Question: The instructor will provide two (2) cases throughout the course to assess students knowledge of financial statement and budgeting. The domain of assessment will include

The instructor will provide two (2) cases throughout the course to assess students knowledge of financial statement and budgeting. The domain of assessment will include four primary knowledge areas: financial evaluation, financial ratios, forecasting projected revenues and expenditures, and preparing cash budget. A different case will be utilized each quarter; therefore, requirements for each case will vary depending upon the nature of the scenario of interest.

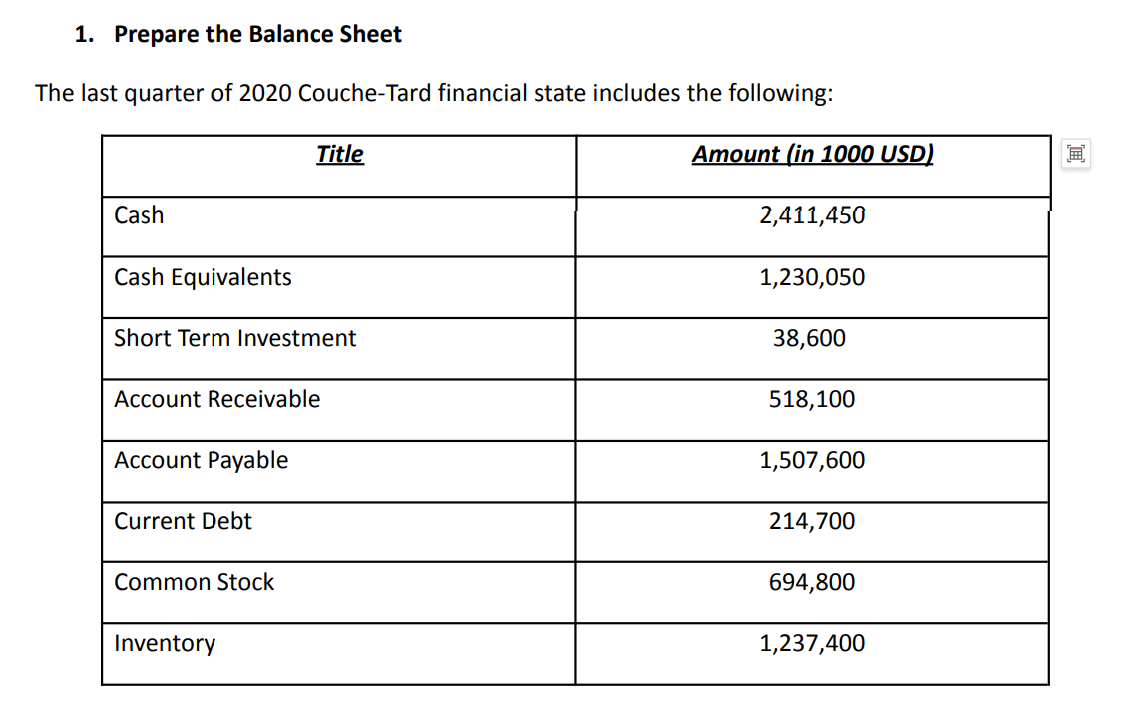

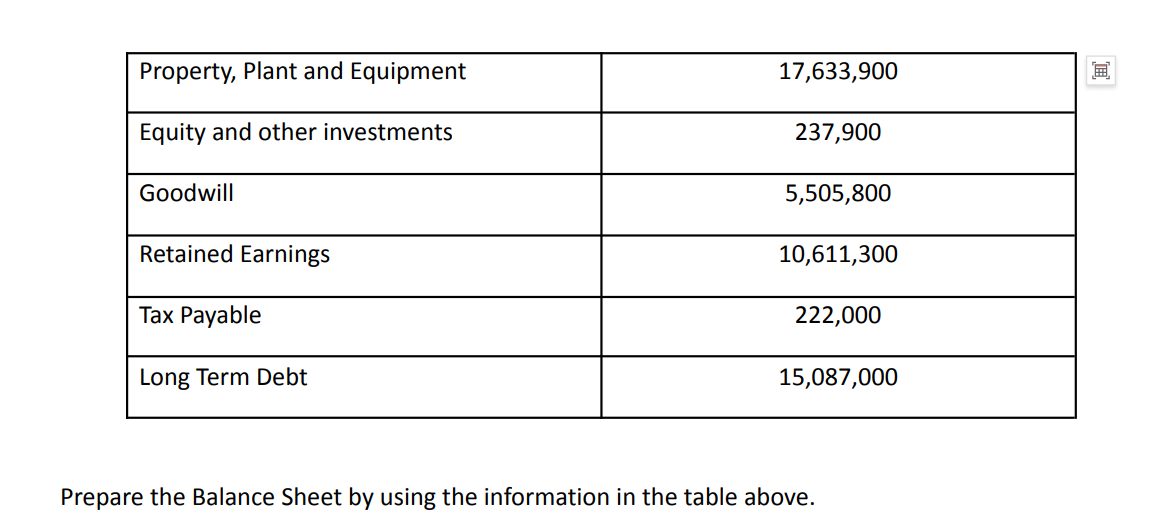

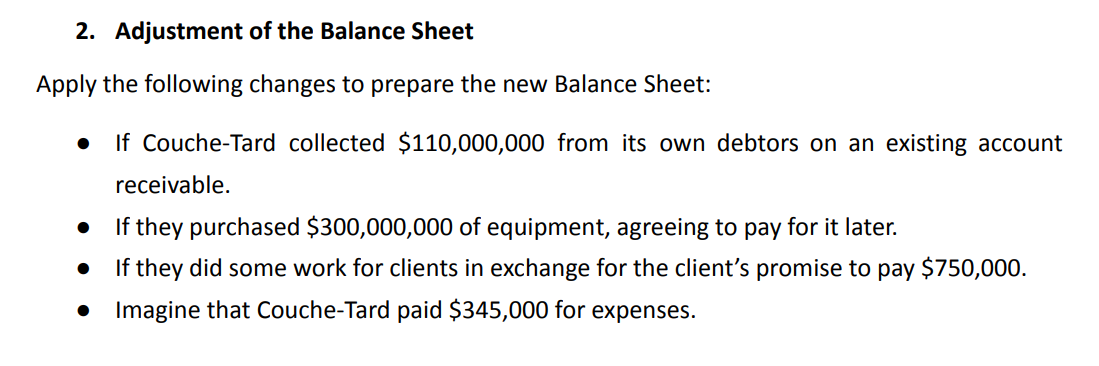

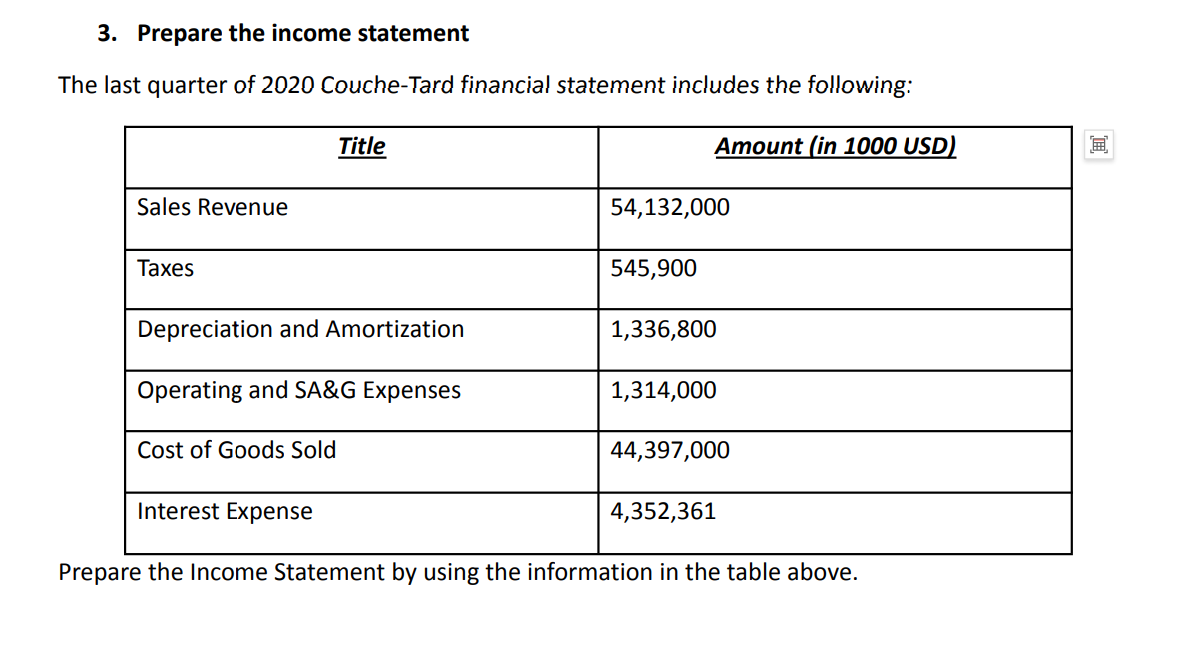

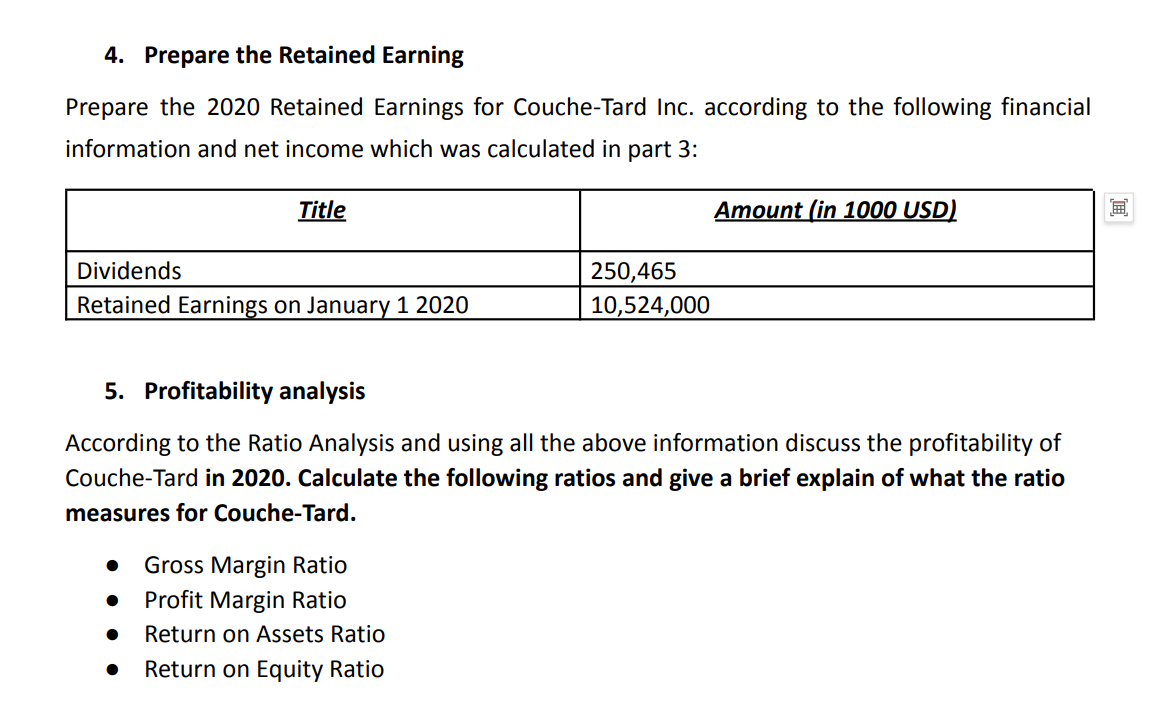

Mini Case Study 1 Alimentation Couche-Tard Inc., or simply Couche-Tard, is a Canadian multinational operator of convenience stores. The company has 15,000 stores across Canada, the United States, Mexico, Ireland, Norway, Sweden, Denmark, Estonia, Latvia, Lithuania, Poland, Russia, Japan, China, and Indonesia. The company operates its corporate stores mainly under the Couche-Tard, Circle K and On the Run brands, but also under the affiliated brands 7-jours, Dairy Mart, Daisy Mart and Winks. 1. Prepare the Balance Sheet The last quarter of 2020 Couche-Tard financial state includes the following: Prepare the Balance Sheet by using the information in the table above. 2. Adjustment of the Balance Sheet Apply the following changes to prepare the new Balance Sheet: - If Couche-Tard collected $110,000,000 from its own debtors on an existing account receivable. - If they purchased $300,000,000 of equipment, agreeing to pay for it later. - If they did some work for clients in exchange for the client's promise to pay $750,000. - Imagine that Couche-Tard paid $345,000 for expenses. 3. Prepare the income statement The last quarter of 2020 Couche-Tard financial statement includes the following: Prepare the Income Statement by using the information in the table above. 4. Prepare the Retained Earning Prepare the 2020 Retained Earnings for Couche-Tard Inc. according to the following financial information and net income which was calculated in part 3 : 5. Profitability analysis According to the Ratio Analysis and using all the above information discuss the profitability of Couche-Tard in 2020. Calculate the following ratios and give a brief explain of what the ratio measures for Couche-Tard. - Gross Margin Ratio - Profit Margin Ratio - Return on Assets Ratio - Return on Equity Ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts