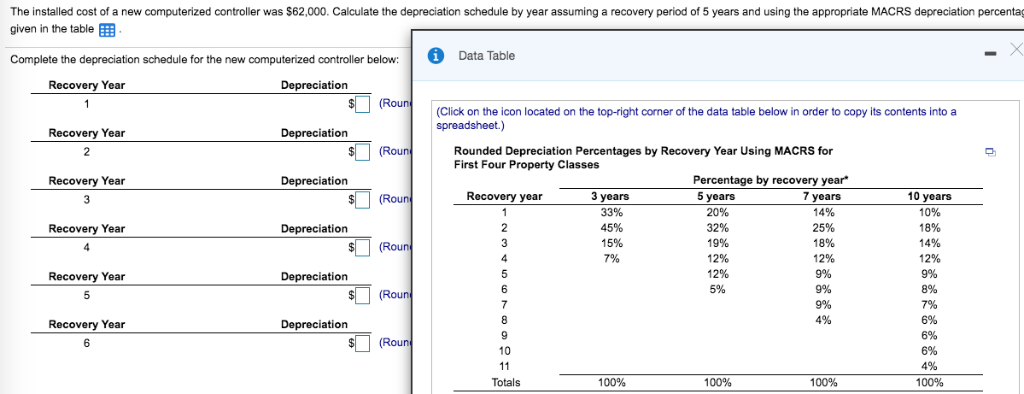

Question: The installed cost of a new computerized controller was $62,000. Calculate the depreciation schedule by year assuming a recovery period of 5 years and using

The installed cost of a new computerized controller was $62,000. Calculate the depreciation schedule by year assuming a recovery period of 5 years and using the appropriate MACRS depreciation percentag given in the table EEB Complete the depreciation schedule for the new computerized controller below: Data Table Recovery Year Depreciation (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Depreciation Recovery Year Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Recovery Year Percentage by recovery year Depreciation 3 years 33% 45% 15% Recovery year 5 years 20% 32% 19% 12% 12% 5% 7 years 14% 25% 18% 12% 9% 10 years 10% 18% 14% 12% 9% 8% Recovery Year Depreciation Recovery Year Depreciation 4% 6% Recovery Year Depreciation 10 6% 4% 100% Totals 100% 100% 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts