. She has provided you with the

following details:

Anita earns K from her job with the mining company.

The mining company also pays for her children's schooling to a value of

pa

Anita has received cash of K for the year in her business. As at the st

December she has K in closing stock and there was opening stock of

K at January She pays K in renting out a small shop.

Anita pays her aunt K pa for bookkeeping support. The market rate for

this type of work is K

Anita opens a PNG term deposit which earns interest. The accrued interest of

K to st December but this, together with additional accrued

interest was not paid until February when a total amount of K was

received.

Anthony has received K from his business during the year. He has also

invoiced an additional K in December which is not received until

January In addition, he pays K in superannuation for a staff

member who's salary is K The staff member is owed annual leave of

K at st December

Anthony has acquired new computers for his office of K on st March

which is expected to have a useful life of years. He does want to

maximize his tax deduction on the purchase. The asset is a replacement for

other old computers which had a carrying amount of K at disposal.

Anthony was able to sell the old computers for K

Anthony spent K during the year on taking out various clients in order to

secure and win more business.

REQUIRED

Prepare a letter of advice to Anita and Anthony explaining

a How each of the transactions identified above will be taxed. Assume that they

do not apply the small business tax regime. Marks

b Explain how the small business tax regime would apply to her and Anthony.

Marks

Your answers should include appropriate legislative, case or ruling references. You

are NOT required to calculate taxable income or tax payable.

OTHER GENERAL REQUIREMENTS STRUCTURING YOUR LETTERS OF

ADVICE

The letter should be a maximum of two page in length for Assessment This

excludes any references and appendices pages plus references and appendices.

Your letters of advice should be prepared and presented in a professional manner,

which means professional looking format, correct spelling and grammar, as well

as correct referencing to legislation, cases and rulings only.

Assume that Anita is a sophisticated taxpayer and questions every piece of tax

advice that she receives. Therefore, you will need to provide sufficient but

concise explanations.

It may be necessary to make assumptions in the absence of specific information that

will be provided by Anita later. Therefore, you may need to make a decision as to

assessability or deductibility, but provide a brief explanation if another course of

action is appropriate.

At a minimum, your letter of advice should include

a Formatting components of a letter eg your name and address, date, recipients

address, greeting, complimentary close and your signature and title

b Executive Summary which incorporates the final advice

c Introduction

d DiscussionAnalysis

e Final advice and recommendation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock