Question: The information below relates to Wellness Ltd and Crip Ltd . Wellness Ltd is a company that manufactures hospital beds and Crip Ltd manufactures mattresses

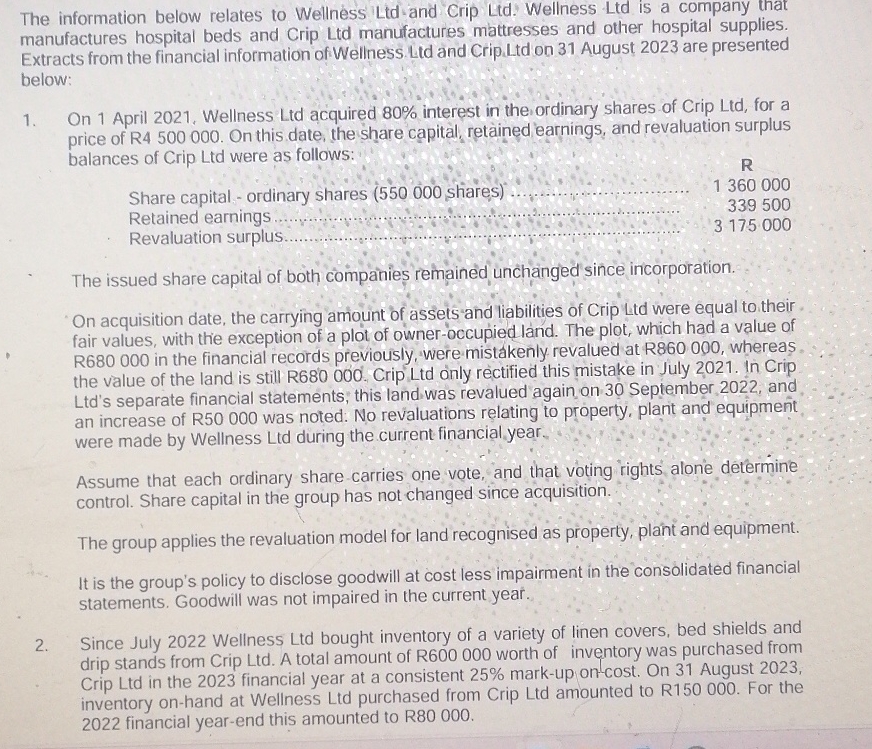

The information below relates to Wellness Ltd and Crip Ltd Wellness Ltd is a company that manufactures hospital beds and Crip Ltd manufactures mattresses and other hospital supplies. Extracts from the financial information of Wellness

Ltd and Crip.Ltd on August are presented below:

On April Wellness Ltd acquired interest in the ordinary shares of Crip Ltd for a price of R On this date, the share capital, retained earnings, and revaluation surplus balances of Crip Ltd were as follows:

tableRShare capital ordinary shares sharesRetained earnings,Revaluation surplus,

The issued share capital of both companies remained unchanged since incorporation.

On acquisition date, the carrying amount of assets and liabilities of Crip Ltd were equal to their fair values, with the exception of a plot of owneroccupied land. The plot, which had a value of R in the financial records previously, were mistkenly revalued at R whereas the value of the land is still R Crip Ltd only rectified this mistake in July In Crip Ltds separate financial statements; this land was revalued again on September and an increase of R was noted. No revaluations relating to property, plant and equipment were made by Wellness Ltd during the current financial, year

Assume that each ordinary share carries one vote, and that voting rights alone determine control. Share capital in the group has not changed since acquisition.

The group applies the revaluation model for land recognised as property, plant and equipment.

It is the group's policy to disclose goodwill at cost less impairment in the consolidated financial statements. Goodwill was not impaired in the current year.

Since July Wellness Ltd bought inventory of a variety of linen covers, bed shields and drip stands from Crip Ltd A total amount of R worth of inventory was purchased from Crip Ltd in the financial year at a consistent markup oncost On August inventory onhand at Wellness Ltd purchased from Crip Ltd amounted to R For the financial yearend this amounted to R

On May Wellness Ltd sold a manufacturing machine to Crip Ltd to facilitate the production of mattresses. The machine was valued at R on date of sale, and it was sold to Crip Ltd for R Machinery is depreciated in the group at per annum using the reducing balance method.

Crip Ltd declared an ordinary dividend of cents per share in the current year. The dividend is payable on September

PART A

Prepare the following proforma journal entries for the Wellness Ltd Group for the year ended August after taking the abovementioned information into account:

a Recording of the noncontrolling interests' share of the current year revaluation in Crip Ltd

b The elimination of the depreciation on unrealised profit in the current year arising from the intragroup sale of machinery.

c The elimination of the intragroup ordinary divident.

Take note:

Calculations are required. No marks will be awarded for calculated amounts unless the amounts are supported by relevant calculations.

Journal narrations are not required.

Show all calculations and round all amounts to the nearest Rand.

Ignore the taxation effect of unrealised profits andor losses, as well as capital gains tax.

PART B

In paragraphs, discuss the proforma consolidation journal entry to record the elimination of the owners' equity of the subsidiary on the acquisition date. Your discussion should include calculations where applicable and the reasons why this proforma journal entry is required for consolidation purposes.

Communication mark logical flow of discussion

PART C

Assume for this part only that Crip Ltd is an associate of Wellness Ltd Wellness Ltd acquired interest in Crip Ltd and the intragroup sale transactions above applies to the two companies. Discuss the accounting treatment of the sale of inventory transaction.

Communication mark logical flow of discussion

Take note:

You are not required to provide the proforma consolidation journals, only a discussion and calculations.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock