Question: The initial situation is an isolated island whose power system is entirely based on gas power plants having the same technologies. The gas is imported.

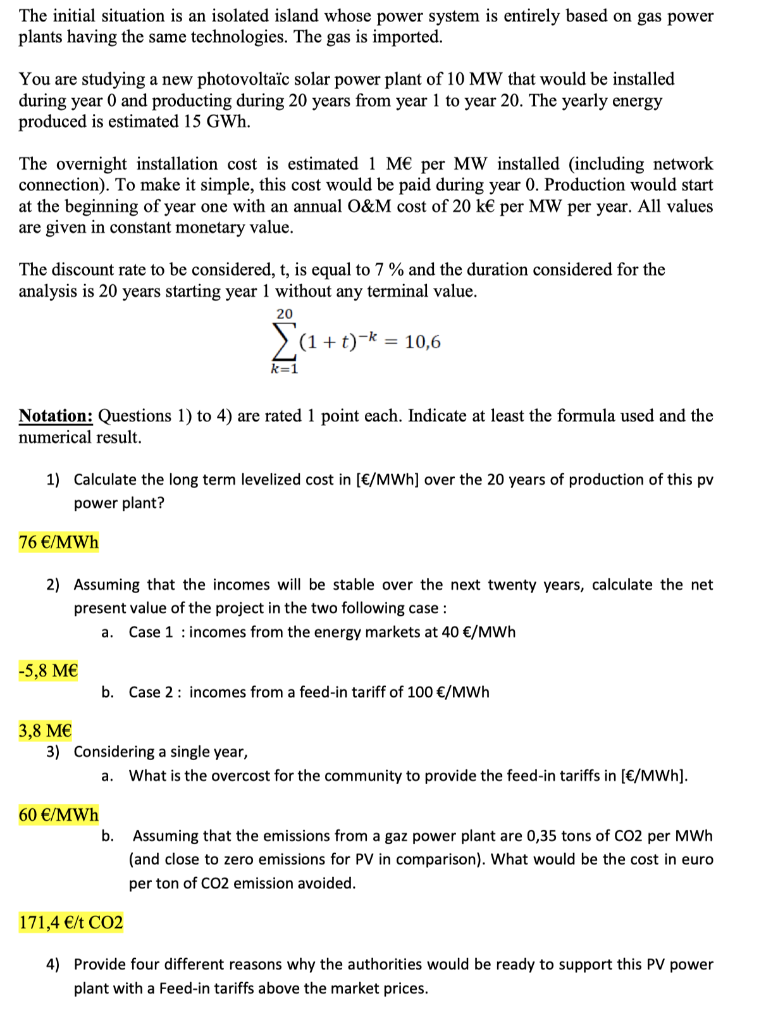

The initial situation is an isolated island whose power system is entirely based on gas power plants having the same technologies. The gas is imported. You are studying a new photovoltac solar power plant of 10 MW that would be installed during year 0 and producting during 20 years from year 1 to year 20. The yearly energy produced is estimated 15 GWh. The overnight installation cost is estimated 1 M per MW installed (including network connection). To make it simple, this cost would be paid during year 0. Production would start at the beginning of year one with an annual O&M cost of 20 k per MW per year. All values are given in constant monetary value. The discount rate to be considered, t, is equal to 7 % and the duration considered for the analysis is 20 years starting year 1 without any terminal value. 20 (1 +t)-k + -K = 10,6 k=1 Notation: Questions 1) to 4) are rated 1 point each. Indicate at least the formula used and the numerical result. 1) Calculate the long term levelized cost in (/MWh) over the 20 years of production of this pv power plant? 76 /MWh 2) Assuming that the incomes will be stable over the next twenty years, calculate the net present value of the project in the two following case: a. Case 1 : incomes from the energy markets at 40 /MWh -5,8 ME b. Case 2: incomes from a feed-in tariff of 100 /MWh 3,8 ME 3) Considering a single year, a. What is the overcost for the community to provide the feed-in tariffs in [/MWh). 60 /MWh b. Assuming that the emissions from a gaz power plant are 0,35 tons of CO2 per MWh (and close to zero emissions for PV in comparison). What would be the cost in euro per ton of CO2 emission avoided. 171,4 /t CO2 4) Provide four different reasons why the authorities would be ready to support this PV power plant with a Feed-in tariffs above the market prices. The initial situation is an isolated island whose power system is entirely based on gas power plants having the same technologies. The gas is imported. You are studying a new photovoltac solar power plant of 10 MW that would be installed during year 0 and producting during 20 years from year 1 to year 20. The yearly energy produced is estimated 15 GWh. The overnight installation cost is estimated 1 M per MW installed (including network connection). To make it simple, this cost would be paid during year 0. Production would start at the beginning of year one with an annual O&M cost of 20 k per MW per year. All values are given in constant monetary value. The discount rate to be considered, t, is equal to 7 % and the duration considered for the analysis is 20 years starting year 1 without any terminal value. 20 (1 +t)-k + -K = 10,6 k=1 Notation: Questions 1) to 4) are rated 1 point each. Indicate at least the formula used and the numerical result. 1) Calculate the long term levelized cost in (/MWh) over the 20 years of production of this pv power plant? 76 /MWh 2) Assuming that the incomes will be stable over the next twenty years, calculate the net present value of the project in the two following case: a. Case 1 : incomes from the energy markets at 40 /MWh -5,8 ME b. Case 2: incomes from a feed-in tariff of 100 /MWh 3,8 ME 3) Considering a single year, a. What is the overcost for the community to provide the feed-in tariffs in [/MWh). 60 /MWh b. Assuming that the emissions from a gaz power plant are 0,35 tons of CO2 per MWh (and close to zero emissions for PV in comparison). What would be the cost in euro per ton of CO2 emission avoided. 171,4 /t CO2 4) Provide four different reasons why the authorities would be ready to support this PV power plant with a Feed-in tariffs above the market prices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts