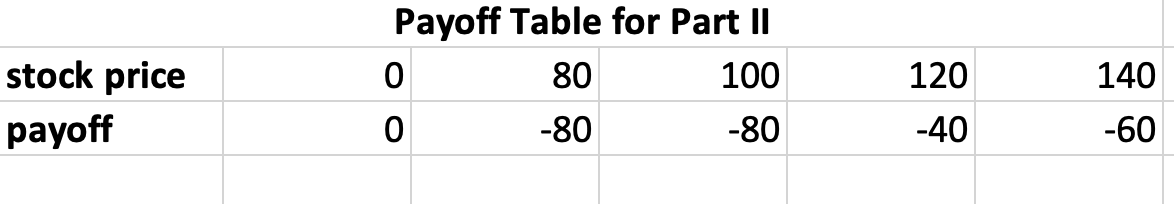

Question: the information given below the payoff table is the question. The payoff table is the answer. I want to understand how the payoff table was

the information given below the payoff table is the question. The payoff table is the answer. I want to understand how the payoff table was created and what steps were taken in creating it.

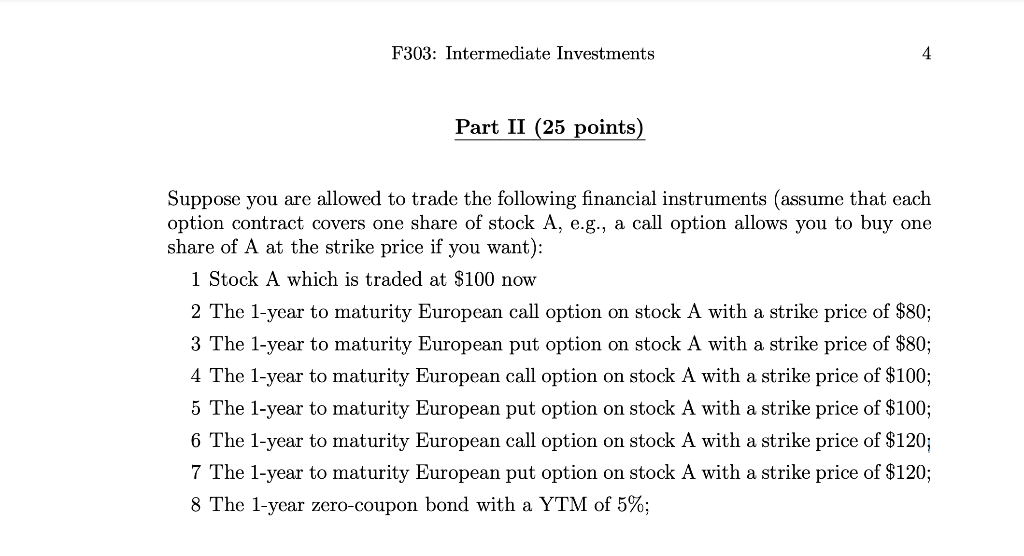

Payoff Table for Part II \begin{tabular}{|l|r|r|r|r|r|} \hline stock price & 0 & 80 & 100 & 120 & 140 \\ \hline payoff & 0 & 80 & 80 & 40 & 60 \\ \hline \end{tabular} Suppose you are allowed to trade the following financial instruments (assume that each option contract covers one share of stock A, e.g., a call option allows you to buy one share of A at the strike price if you want): 1 Stock A which is traded at $100 now 2 The 1-year to maturity European call option on stock A with a strike price of $80; 3 The 1-year to maturity European put option on stock A with a strike price of $80; 4 The 1-year to maturity European call option on stock A with a strike price of $100; 5 The 1-year to maturity European put option on stock A with a strike price of $100; 6 The 1-year to maturity European call option on stock A with a strike price of $120; 7 The 1-year to maturity European put option on stock A with a strike price of $120; 8 The 1-year zero-coupon bond with a YTM of 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts