Question: The inventory is valued on a FIFO basis. The beginning inventory was / yoquired when the exchange rate was $ 0 . 7 4 8

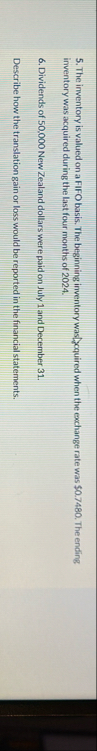

The inventory is valued on a FIFO basis. The beginning inventory wasyoquired when the exchange rate was $ The ending inventory was acquired during the last four months of

Dividends of New Zealand dollars were paid on July and December

Describe how the translation gain or loss would be reported in the financial statements.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock