Question: The instruction states (The data has been collected in the Microsoft Excel file below. Perform the required analysis to answer the questions below. Do not

The instruction states (The data has been collected in the Microsoft Excel file below. Perform the required analysis to answer the questions below. Do not round intermediate calculations. Enter your answers as positive values.) Any Help will be appreciated

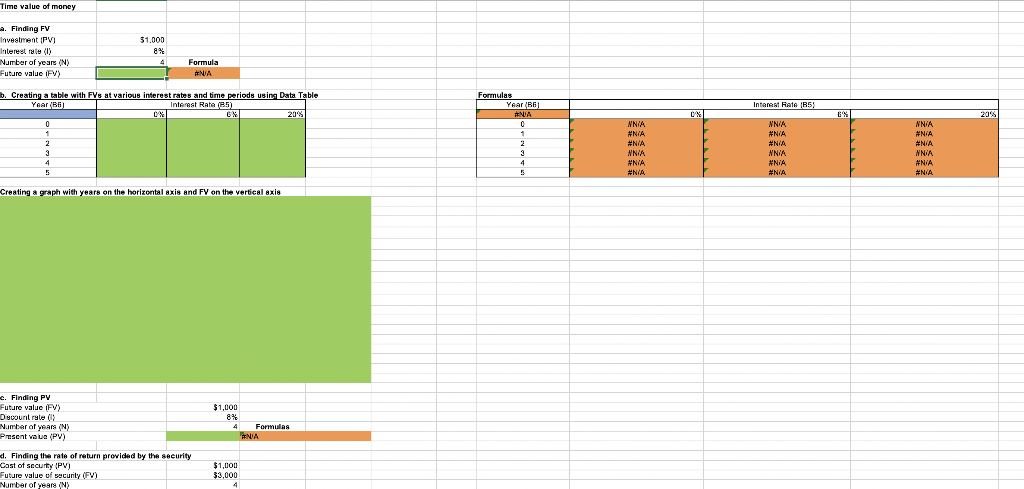

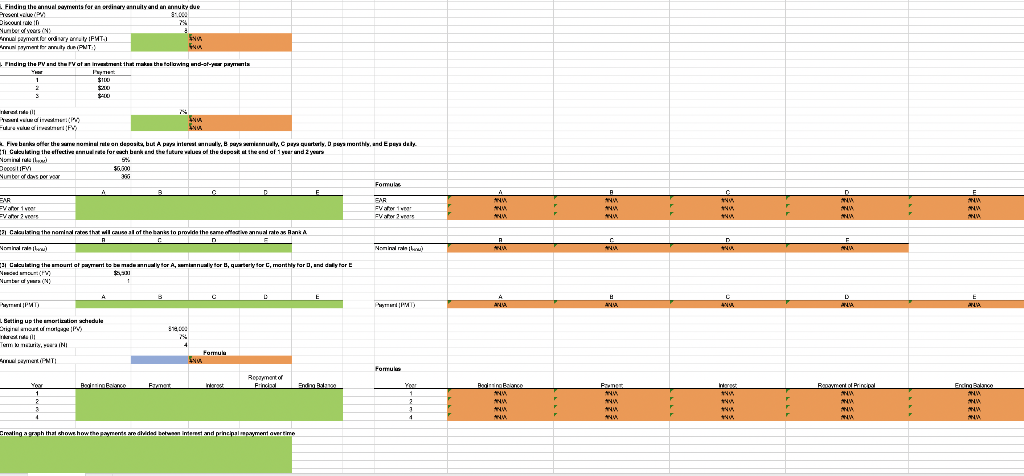

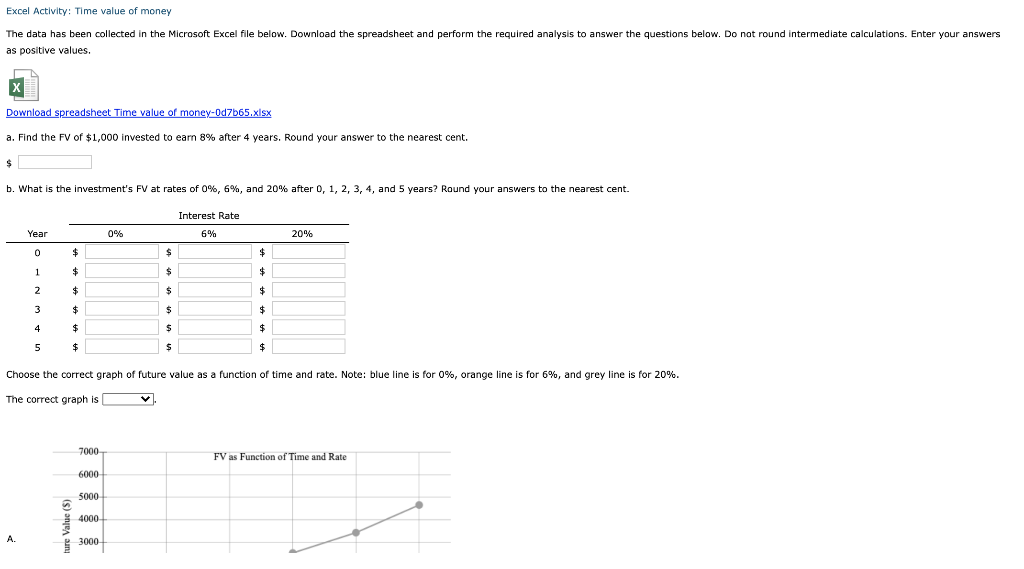

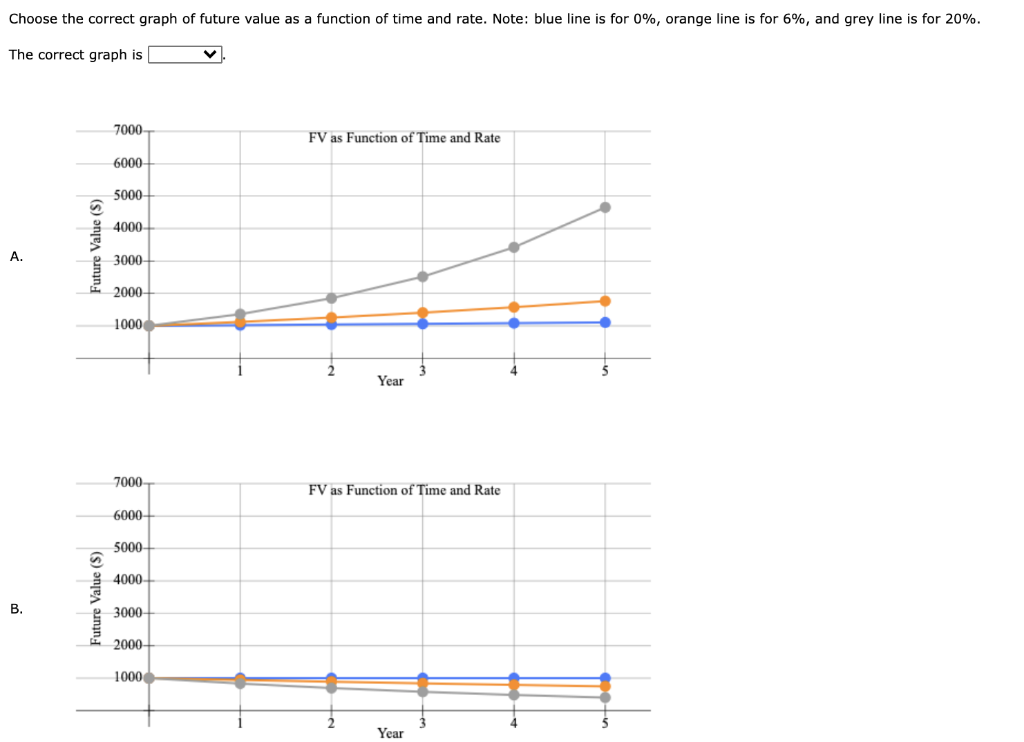

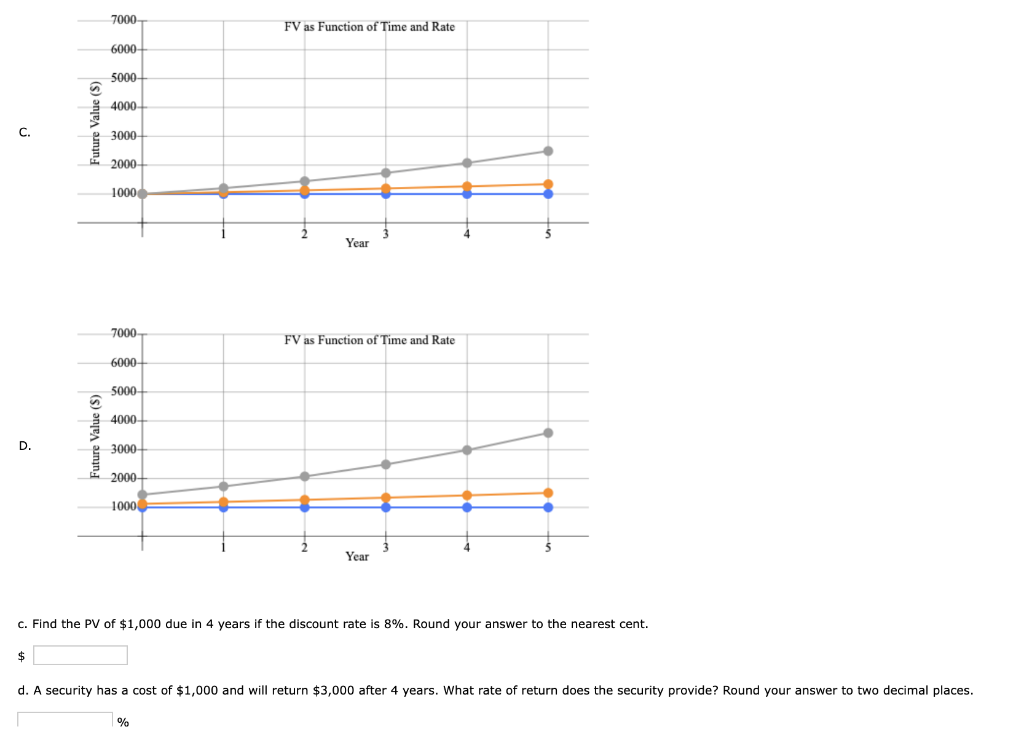

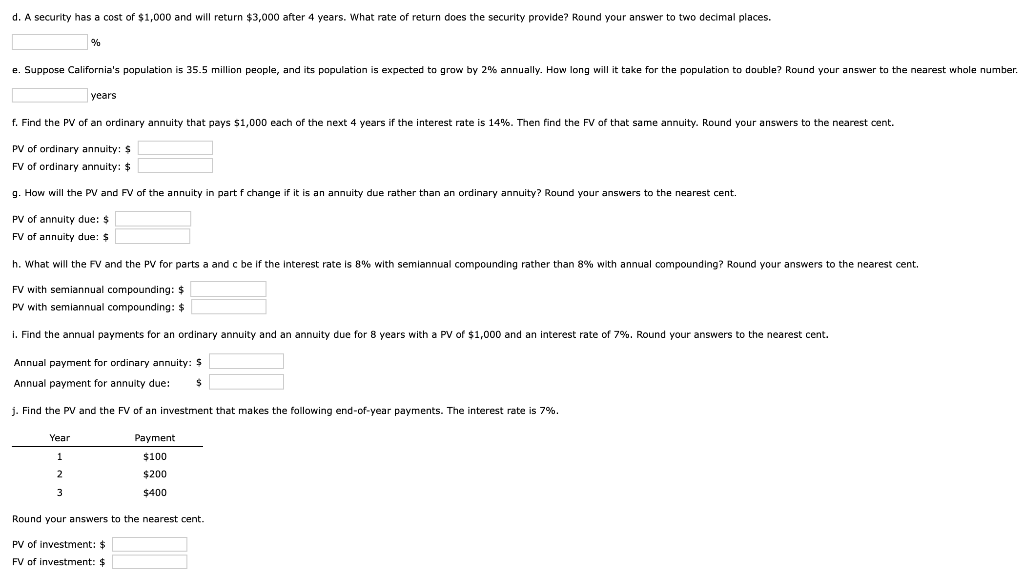

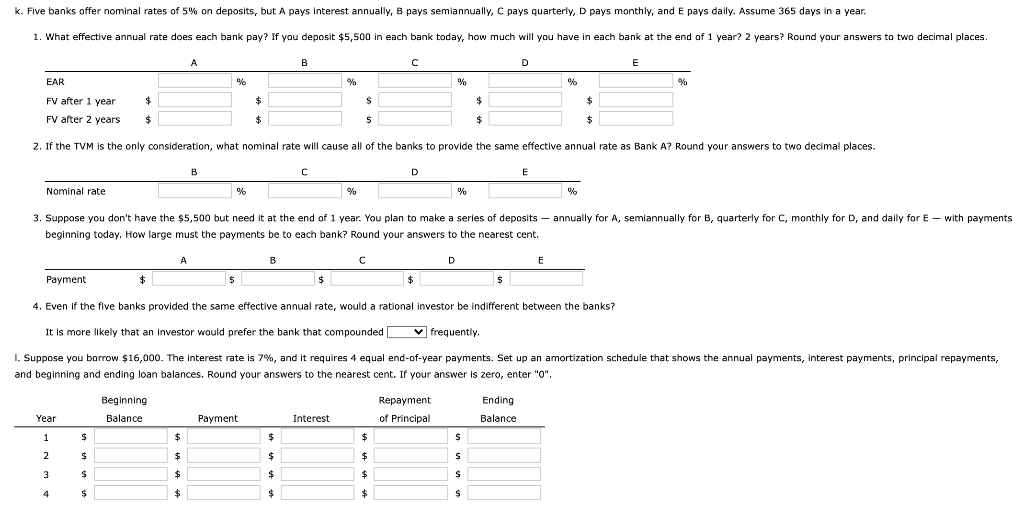

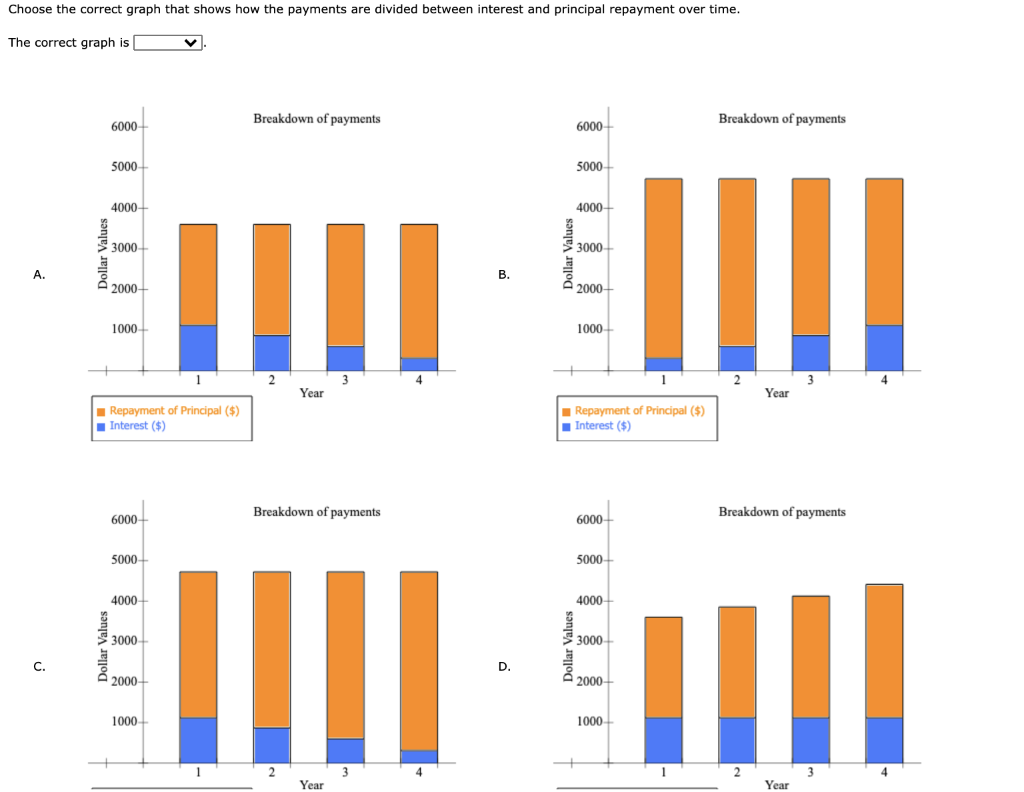

Time value of money a. Finding FV Investment PV Interest rate (1) Number of years (N) Future value (PV) 31.000 8% 4 Formula #NA Interest Rate R5) CAN 6%. 2015 . Creating a table with FVs at various interest rates and time periods using Data Table Year) Interest Rate (85) CX GN 20% 0 1 2 3 4 5 Formulas Year(6) #NA 0 1 2 3 4 5 NN/A #NIA #N/A WNIA #NIA #N/A NNIA #N/A #N/A NN/A #N/A #N/A NNIA #NIA #N/A NNIA #NIA #NA Creating a graph with years on the horizontal axis and FV on the vertical axis c. Finding Pv Future value (PV) scount rate () Number of years (N) Present Value (PV) $1,000 8% 4 Formulas ANA d. Finding the rate of return provided by the security Cast of securty (PV) Future value of security (FV) Number of years (N) $1,000 33.000 4 8% 4 Formulas #N/A Discount rate (1) Number of years (N) Present value (PV) d. Finding the rate of return provided by the security Cost of security (PV) Future value of security (FV) Number of years (N) Rate of retum (1) $1,000 $3,000 4 #N/A e. Calculating the number of years required to double the population Current population in millions (PV) 35.5 Growth rate (1) 2% Doubled population in millions (FV) #N/A Number of years required to double (N) #N/A f. Finding the PV and FV of an ordinary annuity Annuity (PMT) Interest rate (1) Number of years (N) Present value of ordinary annuity (PV) Future value of ordinary annuity (FV) $1,000 14% 4 #N/A #N/A g. Recalculating the PV and FV for part f if the annuity is an annuity due Present value of annuity due (PV) #N/A Future value of annuity due (FV) #N/A h. Recalculating the PV and the FV for parts a and c if the interest rate is semiannually compounded Future value (FV) #N/A Present value (PV) #N/A i. Finding the annual payments for an ordinary annuity and an annuity due Present value (PV) $1,000 Discount rate (1) 7% Number of years (N) 8 Annual payment for ordinary annuity (PMT) #N/A Annual payment for annuity due (PMT2) #N/A j. Finding the PV and the FV of an investment that makes the following end-of-year payments Year Payment 1 $100 $200 $400 3 Interest rate (1) Present value of investment (PV) Future value of investment (FV) 7% #N/A #N/A + . Finding the annual parts for an ordinary annuity and any due S. Nuribor voor in wameforderur.YIFYT for multPNT is EN Finding the Vand the Valment that makes the long and st-yer paymunla 1 SIL SLO Thadde TO :( IN Fundide fr Fieberkester the sun ominal releen deposit but A pura meray, Bundy, pequuntury, Dum, end Epeya duly 11 Calling the effectie mure for at berkend the future value of the deposed of 1 year and yours Nomi Dest om un brodows X Fomul SAR SAR Vw 1er SV EVw SV 2 w D MW NW NW E NEW W 4 Ne NU D A NU F NA Now W 51 Calaile in the nominal rates the will of the banes to provide the care ofera and A A Wantindran les 21 Csulating the amount of parent to be made for Aarbenny for quarterly for C, merthyer, and day ter sed unter der PMID C 49 ANA D ANA ha ANA E ALA Betting up the northedule -rigin turulyws heill , INI 1000 19 . Fortu TINTI Fortuko Bursa Ft Rowent of Find En Why 1 2 3 4 Yoer 1 2 3 1 Byl WW NU N w 44 ty IN w BALATORI W NW NW . Ensin na WWW NA us w NA MW NU Grading a graph that show.how the paymendeandidad dwinan and principal payment overtime Excel Activity: Time value of money The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Enter your answers as positive values. Download spreadsheet Time value of money-Od7b65.xlsx a. Find the FV of $1,000 invested to earn 8% after 4 years. Round your answer to the nearest cent. b. What is the investment's FV at rates of 0%, 6%, and 20% after 0, 1, 2, 3, 4, and 5 years? Round your answers to the nearest cent. Interest Rate 6% Year 0% 20% 0 $ $ $ 1 $ $ $ 2 $ $ $ 3 $ $ $ 4 $ $ $ 5 $ $ $ Choose the correct graph of future value as a function of time and rate. Note: blue line is for 0%, orange line is for 6%, and grey line is for 20%. The correct graph is 7000 FV as Function of Time and Rate 6000 5000 4000 ture Value (S) A. 3000 Choose the correct graph of future value as a function of time and rate. Note: blue line is for 0%, orange line is for 6%, and grey line is for 20%. The correct graph is 7000 FV as Function of Time and Rate 6000 5000 4000 Future Value (S) A. 3000 2000 1000 Year 7000 FV as Function of Time and Rate 6000 5000 4000 Future Value (S) B 3000 2000 1000 Year 7000 FV as Function of Time and Rate 6000 5000 4000 Future Value (s) C. 3000 2000 1000 Year 7000 FV as Function of Time and Rate 6000 5000 4000 Future Value (8) D. 3000 2000 1000 Year C. Find the PV of $1,000 due in 4 years if the discount rate is 8%. Round your answer to the nearest cent. $ d. A security has a cost of $1,000 and will return $3,000 after 4 years. What rate of return does the security provide? Round your answer to two decimal places. % d. A security has a cost of $1,000 and will return $3,000 after 4 years. What rate of return does the security provide? Round your answer to two decimal places. % e. Suppose California's population is 35.5 million people, and its population is expected grow by 2% annually. How long will it take for the population to double? Round your answer to the nearest whole number. years f. Find the PV of an ordinary annuity that pays $1,000 each of the next years if the interest rate is 14%. Then find the FV of that same annuity. Round your answers to the nearest cent. PV of ordinary annuity: $ FV of ordinary annuity: $ g. How will the PV and FV of the annuity in part f change if it is an annuity due rather than an ordinary annuity? Round your answers to the nearest cent. PV of annuity due: $ FV of annuity due: $ h. What will the FV and the PV for parts a and cbe if the interest rate is 8% with semiannual compounding rather than 8% with annual compounding? Round your answers to the nearest cent. FV with semiannual compounding: $ PV with semiannual compounding: $ i. Find the annual payments for an ordinary annuity and an annuity due for 8 years with a PV of $1,000 and an interest rate of 7%. Round your answers to the nearest cent. Annual payment for ordinary annuity: $ Annual payment for annuity due: $ j. Find the PV and the FV of an investment that makes the following end-of-year payments. The interest rate is 7%. Year 1 Payment $100 $200 2 3 $400 Round your answers to the nearest cent. PV of investment: $ FV of investment: $ k. Five banks offer nominal rates of 5% on deposits, but A pays Interest annually, B pays semiannually, C pays quarterly, D pays monthly, and E pays daily. Assume 365 days in a year. 1. What effective annual rate does each bank pay? If you deposit $5,500 in each bank today, how much will you have in each bank at the end of 1 year? 2 years? Round your answers two decimal places. A B D E EAR % % % % FV after 1 year $ $ S $ $ FV after years $ $ $ 2. If the TVM is the only consideration, what nominal rate will cause all of the banks to provide the same effective annual rate as Bank A? Round your answers to two decimal places. B D E Nominal rate % % 3. Suppose you don't have the $5,500 but need it at the end of 1 year. You plan to make a series of deposits - annually for A, semiannually for B, quarterly for C, monthly for D, and daily for E - with payments beginning today. How large must the payments be to each bank? Round your answers to the nearest cent. A B D E Payment $ $ $ $ 4. Even if the five banks provided the same effective annual rate, would a rational investor be indifferent between the banks? It is more likely that an investor would prefer the bank that compounded frequently, 1. Suppose you borrow $16,000. The interest rate is 7%, and it requires 4 equal end-of-year payments. Set up an amortization schedule that shows the annual payments, interest payments, principal repayments, and beginning and ending loan balances. Round your answers to the nearest cent. If your answer is zero, enter "0". Repayment Beginning Balance Ending Balance Year Payment Interest of Principal 1 $ $ $ $ s 2 $ $ $ $ $ 3 $ $ $ $ S 4 $ $ $ $ $ Choose the correct graph that shows how the payments are divided between interest and principal repayment over time. The correct graph is Breakdown of payments Breakdown of payments 6000 6000 5000 5000 4000 4000 3000 3000 Dollar Values Dollar Values IIII A. B. 2000 2000 1000 1000 1 2 4 1 2 3 4 Year Year Repayment of Principal ($) Interest ($) Repayment of Principal (5) Interest ($) Breakdown of payments Breakdown of payments 6000 6000 5000 5000 4000 4000 3000 3000 Dollar Values Dollar Values C. D. 2000 2000 1000 1000 1 Year Year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts