Question: The information below relates to Entity A for the year ended 30 June 2023. Accounting profit before income tax Depreciation of plant Depreciation of

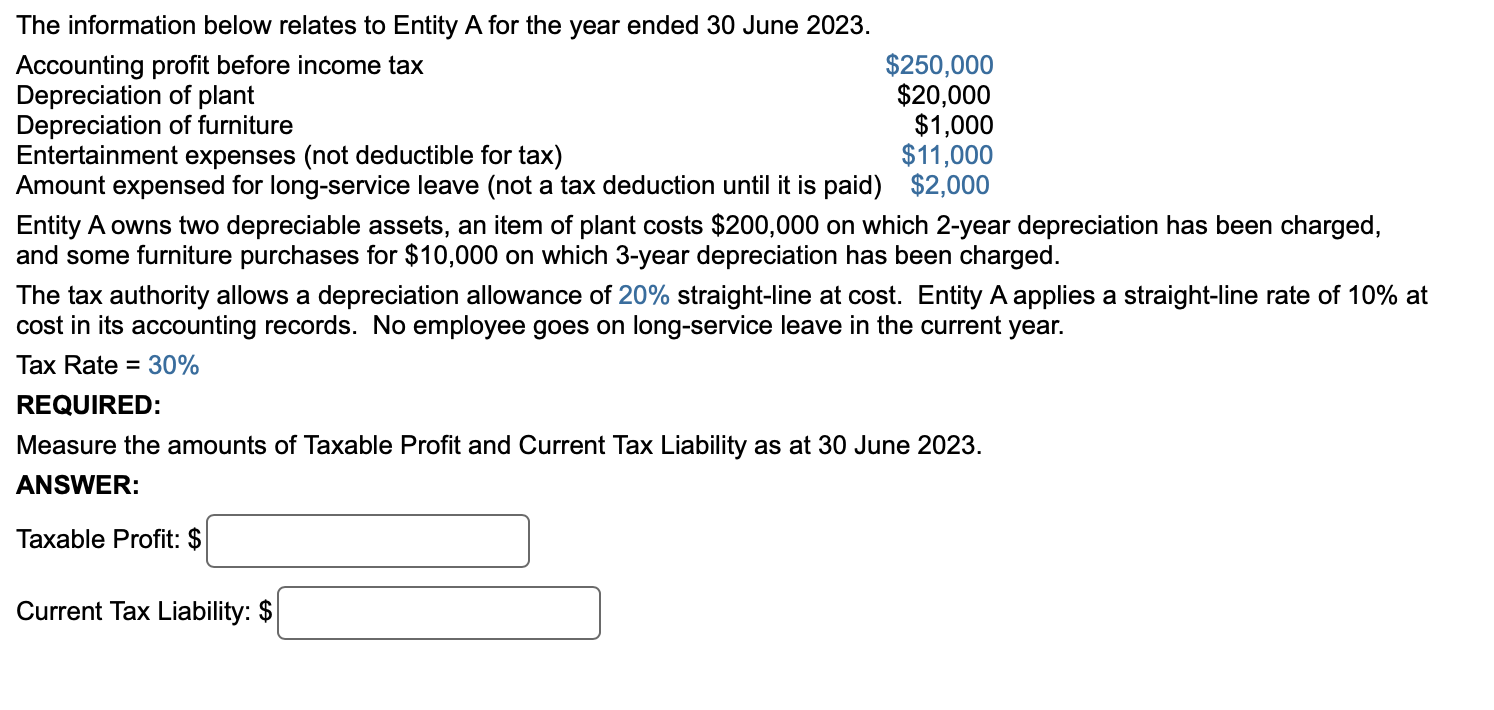

The information below relates to Entity A for the year ended 30 June 2023. Accounting profit before income tax Depreciation of plant Depreciation of furniture $250,000 $20,000 $1,000 Entertainment expenses (not deductible for tax) $11,000 Amount expensed for long-service leave (not a tax deduction until it is paid) $2,000 Entity A owns two depreciable assets, an item of plant costs $200,000 on which 2-year depreciation has been charged, and some furniture purchases for $10,000 on which 3-year depreciation has been charged. The tax authority allows a depreciation allowance of 20% straight-line at cost. Entity A applies a straight-line rate of 10% at cost in its accounting records. No employee goes on long-service leave in the current year. Tax Rate = 30% REQUIRED: Measure the amounts of Taxable Profit and Current Tax Liability as at 30 June 2023. ANSWER: Taxable Profit: $ Current Tax Liability: $

Step by Step Solution

There are 3 Steps involved in it

From the provided information we need to calculate the taxable profit and the current tax liability ... View full answer

Get step-by-step solutions from verified subject matter experts