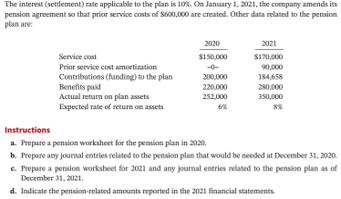

Question: The interest (settlement) rate applicable to the plan is 10%. On January 1, 2021, the company amends its pension agreement so that prior service costs

The interest (settlement) rate applicable to the plan is 10%. On January 1, 2021, the company amends its pension agreement so that prior service costs of 600,000 are created. Other data related to the pension plan are 2020 $150.000 Service cost Prior service cost amortization Contributions Cunding) to the plan Benefits paid Actual retum on planets Expected rate of return assets 200.000 220.000 252,000 2021 $170,000 90,000 184658 280,000 350,000 8 Instructions a. Prepare a pension worksheet for the pension plan in 2020 b. Prepare any journal entries related to the pension plan that would be needed at December 31, 2020 c. Prepare a pension worksheet for 2021 and any journal entries related to the pension plan as of December 31, 2021 d. Indicate the pension related amounts reported in the 2021 financial statements The interest (settlement) rate applicable to the plan is 10%. On January 1, 2021, the company amends its pension agreement so that prior service costs of 600,000 are created. Other data related to the pension plan are 2020 $150.000 Service cost Prior service cost amortization Contributions Cunding) to the plan Benefits paid Actual retum on planets Expected rate of return assets 200.000 220.000 252,000 2021 $170,000 90,000 184658 280,000 350,000 8 Instructions a. Prepare a pension worksheet for the pension plan in 2020 b. Prepare any journal entries related to the pension plan that would be needed at December 31, 2020 c. Prepare a pension worksheet for 2021 and any journal entries related to the pension plan as of December 31, 2021 d. Indicate the pension related amounts reported in the 2021 financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts